Download Pintu App

5 Important Things to Know About Bitcoin This Week as Price Enters Historic 2021 Zone

Jakarta, Pintu News – The crypto market entered the first week of February under intense pressure after Bitcoin (BTC) returned to trading at levels reminiscent of the late 2021 phase. The price of BTC briefly touched around USD 78,000 or equivalent to IDR 1.31 billion, close to its lowest level in 16 months.

This weakness has sparked renewed debate among analysts as to whether the market is building a new bottom or paving the way for a deeper correction. Amidst the uncertainty, there are five main factors that cryptocurrency market participants are watching this week.

Bitcoin Price Approaches Previous Cycle Critical Level

Bitcoin (BTC) price movements over the weekend showed consistent selling pressure, with continued declines after a weak weekly close. BTC even printed its lowest level since November 2024, reinforcing the short-term bearish sentiment.

A number of traders consider the USD 76,000-78,000 area or around Rp1.28-1.31 billion as important support before the risk of further decline opens up. If this area fails to hold, some analysts open a correction scenario towards USD 50,000 or around IDR 839 million.

This view is reinforced by large volumes on dips, which are often read as confirmation of distribution pressure. Some veteran traders think the market structure is still in a bearish phase, so the short-term rally risks being just a temporary bounce. However, the proximity of prices to historical 2021 levels makes the market more sensitive to any changes in sentiment.

RSI Indicator Triggers Reversal Expectations

Amid price pressure, the Relative Strength Index (RSI) technical indicator is one basis for limited optimism. Bitcoin’s (BTC) weekly RSI was recorded at around 32, close to the oversold zone that historically often appears around market bottoms.

Similar levels were last seen at the end of the 2022 bear market, before prices began to build a gradual recovery. This has led to speculation that selling pressure may be approaching saturation point.

Read also: Crypto Market Crucial Week: Rise from Correction or Fall Deeper?

However, some analysts caution that the bottom-building process is rarely instantaneous. The still weak monthly RSI suggests the market could take longer to fully recover. In other words, oversold signals increase the probability of a bounce, but not enough to ensure a major trend change in the near future.

Macro Signals: Bitcoin Called to Send “Early Warning”

The pressure on the crypto market does not stand alone, but goes hand in hand with global asset turmoil. Some analysts believe that Bitcoin’s (BTC) moves this time reflect potential broader liquidity issues in financial markets.

As stocks, precious metals and other risky assets weaken, BTC is seen as an early indicator of macro stress. This makes investors more wary of economic data and monetary policy.

Such concerns are amplified by expectations of tighter central bank policy. The change in leadership at the US central bank and the potential for a hawkish stance are considered to put pressure on risky assets, including cryptocurrencies. In this context, Bitcoin’s weakness is seen as not just a technical issue, but a reflection of global risk adjustment.

Gold, Stocks and US Dollar Join the Changing Landscape

The week was also characterized by extreme volatility in the gold and silver markets, which experienced sharp declines after a long rally. Gold prices briefly fell to close to USD 4,400 per ounce, slashing more than 20% from its peak.

The precious metal’s weakness coincided with the strengthening of the US dollar, which historically tends to suppress risky assets. The combination creates a risk-off environment that is less conducive to crypto.

Read also: Antam Gold Buyback Price Today, Tuesday, February 3, 2026

The strengthening of the US dollar is adding pressure on Bitcoin (BTC), as capital flows tend to shift towards assets that are considered safer. If this trend continues, the crypto market could potentially face a longer consolidation phase. However, some market participants feel that extreme changes are often the beginning of a new adjustment phase.

