Download Pintu App

6 Bitcoin (BTC) Wallet Facts Move Almost 5,000 BTC in January 2026

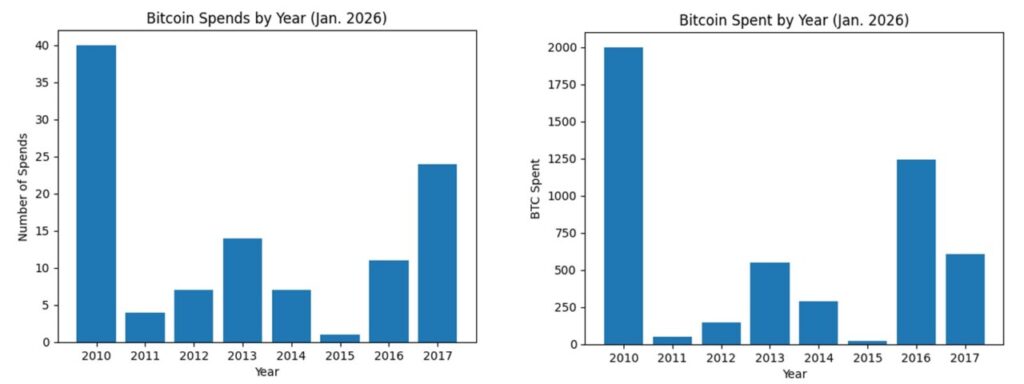

Jakarta, Pintu News – In January 2026, the crypto world recorded another on-chain phenomenon that caught the attention of market and investment players. Several long-dormant Bitcoin (BTC) wallets finally moved their assets, totaling nearly 4,905.98 BTC-equivalent toapproximately USD 383 million or approximately IDR 6.43 trillion based on market value at the time of the report. This huge movement records one of the highest activity of Bitcoin’s early-era “sleeping” wallets and is important data for young and novice investors to understand.

Old Wallet from 2010-2017 is back in business

In January, on-chain data showed that some Bitcoin wallets that had not transacted for a long time had finally started moving again. These wallets date back to the period 2010 to 2017, the early era of the Bitcoin cryptocurrency when most BTC was still mined by small individuals or early adopters. This activity marks that Bitcoin that was previously immobile for years is now transacting again in large numbers.

This movement is not just a small number. A total of around 4,905.98 BTC changed hands, indicating that old wallet owners are now deciding to reactivate their stashes. For investors, this could be used as an indication of short-term supply pressure in the market, especially if a large amount of BTC enters the exchange or spot market.

Also Read: 7 Ethereum (ETH) 2026 Price Predictions: Bullish Targets, Risks & Projections

Economic Value of BTC Moving to Sleep

Bitcoin that moves is worth tens of millions of US dollars in one month. If converted at an exchange rate of USD to rupiah = Rp16,788, the value of the movement of nearly 4 906 BTC reaches around Rp6.43 trillion. The magnitude of this value shows that the movement of old wallets cannot be taken lightly from the perspective of the global crypto market.

Large transactions like these often spark discussions among analysts regarding their potential impact on market liquidity. Large volumes of BTC removed from old wallets can enter the market and increase selling pressure in a short period of time.

Why old wallets suddenly move

There are several reasons why old wallets are finally active again after a long dormant period. One of them is that old wallet owners may now feel it’s time to realize profits after a long and volatile period of Bitcoin prices. Wallets from an earlier era may have held BTC since the time the price was far below the current value, so this moment is seen as an opportunity.

Another factor behind this activity could be the liquidity needs of individual or institutional owners. When certain prices or market sentiments change, existing wallet owners may choose to move or sell some of their holdings.

On-Chain Context and Its Impact on BTC Price

The movement from dormant tight wallets to long term holding patterns in Bitcoin suggests supply rotation potential. Optimal timing of moving BTC from dormant holdings can indicate shifts in investor sentiment about future price trajectories.

On-chain analysis also shows that when previously idle supply turns liquid, short-term volatility tends to increase. This may signal to investors that the market is not only affected by demand, but also by circulating supply.

What Does This Mean for Beginner Investors?

For young investors and beginners in the crypto and cryptocurrency markets, the movements of old Bitcoin wallets provide an important lesson. Large on-chain activity from old wallets is one of the factors that can trigger short-term price volatility, especially if assets are being streamed to exchanges or spot markets.

Understanding supply dynamics and long-term holder behavior helps investors better read market pressures. Such on-chain data is sometimes more useful for identifying major trends than simply looking at daily prices on exchanges.

Conclusion

The reactivation of old Bitcoin wallets that have been idle for a long time reflects the changing supply dynamics in the cryptocurrency market. The movement of nearly 4 906 BTC in one month is not just a big number, but also important data for understanding market pressures. Novice investors need to understand that changes in long-holder behavior can affect prices and volatility in the short and medium term.

Also Read: 7 Gold Price Predictions for February 2026: Rise, Scenarios & Risk Factors!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Bitcoin.com News. Sleeping Stashes Blink:Early Bitcoin Wallets Shift Nearly 5 000 BTC in January. Accessed February 2, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.