Download Pintu App

4 Crypto Market Movements Today: BTC vs Gold, XRP Faces Pressure, DOGE & Its Potential

Jakarta, Pintu News – The cryptocurrency market is showing mixed dynamics with major price movements such as Bitcoin (BTC) and Ripple (XRP) under pressure, while the dynamics of traditional assets such as gold continue to attract investors’ attention.

Daily analysis indicates that price resistance and risk sentiment are the main factors influencing cryptocurrencies like XRP and Dogecoin (DOGE), while also showing how Bitcoin reacted to the gold rally. This overview is important for both novice and experienced investors to understand short-term market trends and potential changes in direction.

1. Bitcoin (BTC) Still on Hold without Market Reversal

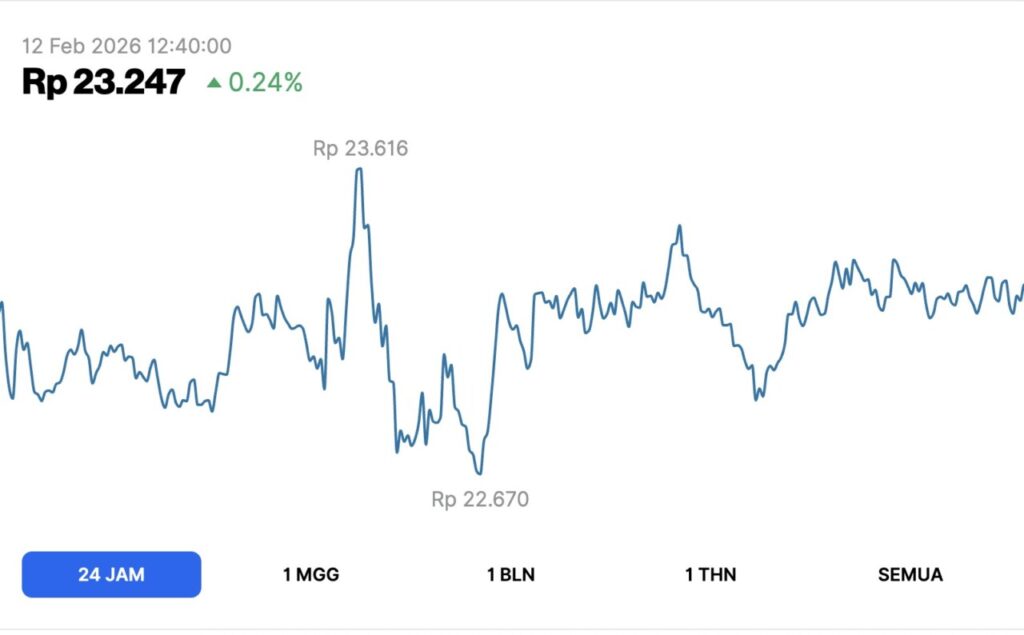

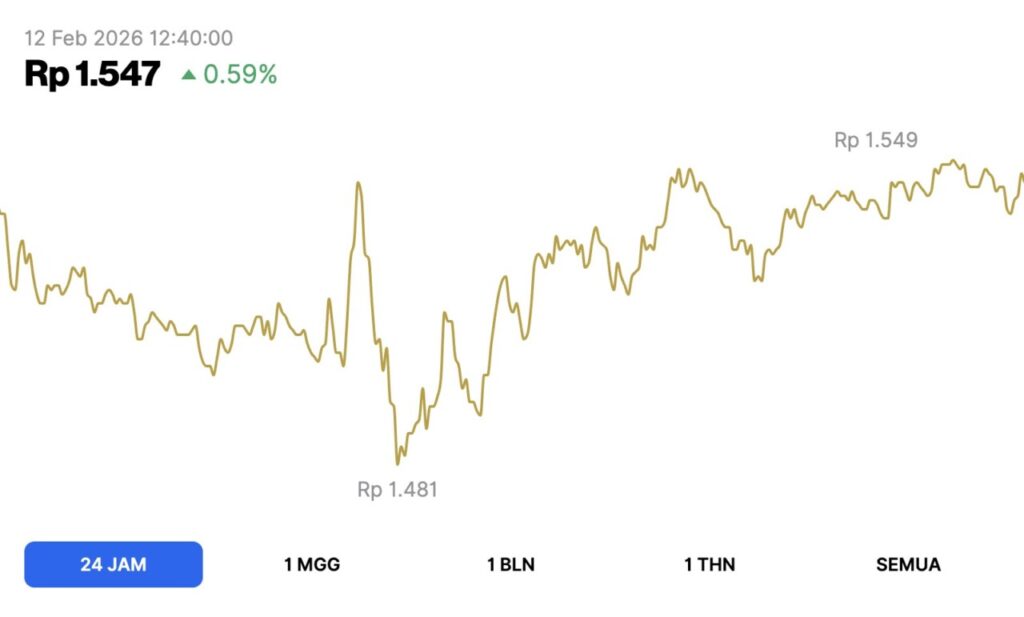

A comparison between Bitcoin (BTC) and gold shows that the market is yet to signal a clear trend reversal. Bitcoin is currently under the scrutiny of global traders, yet it has not been able to outperform gold’s massive rally that occurred amidst the current macroeconomic uncertainty. BTC’s inability to take over the market’s attention gives gold additional momentum as a safe haven asset.

The strengthening of gold suppressed the performance of risk assets and kept Bitcoin stagnant in a price consolidation phase. Investors looking for short-term outperforming assets tend to be more cautious, while BTC remains viewed as a medium to long-term asset. This reflects that Bitcoin’s movement is heavily influenced by global risk sentiment and investors’ decisions on traditional assets.

Also Read: Tokenized Commodities Surpass $6 Billion: What Does It Mean for Crypto Markets?

2. XRP Faces Strong Price Resistance

Ripple (XRP) is currently facing significant technical pressure as the price is near the ceiling or resistance level. This suggests that the bullish momentum for XRP is currently limited by the strong supply factor at certain prices. As a result, it is difficult for XRP to break through higher psychological levels in the short term.

This kind of pressure is common in the cryptocurrency market when investor sentiment weakens or when certain technical levels become resistance. Such moves are a concern for day traders and short-term investors who rely on breakouts as entry signals. Resistance conditions like this also show that market volatility remains a key characteristic of cryptocurrencies.

3. Dogecoin (DOGE) Still Has the Potential to Enter Recovery

Dogecoin (DOGE) is currently analyzed as one of the crypto assets that has the potential to enter the price recovery phase in the coming period. Although market conditions have not yet shown a strong rebound, DOGE’s technical structure shows that there is a chance of a trend reversal if it gets sufficient buying volume.

DOGE’s potential reconsolidation and recovery reflects how meme coin assets generally react to changes in market sentiment. While volatility remains high, DOGE’s price movement could be an indicator of market optimism towards other non-major cryptocurrencies if Bitcoin begins to strengthen.

4. Crypto Market Dynamics Affected by Risk Sentiment and Traditional Assets

The current trend shows that when traditional assets like gold experience a strong rally, crypto assets tend to hold back or move sideways. This is because investors may shift capital to instruments that are seen as more stable when economic uncertainty increases. From a technical and fundamental perspective, the movements of Bitcoin, XRP, and DOGE are influenced by global dynamics such as interest rates, inflation, and geopolitics.

This shows that investors need to consider not only the internal factors of the crypto market, but also the influence of traditional assets and the global macroeconomy. A comprehensive evaluation helps in making more rational decisions, especially amidst the high volatility of the cryptocurrency market.

Also Read: 7 Reasons Silver Demand Remains Strong in 2026: Market Deficit & Investment Rising

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.