Download Pintu App

6 Impacts of BTC Price Falling Below US$67K that Crypto Investors Should Understand

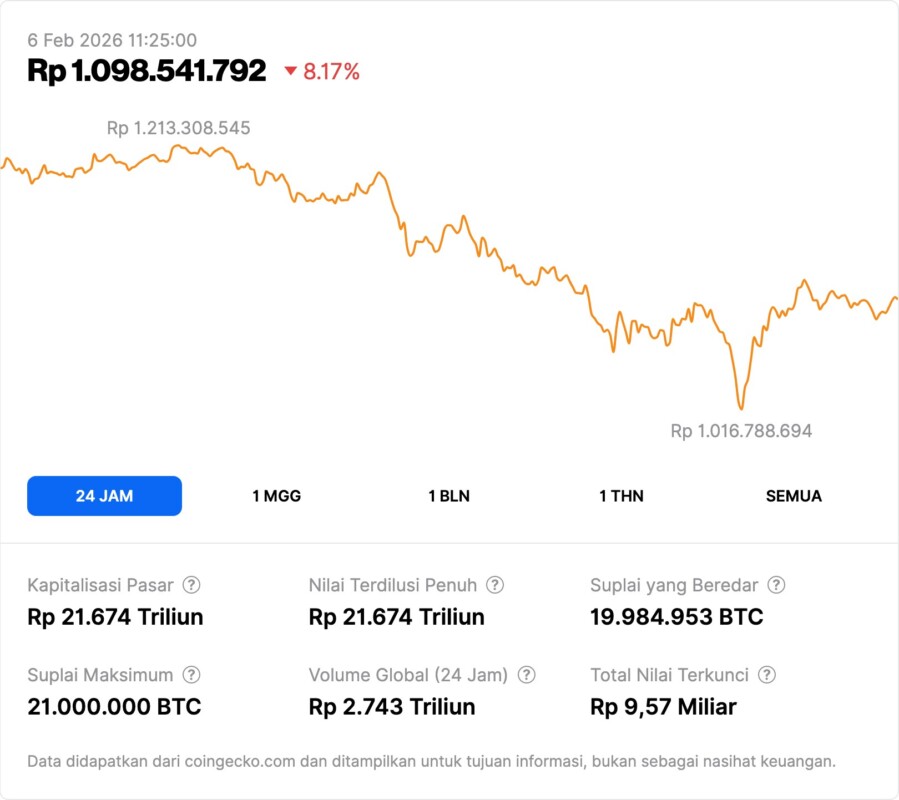

Jakarta, Pintu News – The price of Bitcoin (BTC) came under sharp pressure in early February 2026, correcting from levels above US$70,000 to below US$67,000 in recent days. This decline has had a significant impact on the crypto market, liquidity, and global investor sentiment. This trend not only affects BTC directly, but also reflects broader risk conditions across the cryptocurrency ecosystem.

1. Bitcoin Correction Shows Crypto Market Volatility

Bitcoin price plummeted significantly in the last few trading sessions, surpassing the important technical level below US$67,000 and becoming the lowest since October 2024. This drop shows that volatility in the crypto market is still high despite some investors hoping for stabilization after the previous rally.

In highly volatile market conditions, buyers are reluctant to enter while sellers accelerate selling to minimize losses, which magnifies the downward movement. Sharp corrections like this emphasize the crypto market’s character of being sensitive to macro news and large capital actions.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

2. Big sell-off in tech sector worsens sentiment

Bitcoin’s decline coincided with a major sell-off in global tech stocks, which often signals a shift in investment from riskier assets to safer instruments. When investors move capital into instruments like bonds or fiat currencies, assets like crypto usually receive stronger selling pressure.

Weakened risk sentiment led to capital outflows from the crypto market, pushing BTC and altcoins down together. When tech assets fall, the correlation between stocks and crypto makes the declines mutually reinforcing.

3. Liquidation of Leverage Accelerates Price Decline

The selling pressure in Bitcoin triggered various liquidations of leveraged positions, especially long positions that utilized large margins. As the price fell, many auto-trading positions were executed to cover losses, which only added to the selling volume in the market.

This forced liquidation added to the already existing downward momentum and created a domino effect in the crypto derivatives market. Other crypto assets such as Ethereum (ETH) and altcoins have also recorded similar price pressure from this action.

4. ETFs and Institutional Investments Under Pressure

The decline in Bitcoin’s value has impacted crypto-based investment products such as the Bitcoin ETF, which recorded significant capital outflows. Institutional investors who were big buyers during the rally period are now reducing their exposure in the market.

These outflows signal that professional investors’ interest in crypto is weakening, which could reduce spot market liquidity and exacerbate short-term selling pressure. It also lowers overall market confidence, which is important in medium-term price dynamics.

5. Crypto Investor Sentiment Increasingly Turns to Risk

Bitcoin’s sharp price movements are affecting sentiment broadly in the crypto market. Many market participants are now entering risk-off mode by reducing allocations to speculative assets such as crypto. This is reflected in an increase in the crypto market’s fear index and analysts’ comments that the market may be undergoing a long-term reset.

This negative sentiment could trigger more selling if there are no new positive catalysts in the near future.

6. Impact on Altcoins and Crypto Ecosystems

Apart from Bitcoin, many other cryptocurrencies have also taken a hit due to high market correlation. Altcoins with medium and small market capitalizations usually suffer more when BTC drops, as investor capital flows tend to exit high-risk assets first.

The downturn has also affected DeFi projects, NFTs, and other tokens that are often seen as speculative assets, so investors need to be careful in assessing the risk of their portfolios.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CNBC. Bitcoin prices tumble as crypto investors face selloff and market risk. Accessed February 6, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.