Download Pintu App

Bitcoin at a Critical Point, Will the Bullish Trend Repeat? BTC Enters Historical Accumulation Zone

Jakarta, Pintu News – Bitcoin (BTC) is currently in a zone referred to as a “shopping area” based on CryptoQuant’s analysis. This zone usually occurs when the price of BTC experiences a decline of between 15% to 20%, which has been the case in recent times. Currently, the price of BTC has decreased by 17.47% in the past month, with the price previously touching Rp1,484,010,000 before dropping further.

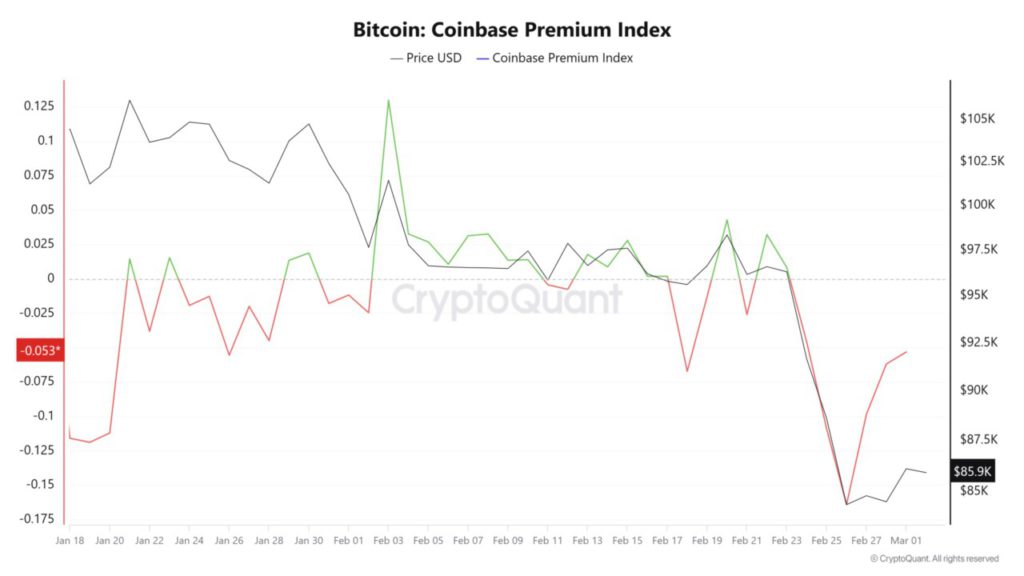

This price drop caught the attention of investors in the United States, who started accumulating the crypto asset. The Coinbase Premium Index, which measures BTC buying and selling activity by US investors, is showing an upward trend towards zero from its previous negative position (-0.053). If this index moves into positive territory, then there is likely to be a larger wave of buying, potentially pushing BTC prices to higher levels.

Historical Patterns Point to a Potential Rise in BTC Price

History shows that Bitcoin often experiences price spikes after going through a sharp correction phase. The current situation is reminiscent of the price movement that occurred last August, where after experiencing a significant decline, BTC managed to break through the resistance level and print a new high.

In the latest technical analysis, a similar pattern appears to be forming again. If BTC manages to break through the resistance line that has been formed, there is a high probability that the price will experience a significant rally. However, pressure from the derivatives market is still a factor that could hinder this upside.

Also Read: Why is Ripple Still Fighting in Court Despite SEC Dropping Another Crypto Case?

Derivatives Traders Maintain Bearish Sentiment

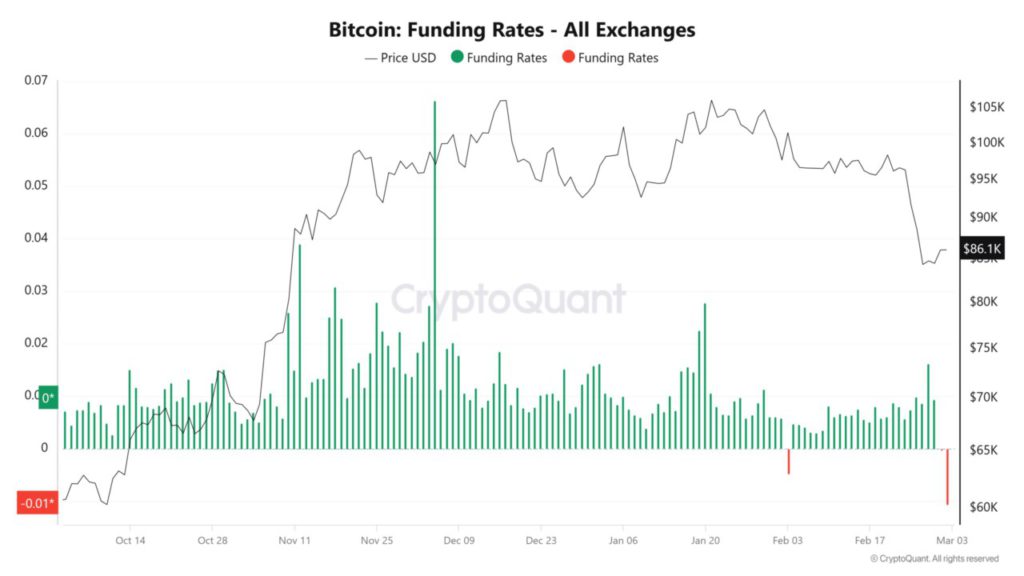

On the other hand, the derivatives market is showing the opposite indication of retail investor optimism. The funding rate for Bitcoin on various crypto exchanges has been falling since February 3, with the latest figure standing at -0.01. A negative funding rate indicates that traders who go short are paying a premium to maintain their position, signaling market expectations of further price declines.

Additionally, the Taker Buy/Sell Ratio shows that selling pressure is still more dominant than buying pressure. If this trend continues, then BTC may have a hard time experiencing significant price increases in the short term. However, if buying pressure increases suddenly, derivatives traders holding short positions are at risk of liquidation, which could trigger a drastic spike in BTC prices.

Conclusion

Bitcoin is currently at a tipping point that could determine the direction of its next price movement. While retail investors have started accumulating BTC, the negative sentiment in the derivatives market is still a hindrance to the price rally. If the historical pattern repeats itself and buying pressure increases, BTC could potentially experience a price spike like the one last August. However, market uncertainty is still high, so investors need to remain wary of the cryptocurrency’s price volatility.

Also Read: XRP Faces Hurdle at $2.4: Can Bulls Break Through? (4/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. Bitcoin at a turning point: Can BTC replicate its August surge? Accessed March 4, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.