Download Pintu App

Bitcoin Plunges 50%: These Are the Cryptos Grayscale Is Backing for a Rebound – ETH, SOL, LINK & More

Jakarta, Pintu News – Bitcoin (BTC) plummeted to around $60,000 on February 5, down more than 50% from its October peak. The latest market commentary report from Grayscale mentions that this fall was not caused by any specific factors in the crypto world.

Instead, it followed the same correction pattern as the massive sell-off in high-growth technology stocks.

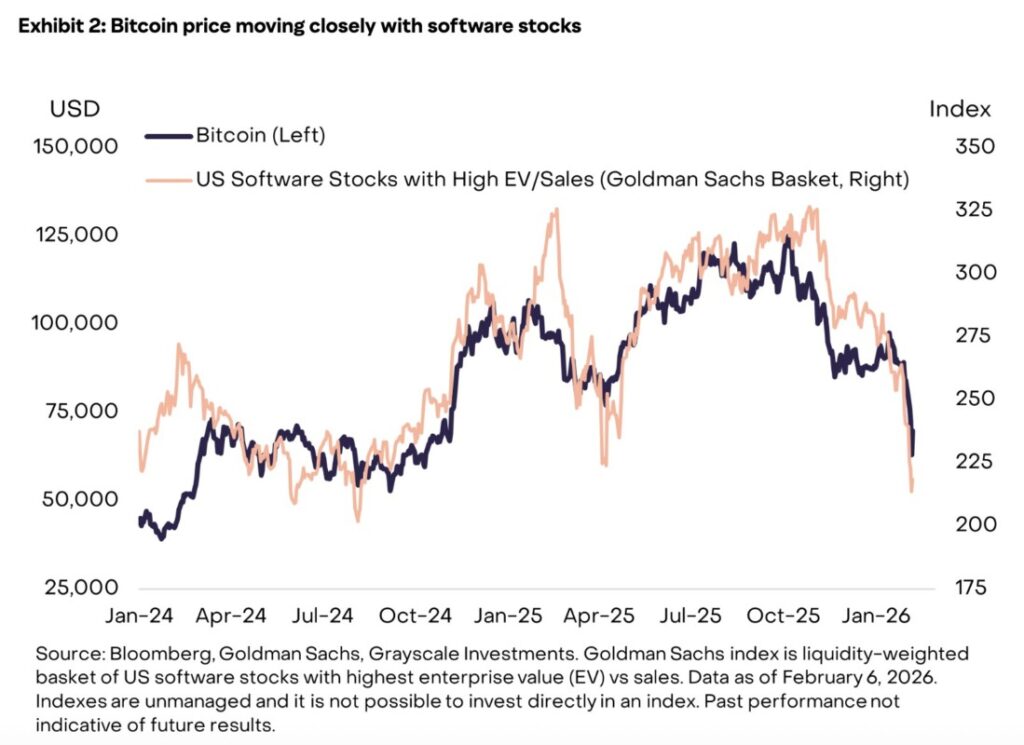

Grayscale ‘s data shows that Bitcoin’s movements have closely aligned with stocks of high-value US software companies for at least the past 12 months. The two assets moved almost identically during this latest downturn, indicating that investors are reducing exposure to riskier assets in general.

Is Bitcoin a Store of Value or a Growth Asset?

According to Grayscale, the answer is simple: “We believe Bitcoin is both.”

The company recognizes that Bitcoin has important characteristics similar to gold, such as its limited supply and government-independent nature. However, gold has been used as money for thousands of years, while Bitcoin is only 17 years old.

Read also: XRP Overtakes Bitcoin and Ethereum as Price Finds a Bottom, Setting the Stage for a Rebound

If in the long run Bitcoin succeeds as a monetary asset, Grayscale predicts its price movements “will eventually resemble gold more than growth stocks, with lower volatility, less correlation to the stock market, and lower yields.”

Who’s Leading the Sell-off?

The selling pressure is mainly coming from American investors. Bitcoin’s price on Coinbase was well below the price on Binance when it hit its recent low, indicating that US-based traders were offloading their holdings. Spot Bitcoin ETP products have also posted net outflows of around $318 million since the beginning of February.

However, the behavior of long-term holders is different. Based on on-chain data, Grayscale did not find any new waves of liquidation from Bitcoin’s “OG Whales”.

Altcoins Under Further Pressure

Bitcoin’s decline looks relatively mild when compared to altcoins. AI-themed crypto tokens slumped 71% so far this month. Utility and service tokens fell 69%. Consumer and cultural sector tokens corrected 66%. Smart contract platforms plummeted by around 58%.

Looking ahead, Grayscale highlights three emerging areas: privacy, perpetual futures, and prediction markets. They named Ethereum (ETH), Solana (SOL), and Chainlink (LINK) as prime candidates to benefit from the increasing adoption of stablecoins and tokenized assets. ZEC was highlighted for its privacy use case, while HYPE was mentioned for its expansion into the prediction market space.

A short-term factor to watch is the CLARITY bill. Delays in the Senate have pressured crypto valuations, and the White House recently held a second meeting with industry players to push the bill forward.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Grayscale Names Top Crypto Recovery Picks After 50% Bitcoin Crash: ETH, SOL, LINK & More. Accessed on February 12, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.