Download Pintu App

Bitcoin (BTC) is in buying territory, is it the right time to buy? Here’s what analysts say! (2/26/25)

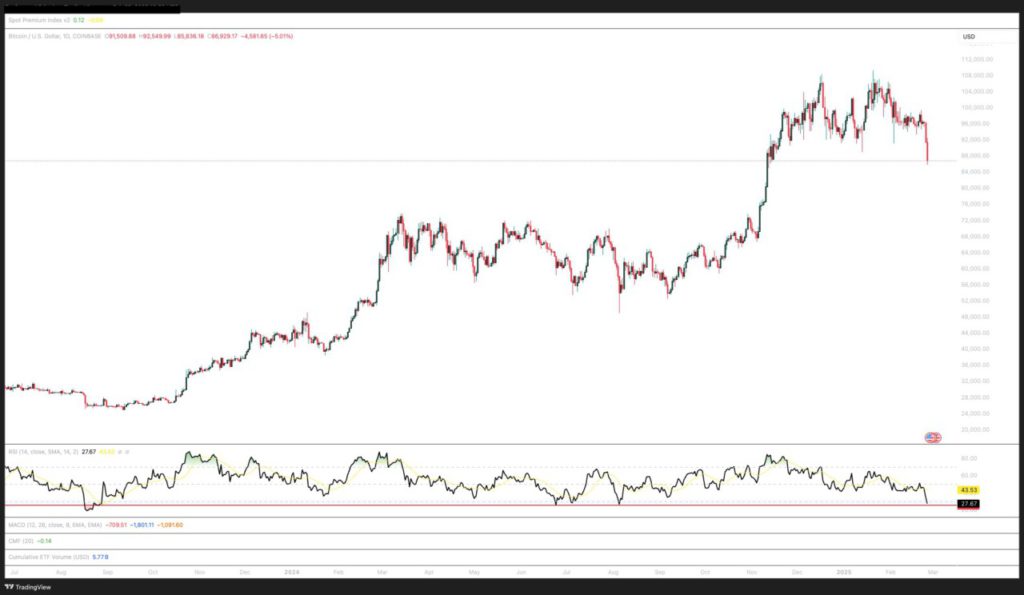

Jakarta, Pintu News – The price of Bitcoin (BTC) fell again on February 25, 2025, recording a three-month low of $86,050 (IDR 1,404,199,500). This drop adds to market concerns regarding the performance of US equities, surging inflation, and a sharp drop in consumer confidence that occurred this month.

Despite the significant correction in Bitcoin’s price, some analysts say that Bitcoin is currently in “generational buy territory” and investors should consider the big picture before making short-term decisions.

Factors that Suppress Bitcoin Price

Bitcoin’s recent price drop cannot be separated from global economic uncertainty, particularly in the US market. Some analysts attribute this price drop to the poor performance of US equities, which have shown pressure on large stocks.

In addition, rising inflation and a sharp decline in consumer confidence, as recorded in the Conference Board’s Consumer Confidence index which fell to 98.3 in February 2025, further worsened market sentiment. This is the largest decline since August 2021, and indicates growing concerns about the near-term economic outlook.

Furthermore, there are other uncertainties related to global political policies, including the import tariffs that President Donald Trump will impose on Canada and Mexico. These policies have exacerbated economic uncertainty, which in turn has led many investors to take a “risk-off” approach and exit risky assets such as cryptocurrencies.

Also Read: Senator Dick Durbin Introduces Legislation to Stop Fraud at Crypto ATMs

Is it a Good Time to Buy Bitcoin?

