Download Pintu App

These 3 Signals Call Bitcoin Rp1 Billion is the Lowest Point, Ready to Explode to Rp1.5 Billion?

Jakarta, Pintu News – The recent price movements of Bitcoin (BTC) have been quite thrilling for investors, especially after the asset corrected sharply from its record high. However, despite the clouds hanging over the crypto market, a number of high-level technical metrics are giving very positive signals.

Analysts believe that the current price level is not the beginning of a deeper fall, but rather an oversold point signaling that the bottom of the cycle has been reached and a major recovery is in sight.

Sharpe Ratio hits the lowest “pain zone” level

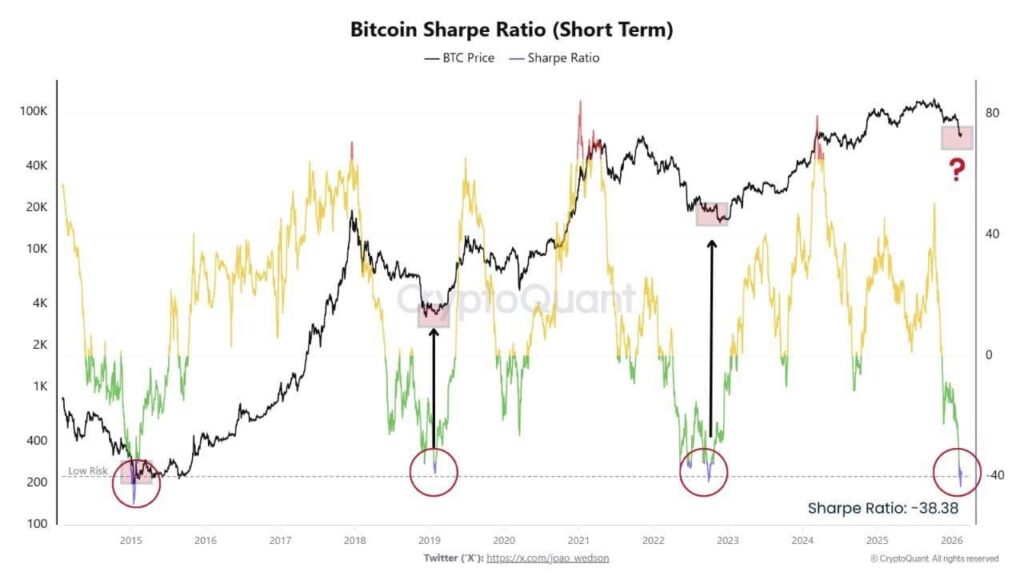

One of the most accurate signals to emerge at the moment is Bitcoin’s (BTC) short-term Sharpe Ratio plummeting to -38. Numbers this extreme have historically only ever occurred at major cycle lows, as seen in 2015, 2019, and late 2022. When this metric hits that zone, it signals maximum exhaustion on the seller’s side, where almost no one is willing to dump their assets at low prices anymore.

This “pain zone” condition is often followed by a very aggressive price recovery. Currently, Bitcoin (BTC) is trading at around $66,988 or equivalent to Rp1,131,226,356, down about 46% from its record high of $126,000 (Rp2.12 Billion). This drastic drop in the Sharpe Ratio is a strong indication that the selling pressure has peaked and the market is preparing for a reversal in the near future.

Also Read: Warren Urges Fed and Treasury to Reject Crypto Billionaire Bailout, Afraid to Favor Trump?

BTC scarcity hits a new record high

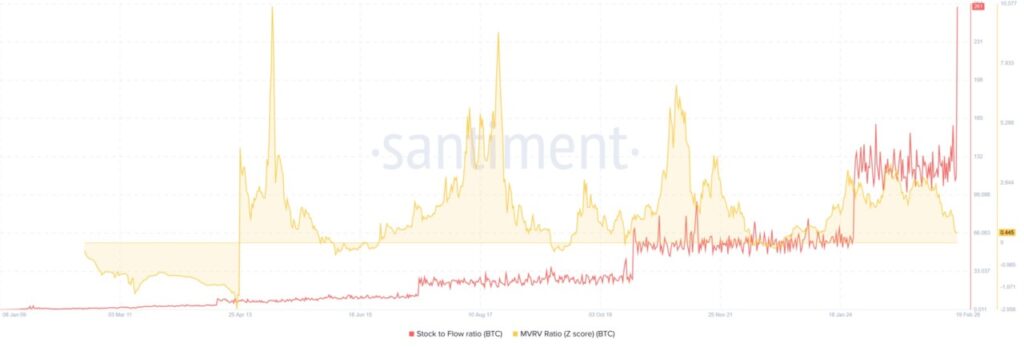

The second important metric is the Stock to Flow Ratio (SFR) of Bitcoin (BTC), which jumped sharply from 127 to 261. This rise in SFR to an all-time high shows that the level of scarcity of Bitcoin (BTC) in the current market is massive as the circulating supply is dwindling. Despite the downward price trend, the data shows that long-term holders are not aggressively selling, but rather continuing to accumulate.

This extreme scarcity usually puts immense pressure on the supply side of the market, which automatically positions prices to move upwards. Additionally, the MVRV Z-Score metric has also fallen to a 2023 low of 0.445. This figure signals that the current price of Bitcoin (BTC) is well below its historical cost value, a classic condition where “smart money” begins to take the asset out of the hands of panicked investors before the market has fully recovered.

Projection: Stay at IDR1 Billion or Fly to IDR1.5 Billion?

Although the fundamental metrics are bottoming out, the technical market structure still looks quite weak with the Relative Strength Index (RSI) at 32 which is approaching the oversold zone. If the selling pressure from day traders continues, Bitcoin (BTC) is predicted to move sideways in the range of $60,000 to $65,000 (around Rp1.01 Billion to Rp1.09 Billion). However, this $60,000 zone is believed to be a healthy “reset” for the overall cryptocurrency ecosystem.

If the basic signals of this cycle prove to be accurate, then Bitcoin (BTC) is projected to soon break the psychological level of $70,000 (Rp1.18 Billion) and return to aim for the ambitious target of $90,000 or the equivalent of Rp1.51 Billion. The transfer of wealth from weak hands to strong hands is currently the main foundation for a sustainable rally in the future. For those with a long-term view, this consolidation phase is often seen as the last chance to enter before the next bullish cycle begins.

Also Read: Tron (TRX)’s Glory in 2026: King of Transactions and Digital Payment Infrastructure

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Gladys Makena. Bitcoin: Why THESE signals point to $60K as BTC’s cycle low. Accessed February 20, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.