Download Pintu App

5 Facts about Floki (FLOKI) Up 12% – Can Whale Maintain Rally?

Jakarta, Pintu News – Dogecoin may often be in focus, but Floki (FLOKI) memecoin also showed interesting price action when it managed to hold an important support level and rallied 12 percent in the latest session. This surge was triggered by buying interest from whales and other market participants, fueling speculation as to whether this momentum could last in the medium term in a crypto market that is still full of volatility.

1. Support $0.00003 and Spike 12 %

FLOKI managed to hold the support level around $0.00003, which then pushed the price up to $0.0000359, reflecting a gain of about 12 percent from the previous price. This price action marked a change from an accumulation phase to a more positive retracement phase after several sideways days. This rise coincided with sharply increased trading volumes, indicating broader market participation.

Increased volume reflects strong buying interest, but resistance above the level remains a key challenge for the continuation rally. Successful defense of support suggests that the lower zone provides a foothold for bulls to consider further accumulation.

Also Read: 7 Crypto in the Spotlight Ahead of Chinese New Year 2026, Seasonal Momentum or Just a Trend?

2. Whale and Spot Accumulation are the Main Factors

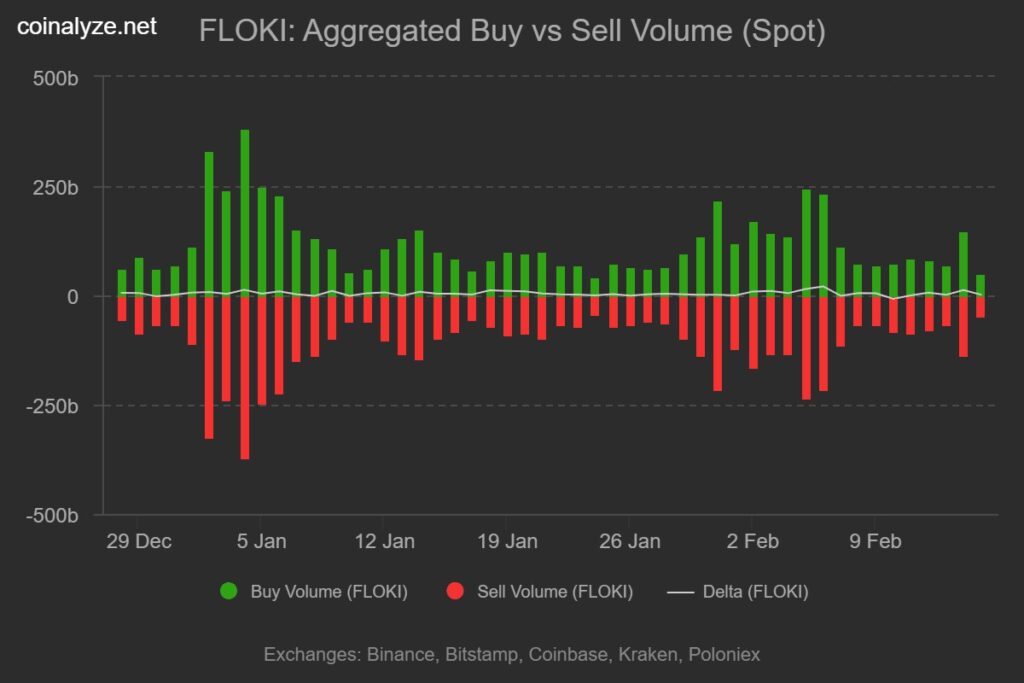

On-chain data shows heavy accumulation by both whales and retail participants. The positive buy-sell delta shows 349 billion FLOKI tokens were bought versus 326 billion sold, meaning there was aggressive accumulation in the spot market. Whale buying activity also increased significantly, with whales buying around 203.4 billion tokens-far above the average volume.

Increased accumulation by whales is often an indicator of short-term bullish sentiment, as whales tend to move when they see value appreciation opportunities. This could trigger further momentum if accumulation continues and is not followed by major profit-taking.

3. Technical Indicators Show Strong Demand

In addition to the on-chain data, some technical indicators also support upside strength. Floki’s Relative Strength Index (RSI) increased from around 31 to around 47, indicating a shift from oversold conditions towards stronger momentum. Floki also managed to cross the 20 Exponential Moving Average (EMA), which is often considered an early signal that a short-term uptrend is developing.

However, the RSI is still below the overbought zone, which means there is still room for additional upside potential if the buying pressure continues. The use of the 50 EMA will then be an important indicator to determine if a bigger breakout will occur.

4. Rally Support Challenge

Although whale accumulation and technical data point to positive sentiment, memecoin rallies tend to be more vulnerable to quick sell-offs and profit-taking. If most of the holders who are still losing money since the previous drop start to realize profits at the local highs, the selling pressure could return the price to support around $0.00003. Broader crypto market conditions also remain cautious, with the Fear & Greed index showing extreme low sentiment, reflecting market concerns.

High volatility in memecoins like Floki means that rallies can feel strong in the short term but are easily fragile if key catalysts, such as whale interest or market sentiment, weaken.

5. Implications for Cryptocurrency Investors

For crypto investors, Floki’s latest rally shows that accumulation by whales can be a strong catalyst for memecoin price movements. However, due to the sensitive nature of memecoin to market sentiment and liquidity, investment decisions should still consider strict risk management. Successful holding of support and continued accumulation could extend the rally, but the risk of reversal remains high in a market that is still vulnerable to external factors.

Understanding trading volumes, technical patterns, and on-chain accumulation data helps investors gauge whether the memecoin rally has a stronger foundation or is just a temporary spike driven by momentum traders and whales.

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Analyzing FLOKI’s 12% Rise: Can Whales Sustain the Rally? Accessed February 16, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.