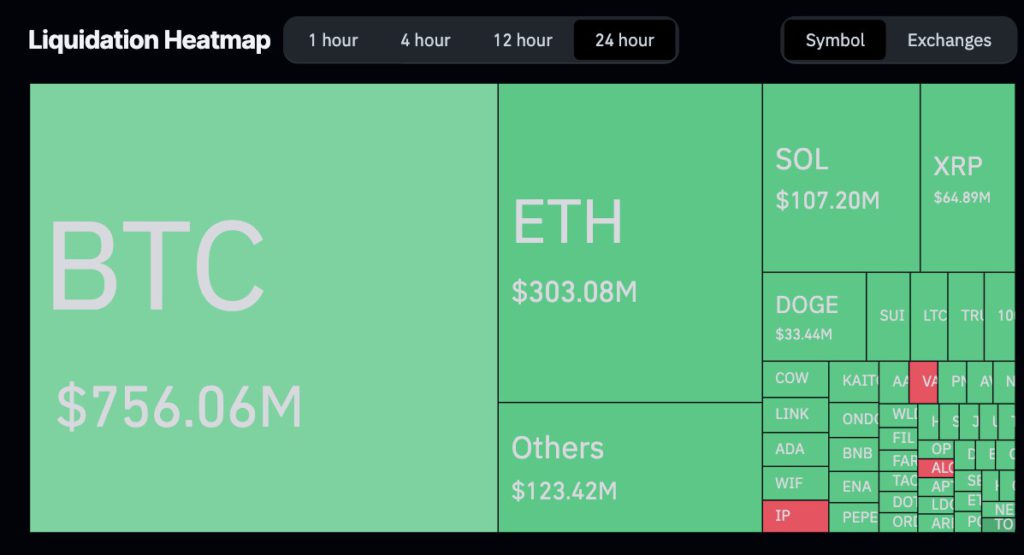

As Bitcoin’s price continues to fall, some analysts and leading figures in the cryptocurrency space are advising investors to “zoom out” and look at the big picture. While Bitcoin’s RSI (Relative Strength Index) is currently below 27, signaling oversold conditions, this is often an opportunity to buy at a discount. This low level of RSI was last recorded on August 5, 2024, when the price of Bitcoin fell to $49,000.

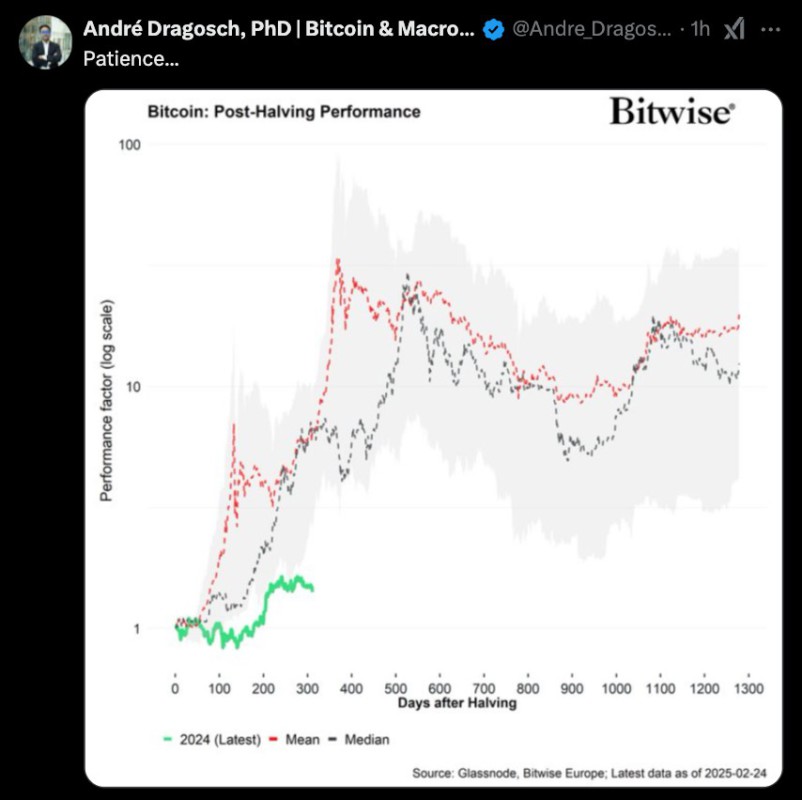

Some analysts such as André Dragosch of Bitwise Europe also advise investors to be patient. He cautioned that despite Bitcoin’s short-term underperformance, a long-term bull market rally could still potentially occur. Based on Bitcoin’s historical post-halving data, it is common for most of the new price gains to occur after the next halving, which is expected to push Bitcoin’s price higher.

