Download Pintu App

Why did Antam Gold Rise Today (2/4/26)?

Jakarta, Pintu News – The increase in Antam gold prices on February 4, 2026 was mainly triggered by a sharp rebound in world gold prices after extreme selling pressure at the end of January. The re-ignition of geopolitical tensions and expectations of monetary policy easing have made investors hunt gold as a safe haven asset again.

In the domestic market, the adjustment to the global price spike was reinforced by movements in the rupiah exchange rate against the US dollar. It is this combination of external factors and the quick response of local market players that is reflected in the surge in Antam’s gold bullion prices today.

Antam Gold Price Increases IDR 102,000 Today

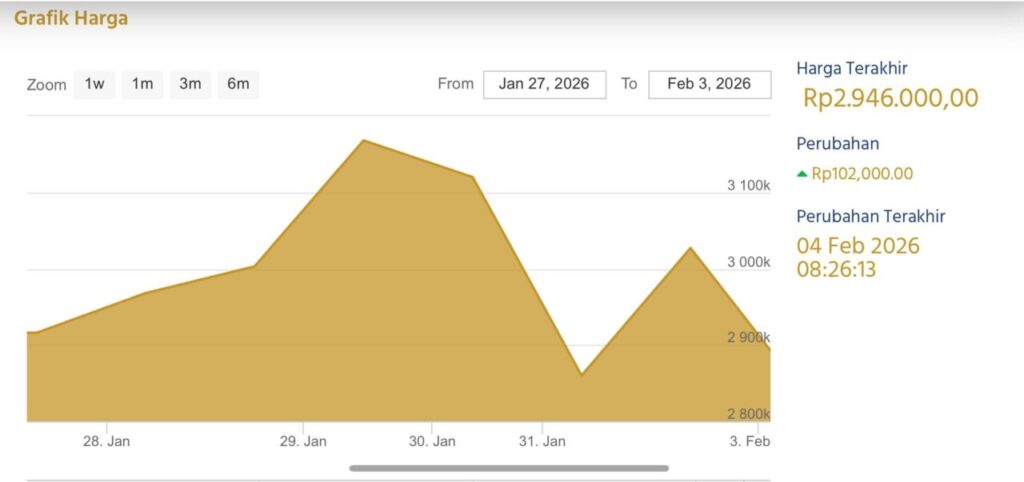

The chart shows the price movement during the period from January 27 to February 3, 2026 with a sharp up-and-down pattern. At the beginning of the period, the price moves up gradually until it reaches a peak around the end of January, approaching a range above Rp3,000,000.

After touching this high, the price started to reverse down and experienced a significant correction on January 31, approaching the IDR 2,800,000 area. This pattern depicts a brief euphoric phase followed by a rapid decline after selling pressure builds up.

Entering early February, the price attempted to recover with a rebound that brought the value back close to IDR 3,000,000, although it was not able to break the previous peak. On February 3, the chart showed a moderate decline from the rebound point, with the price last recorded at around IDR 2,946,000.

The information on the right side of the chart also recorded a positive change of around IDR 102,000, indicating a daily increase despite the overall market still being volatile. In general, this data illustrates a volatile market with a tendency to consolidate after phases of sharp rises and corrections.

Read also: 25 Gram Gold Price in 2026

Why did Antam’s Gold Price Rise Today?

The increase in Antam gold prices today is mainly a rebound effect after the previous two days experienced a very sharp correction.

On the global front, global gold prices are bouncing strongly near US$5,100 per troy ounce after falling sharply due to rising margins and a wave of forced liquidation in late January. This rebound was driven by the re-heating of geopolitical tensions, particularly related to the US-Iran military incident, which revived gold’s function as a safe haven asset.

In addition, major financial institutions such as J.P. Morgan still maintain bullish projections that gold could reach around US$6,300 per ounce by the end of 2026, so investors’ medium-term expectations for gold remain positive despite high volatility. This combination of rebounding global prices, safe sentiment, and adjustment of the US dollar exchange rate against the rupiah is reflected in the increase in Antam gold prices in the domestic market today.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Precious Metals

- Featured Image: Compass Money

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.