Download Pintu App

Gold in February 2026: ChatGPT’s Price Prediction

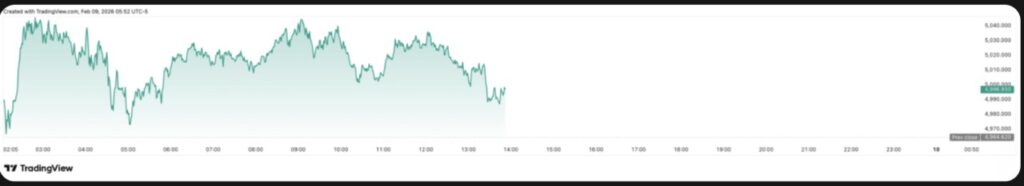

Jakarta, Pintu News – As gold prices continue to hold above the $5,000 (IDR 84,095,000) per ounce level, an artificial intelligence model predicts that the precious metal is likely to remain above that range until the end of February.

As of February 9, gold was trading at around $5,010 (IDR 84,263,190), up around 0.7% on the day, continuing a rally that has seen gold prices gain more than 15% since the start of the year.

Gold Price Prediction According to ChatGPT

To estimate where gold prices could be on February 28, Finbold’s website requested projections from OpenAI’s AI model ChatGPT. The model ruled out a sharp decline scenario and instead signaled continued upward momentum.

Read also: Nvidia (NVDA) Stock Analysis: Time to Buy, Sell, or Hold in 2026?

ChatGPT forecasts gold prices at around $5,180 (IDR 87,122,420) per ounce, which translates to a potential upside of around 3-4% until the end of February.

According to ChatGPT, this movement resembles a gradual rise rather than a sharp spike or trend reversal, as the market “digests” and consolidates the price increases that have already occurred.

The projection is based on gold’s ability to hold above the $5,000 level, where the absence of strong resistance in this area is seen as a sign of acceptance by institutional players, rather than excessive speculation.

The model also noted that real yields appear to be contained, so gold’s downside is limited even if US economic data remains strong. At the same time, the expectation that US monetary policy will remain loose until 2026 is considered to be an additional supporting factor.

In addition, the weakening momentum of the strengthening US dollar and the consistent purchase of gold by central banks, which are not very price-sensitive, were cited as other tailwinds for gold.

Gold Price Recovery

Gold prices recorded another rally, extending gains after a weaker US dollar prompted dip-buying, following weeks of extreme volatility in the precious metals market.

Read also: 5 Key Factors that Make Gold Prices Rise

The rebound came amid dollar weakness and the pending release of US labor and inflation data this week, which could potentially affect market expectations of the Federal Reserve’s interest rate cut opportunities.

Analysts also highlighted the strong demand for safe haven assets, fueled by geopolitical tensions, continued buying by central banks-including China-as well as broader global economic uncertainty.

Although prices have bounced back, market conditions are still considered volatile after gold touched a record high of close to $5,600 (IDR 94,186,400) in late January before experiencing a historic major correction.

Many market participants see the decline as a “healthy break” in the long-term bullish trend. Price projections through 2026 are still high, with some analysts predicting an average price above $4,700 (IDR 79,049,300), and long-term potential towards the $6,000 range (IDR 100,914,000).

Seasonal factors in February, a relatively balanced market position, and still constructive technical signals also reinforce the scenario of a steady price increase.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Finbold. ChatGPT sets Gold price for February 28, 2026. Accessed on February 13, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.