Institutional Adoption and Bitcoin’s Long-term Potential

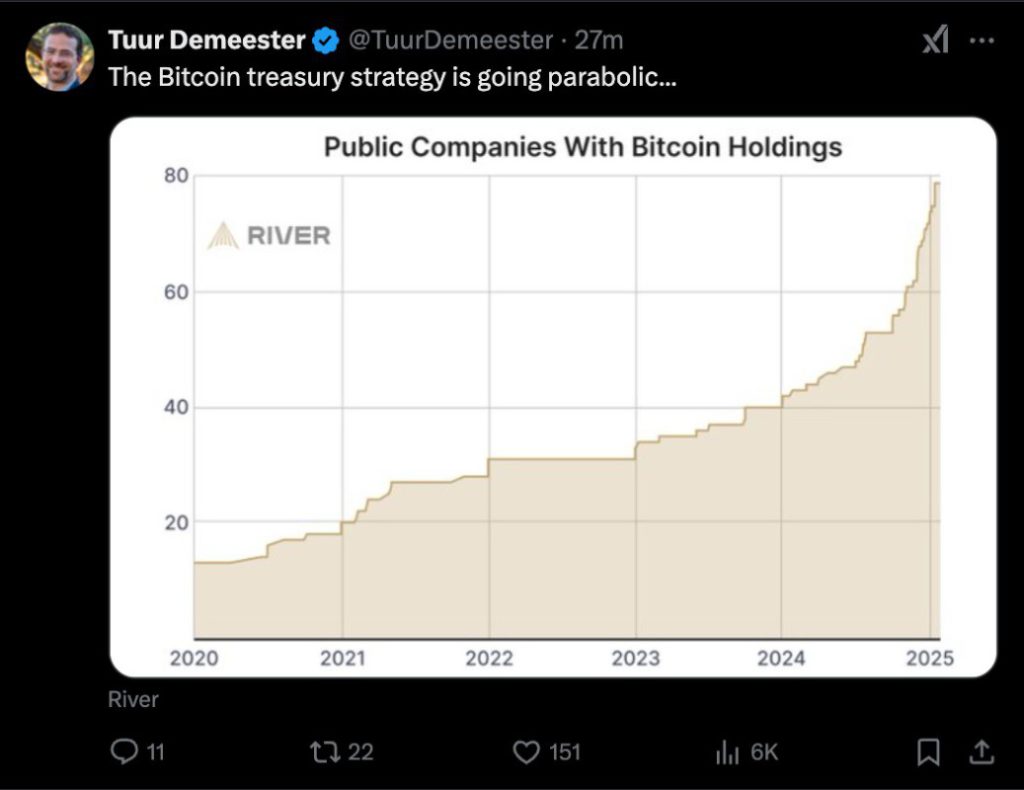

Although Bitcoin price is in a short-term downward trend, there are positive factors that support Bitcoin’s long-term prospects. One of them is the growing institutional adoption. Many large corporations and financial institutions are increasingly interested in accumulating Bitcoin, which is reflected in the increasing BTC balances on the balance sheets of public companies. This shows that Bitcoin is not only seen as a speculative asset, but also as a trustworthy asset for long-term investment.

Tuur Demeester, a renowned Bitcoin analyst, also cautioned that despite Bitcoin’s depressed daily price, growing institutional adoption is an important factor supporting Bitcoin’s fundamentals. With increasing demand from large financial institutions and publicly traded companies, Bitcoin has the potential for stronger long-term value, even though the market is currently in a correction phase.

Short-term vs Long-term Perspective

Overall, while Bitcoin’s price drop can be viewed as an indication of short-term market pressure, the factors supporting institutional adoption and Bitcoin’s potential long-term rally cannot be ignored. Traders and investors with a long-term view may see this time as an opportunity to buy at lower prices, especially if they believe in Bitcoin’s fundamentals.

However, it is important for investors to remain cautious and realize that cryptocurrency investment involves high risk. It’s best to do in-depth research and consider broader market conditions before making a decision.

Also Read: 3 Factors Causing the 50% Drop in Solana (SOL) Price from All-Time Highs

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin Price in ‘Generational Buy’ Territory: Should Traders Expect More Downside? Accessed February 26, 2025.

- Featured Image: BuyUcoin

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.