Download Pintu App

5 Facts Gold & Silver Prices Plummet as Crypto Rises, Impact on Investors 2026

Jakarta, Pintu News – Global economic uncertainty has once again put pressure on commodity markets, including gold and silver, which saw significant price declines. At the same time, crypto assets and cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) have shown relative resilience amidst the stress of the US financial system. This has triggered a shift in investor interest away from traditional safe haven assets towards blockchain-based digital instruments.

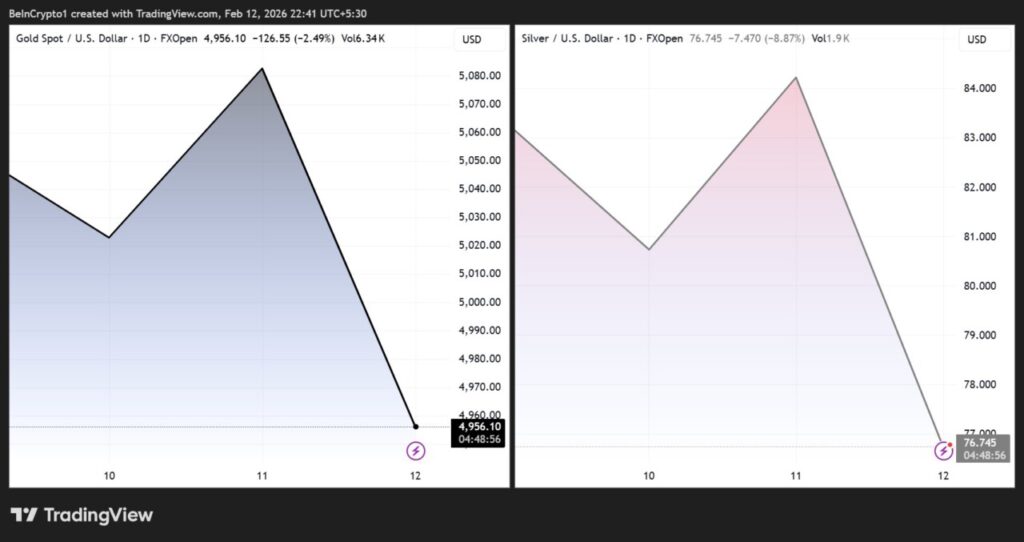

1. Gold Prices Fall Amid US Financial Pressure

Global gold prices are reportedly experiencing a sharp correction due to increased pressure on the United States financial system. Investors reacted to economic data and the potential for tighter monetary policy from central banks. This prompted a sell-off in the precious metal, which was previously considered a key hedge.

If converted using the assumption of an exchange rate of 1 USD = IDR 16,834, then a decrease of USD100 is equivalent to around IDR 1,683,400 per ounce. This correction is considered quite significant for investors who hold large amounts of gold. The situation also affects sentiment towards silver as a commodity asset companion to gold.

Read More: Silver Price Projections 2026 Based on J.P. Morgan Outlook

2. Silver weakens, volatility increases

Silver also came under price pressure as gold weakened and market volatility increased. Investors tend to rebalance their portfolios to reduce exposure to physical assets. This caused silver prices to move more volatile than gold over the same period.

Historically, silver has had higher volatility due to its function as not only an investment asset, but also an industrial raw material. When concerns about an economic slowdown increase, industrial demand tends to decline. As a result, silver prices can correct more deeply than gold.

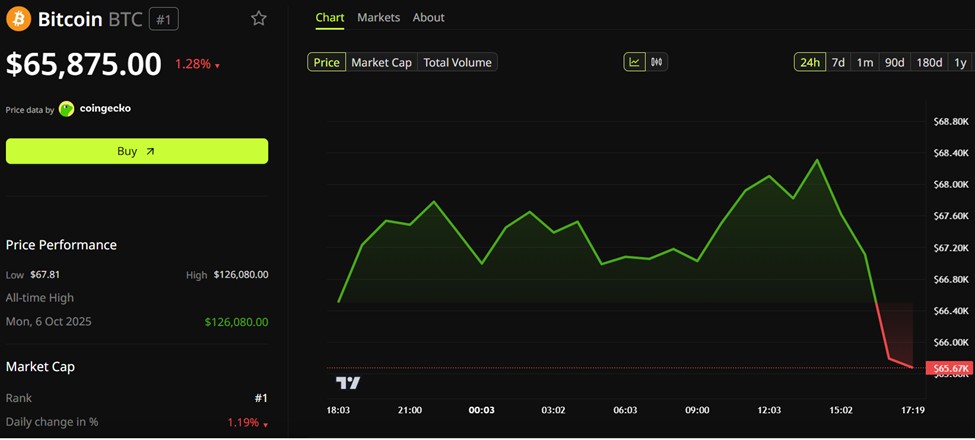

3. Crypto and Cryptocurrencies Show Resilience

Amid the decline in gold and silver, a number of crypto assets are showing relative stability. Bitcoin (BTC) and Ethereum (ETH) continue to attract investors looking for digital hedging alternatives. Some analysts think that crypto is starting to be seen as a non-correlated asset to the traditional financial system.

This phenomenon reinforces the narrative that cryptocurrencies do not always move in the same direction as conventional commodities. While it still has high volatility, crypto is considered more flexible to changes in monetary policy. Retail and institutional investors are starting to consider diversification across digital and conventional assets.

4. Shift in Investor Interest to Digital Assets

Pressures on the banking sector and interest rate policies have the potential to change global investment patterns. Investors who previously relied on gold as a safe haven are starting to look at blockchain-based instruments. This change in preference is also influenced by the ease of access and liquidity of the crypto market.

In addition to Bitcoin (BTC) and Ethereum (ETH), several altcoins have also recorded increased transaction interest. Ripple (XRP) and Pepe Coin (PEPE), for example, remain part of the market discussion despite their high volatility. Nevertheless, the risk of price fluctuations still needs to be taken into account rationally by investors.

5. What does this mean for Indonesian Investors?

For Indonesian investors, the weakening of gold and silver can be a momentum to evaluate investment strategies. With an exchange rate of IDR16,834 per USD, every USD50 movement is equivalent to around IDR841,700, so the impact is quite pronounced on large portfolios. Therefore, cross-asset diversification is becoming an increasingly relevant approach.

However, it is important to understand that both gold, silver and cryptocurrencies are characterized by different risks. Crypto offers high growth potential, but with significant volatility. Meanwhile, gold retains its historical reputation as a long-term hedge asset while not being immune to market pressures.

Overall, these dynamics show that the relationship between commodities and crypto is getting more complex. Investors need to pay close attention to economic data, monetary policy, and market sentiment before making decisions. An analysis-based approach and risk management remain key in the face of volatile market conditions.

Also Read: 3 Scenarios of Martabe Gold Mine & Its Impact on Crypto: Price Could Reach Rp84 Million per Ounce?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Gold and Silver Prices Plunge Amid US Financial Stress. Accessed February 13, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.