Download Pintu App

Crypto Winter Different? Bitcoin (BTC) plummets 25% in a month, institutions are to blame?

Jakarta, Pintu News – The crypto market has been rocked by another sharp correction after Bitcoin (BTC) fell more than 25% in the past month. Since setting a record above US$120,000 in October, the price of BTC has continued to slide, sparking new concerns about the next crypto winter.

However, some observers believe that this weakening reflects a new phase of institutional adoption that has not fully viewed Bitcoin as a hedging asset. The debate rages on whether this cycle is different from the previous four-year pattern.

Institutions Come in, Volatility Doesn’t Go Away

Bitwise’s Chief Investment Officer, Matt Hougan, believes that the price decline is still in line with the four-year cycle pattern that has shaped the dynamics of the cryptocurrency market. The cycle is often characterized by a phase of euphoria, sharp correction, and consolidation before the next rally. In this context, the decline from over Rp2 billion to a much lower range is not an anomaly. However, the intensity of the correction this time raises questions about changes in the market structure.

US Federal Reserve Governor Chris Waller said the entry of large institutions has changed the risk dynamics. Mainstream financial institutions have a lower risk tolerance than retail investors who are chasing the potential for multiple returns.

Galaxy Digital’s CEO, Mike Novogratz, also thinks that retail investors are not getting into crypto for a return of 10% per year, but rather chasing an eight to thirty-fold increase. This difference in expectations makes sell-offs faster when sentiment changes.

Read also: 3 Potential Altcoins in Mid-February 2026

Bitcoin not yet “digital gold”?

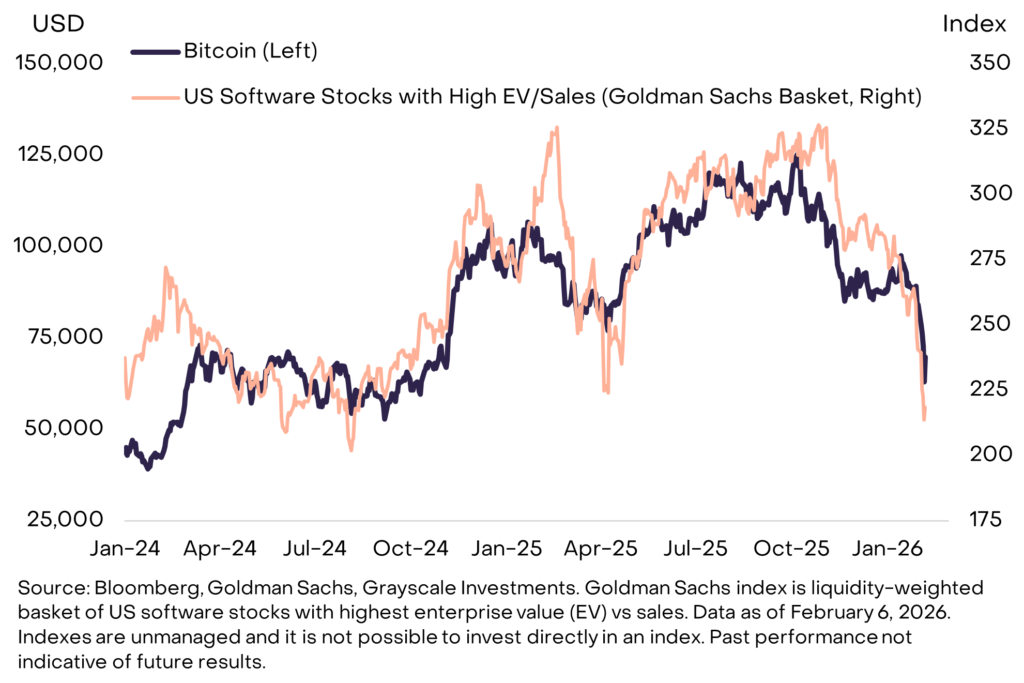

Some analysts think Bitcoin is still being treated as a risky asset, not as digital gold. Grayscale’s report shows that BTC’s price movements are more correlated with high-value technology stocks than with physical gold. This means that when sentiment towards risky assets deteriorates, BTC takes a hit. The short-term correlation with precious metals is also not considered strong.

Bloomberg commodity strategist Mike McGlone even calls Bitcoin a speculative asset that has yet to prove itself as digital gold. He argues that the level of US$60,000 or around Rp1,009,920,000 is only a midpoint before a potential deeper correction. But Grayscale remains optimistic in the long run, stating that the Bitcoin network is likely to survive and maintain its real value.

Read also: 5 Timeless Rings at Frank&Co that are Perfect for Lebaran

U.S. Regulations Set the Course for Crypto

Regulatory uncertainty in the United States has also worsened cryptocurrency market sentiment. The CLARITY bill aimed at clarifying the structure of crypto supervision is still stuck in the Senate. The debate between crypto companies such as Coinbase and the banking lobby regarding stablecoins has made the discussion slow. This lack of clarity is seen as holding back the flow of more institutional capital.

Novogratz stated that both Democrats and Republicans have an interest in passing the rules to restore market confidence. Grayscale also emphasized that clearer regulations will encourage the use of stablecoins, asset tokenization, and other public blockchain applications. On the other hand, Kaiko Research analysts call the US$60,000 level a crucial technical area to maintain the four-year cycle framework.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Is this crypto winter different? Key observers reevaluate Bitcoin. Accessed February 15, 2026

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.