Download Pintu App

Solana Price Outlook: SOL Holds $87 After 20% Rally Even as ETF Funds Head for the Exit

Jakarta, Pintu News – The price of Solana (SOL) briefly hovered around $87.10 on February 9, after stabilizing gains from a 20% surge since falling to $72, which was the token’s lowest point since early 2024.

This recovery came as spot flows turned positive, but the still large ETF outflows suggest that institutional investors are still skeptical that prices have bottomed.

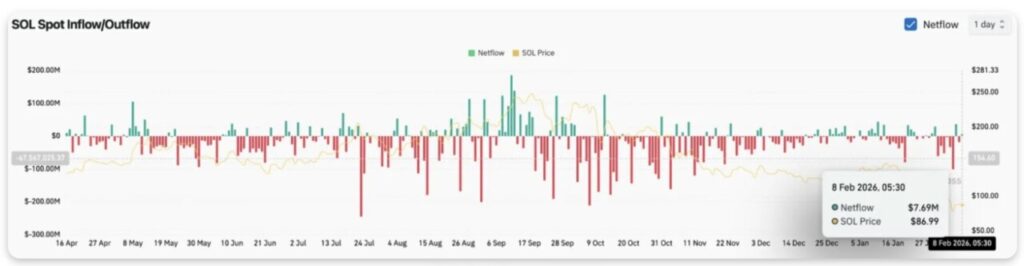

Spot Inflows Turned Positive by $7.69 Million

Data from Coinglass showed spot inflows of $7.69 million on February 8, breaking the string of outflows that dominated the price fall. This positive flow suggests that some buyers are starting to see the current price level as an attractive entry point after a 66% drop from the September peak.

Read also: Analyst Says XRP Could Crash Below $1 Before Soaring to $10 – Here’s Why

A reversal from heavy selling pressure (outflows) to inflows often signals that short-term selling pressure is beginning to ease. When the spot market turns positive as prices bounce off crash levels, it could indicate that the “weak hands” have given up and assets are now being accumulated by stronger market participants.

Daily Chart Shows $100 as Key Resistance

On the daily chart (9/2), Solana is trading below the downtrend line from September that has so far stopped any rally attempts. The $100 level, which was previously a key support area, has now turned into resistance.

The price briefly broke the $100 psychological level and then found support at $72, a zone that has not been touched since the summer of 2024. The bounce to $87 reflects a recovery of around 20%, but still well below the broken support structure.

Moreover, the downtrend line is still shifting down and is currently around the $95 area, creating a kind of “ceiling” that limits further price recovery attempts.

ETF Outflows Signal Institutional Investor Retreat

Although spot flows have started to improve, Solana-focused ETFs are still under selling pressure. In the past week, outflows of 67,632 SOL or approximately $5.68 million were recorded.

On February 6 alone, more than $1 million worth of Solana was withdrawn, marking the seventh instance of such a large outflow.

Read also: Ethereum Price Held at $2,000 Today: ETH Stable, but Bears Still Dominate the Trend?

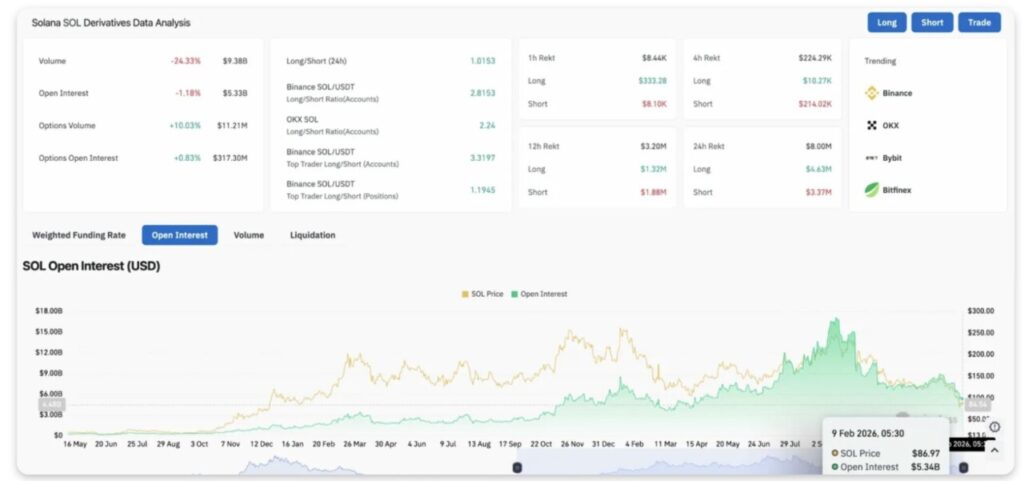

Derivative Data Shows a More Balanced Position

Open interest currently stands at $5.33 billion, down 1.18% as the market enters a consolidation phase. Trading volume also fell 24.33% to $9.38 billion, reflecting reduced activity after a surge in volatility during the price crash.

The long/short ratio of 1.01 shows an almost balanced market position, quite different from the condition before the “liquidation cascade” when the market was dominated by long positions. On Binance, the top traders still show a ratio of 3.31 based on the number of accounts, suggesting that there is still a bullish tendency among large players.

In the last 24 hours, there was an $8 million liquidation of positions, consisting of $4.63 million of long positions and $3.37 million of short positions. The balance of this liquidation, when compared to the large sweep of long positions during the crash, indicates that a large portion of leverage has been swept out of the market.

Options open interest rose 0.83% to $317.30 million, while options volume jumped 10.03% to $11.21 million. This suggests that traders are positioning themselves more for continued volatility rather than taking strong directional bets (bullish or bearish in the extreme).

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Solana Price Prediction: SOL Defends $87 After 20% Surge While ETFs Continue To Exit. Accessed on February 10, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.