Download Pintu App

A Dormant Satoshi-Era Whale Wallet Reawakens After 14 Years to Purchase 7,000 BTC

Jakarta, Pintu News – A Satoshi-era Bitcoin (BTC) wallet that has been dormant for more than 14 years is suddenly active again. Shortly after the “dormant” wallet was activated, it immediately bought nearly 7,000 BTC worth about 470 million US dollars.

This big move raises an important question in the market: does this Bitcoin pope know something that others don’t?

Bitcoin wallet from the Satoshi era is back after 14 years of “sleep”

According to a report by blockchain analytics firm Arkham Intelligence, the wallet dubbed “Satoshi Whale” with an address beginning with (bc1qq) received 7,068 BTC, worth nearly $470 million.

Read also: Bitcoin Slips Back to $68,000: What Could Be the Next Move for BTC?

This sudden transfer immediately triggered a whale alert in the market. Once the long-dormant wallet became active again, traders and analysts immediately took notice as the movement was considered unusual.

Shortly after, the Bitcoin price jumped more than 4% and is now trading around $69,413, showing how sensitive the market is to large transactions from whales.

Bitcoin Whale Activity Indicates a Major Market Positioning Shift

This level of Bitcoin whale activity usually signals high confidence. Some crypto analysts think this could be a strong signal of whale accumulation, where big players add to their holdings. Historically, similar accumulation phases often appear around market bottoms.

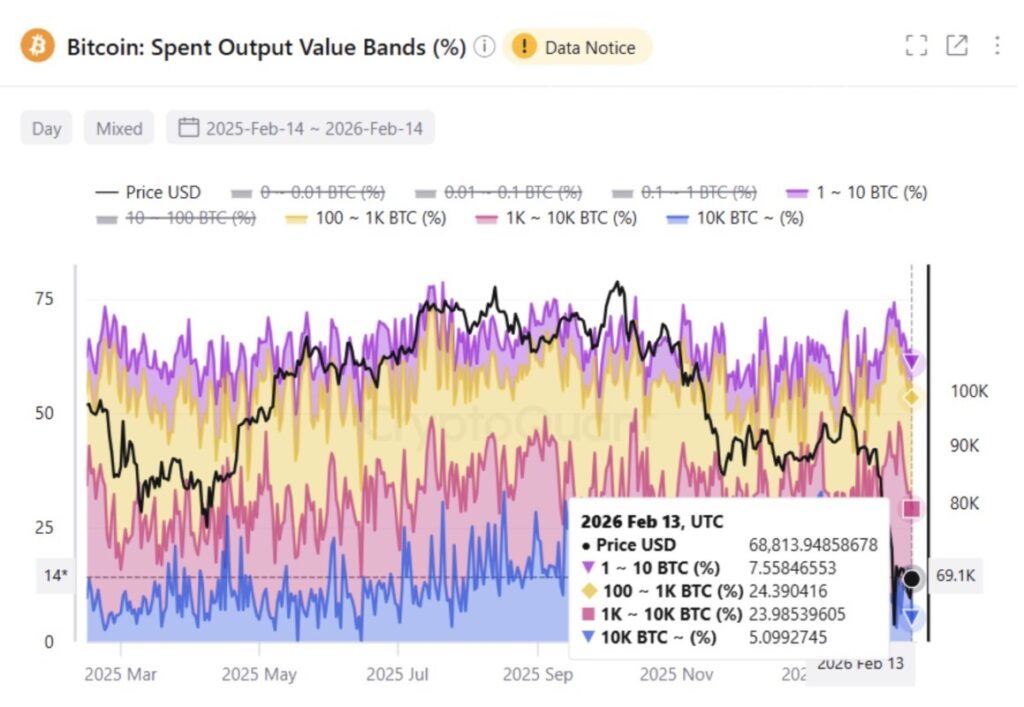

However, on-chain data from CryptoQuant shows mixed signals. As Bitcoin trades around $68,813, Spent Output Value Bands data shows that the 100-1,000 BTC holding group accounts for 24.39% of spending activity, while whales with 1,000-10,000 BTC holdings are at 23.98%. This means that the big players are on the move.

If the share of whale selling falls below 20%, stronger accumulation is likely to start. But if it remains above 25%, Bitcoin is likely to flatten out in the $65,000-$75,000 range in the short term.

Read also: Ethereum Falls to $1,970 as Whale Activity Sends Mixed Signals

In the last 96 hours, the whale has even recorded distributing more than 20,000 BTC, equivalent to about $1.40 billion.

Bitcoin Price Prediction

By the end of the week, Bitcoin was hovering around $70,260, reflecting a gain of about 5% on February 15. From the 3-day price chart, there was an early buy signal from the TD Sequential indicator. According to chart analyst Ali Charts, the TD Sequential indicator is often used to detect weakening trends or signs of movement saturation.

When a count of “9” appears after a series of consecutive bearish candles, it indicates the selling pressure is starting to weaken. Based on the historical patterns of this indicator, Bitcoin could potentially enter a recovery phase in the next 3 to 9 days.

If Bitcoin is able to hold above the recent low of around $64,000, the bulls will likely try to push the price towards the $72,000 to $75,000 resistance area.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Satoshi Era Bitcoin Whale Wallet Buys 7000 BTC After 14 Years. Accessed on February 16, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.