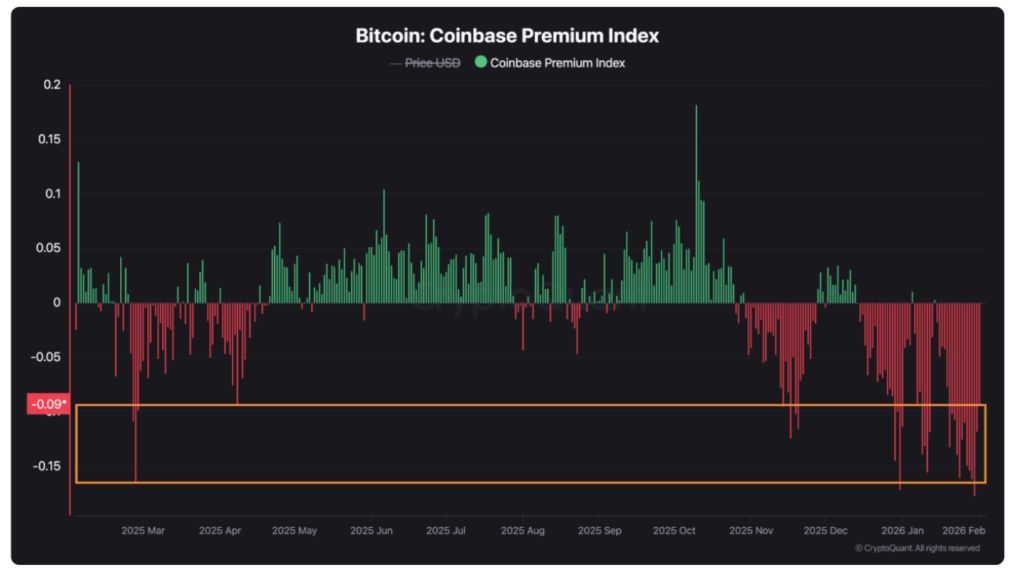

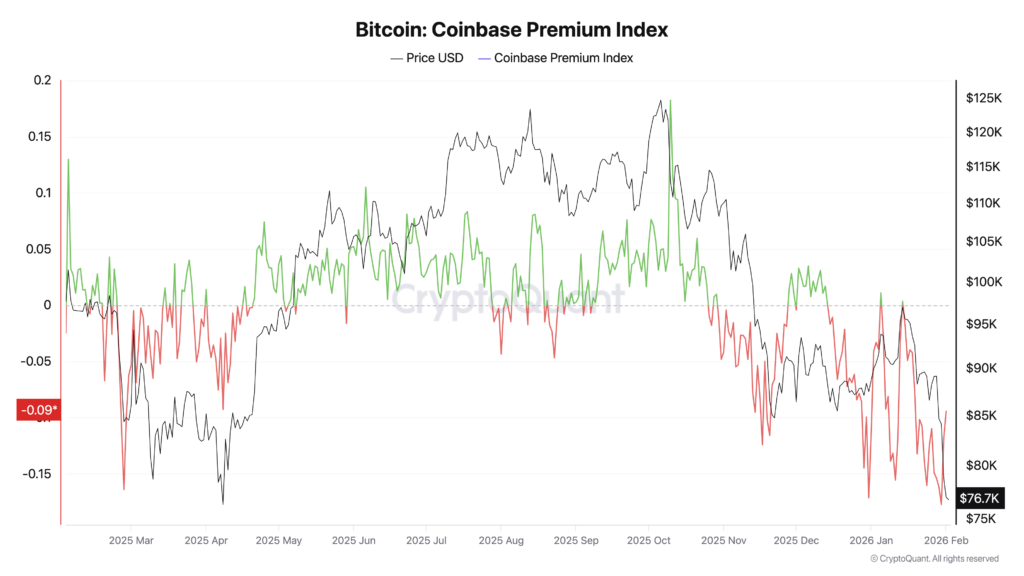

US Demand Weakens, Coinbase Premium Negative

From the on-chain side, the Coinbase Premium indicator shows less encouraging signals. The price difference of BTC on Coinbase compared to global exchanges was recorded in a deep and persistent negative zone. This signaled weak spot demand from US investors, even after the price dropped significantly. The situation is in contrast to previous corrections which are usually followed by an influx of buying interest.

The persistent negative premium is often interpreted as the absence of US institutional buyers. As long as this condition has not improved, the potential for further pressure remains open. For the market, this is a reminder that a sustainable recovery requires the return of real demand, not just short-term speculation.

Conclusion

Bitcoin (BTC) started February with a position reminiscent of the critical phase of 2021, sparking intense discussions about its next direction. Five key factors, ranging from price structure, RSI signals, macro pressures, global asset dynamics, to weak US demand, form a complex market picture. Although the opportunity for a technical bounce exists, the risk of further correction has not completely disappeared. Under these conditions, the crypto market tends to move sensitively to any changes in sentiment and economic data.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. BTC price heads back to 2021: Five things to know in Bitcoin this week. Accessed February 7, 2026.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.