Download Pintu App

BNB is resilient amidst a shaky crypto market, here’s why! (4/2/25)

Jakarta, Pintu News – The crypto market has experienced a sharp decline recently, but Binance Coin (BNB) has shown remarkable resilience. Unlike Bitcoin (BTC) and Ethereum (ETH), which experienced drastic declines, BNB only corrected by about 8.5%. This strength has caught the attention of many investors who are looking for stability in an uncertain market.

BNB More Stable Amid Market Uncertainty

Amidst a bad week for the crypto market, where Bitcoin (BTC) and Ethereum (ETH) experienced significant declines, Binance Coin (BNB) only corrected by 8.5%. Data from CoinMarketCap shows that this is the smallest decline among the top five crypto assets.

This indicates that Binance Coin (BNB) may be considered a safer asset when markets experience high volatility. Currently, Binance Coin (BNB) is trading at $610.47, with a daily high of $611.23 and a low of $590.99.

This performance shows that Binance Coin (BNB) managed to maintain a more stable price range than Bitcoin (BTC) and Ethereum (ETH) during the last market downturn. Binance Coin’s (BNB) Relative Strength Index (RSI) has risen sharply but is still near oversold territory, signaling renewed buying pressure.

Also Read: Why is Ripple Still Fighting in Court Despite SEC Dropping Another Crypto Case?

Binance’s stablecoin dominance strengthens its position

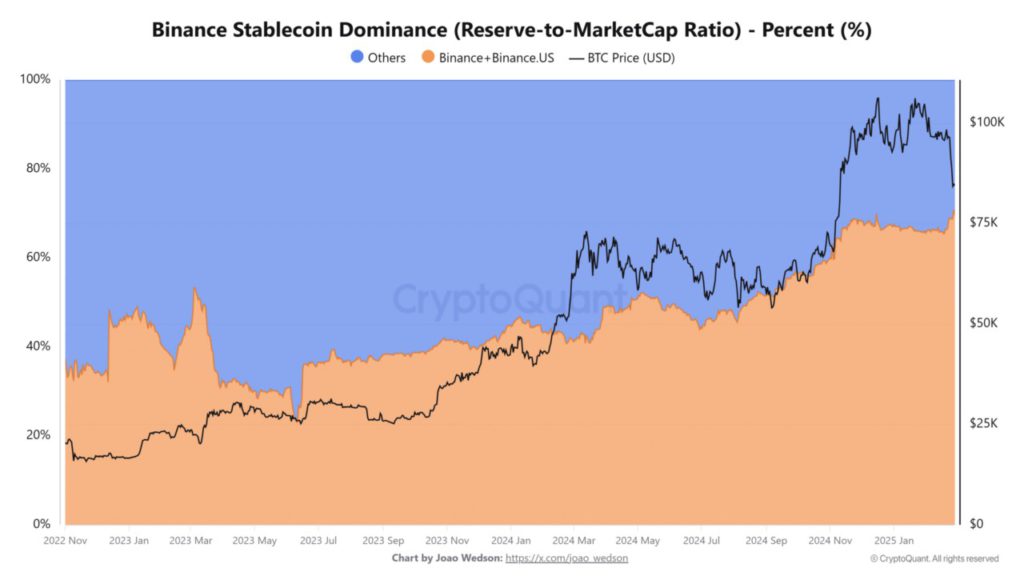

Binance now controls around 70% of all stablecoins held on crypto exchanges. This dominance emphasizes Binance’s growing influence in the crypto trading ecosystem, where stablecoins are essential for liquidity, trading, and hedging against volatility.

The large availability of stablecoins on Binance demonstrates users’ high trust and reliance on the platform for trading and liquidity needs. This increased dominance of Binance stablecoins is attributed to the growth in Futures and Spot trading volumes on the exchange.

This shows that trading activity on Binance is growing, attracting more liquidity and strengthening its presence in the market. By controlling a large portion of the stablecoin reserves, Binance increases its ability to influence market liquidity, providing a reliable platform for trading and asset management.

Implications for the Crypto Market

Binance Coin’s (BNB) resilience during periods of broad market declines highlights its potential as a more stable asset in volatile conditions. Investors looking to reduce risk exposure might consider allocating a portion of their portfolio to Binance Coin (BNB), as its historical performance demonstrates relative strength in declining market conditions. Moreover, Binance’s dominance in stablecoin holdings further reinforces its status as a leading crypto exchange.

Subtitle: Closing Paragraph

Taking all these factors into account, Binance Coin (BNB) offers an oasis of stability in the desert of crypto market volatility. Binance’s strength and dominance in the stablecoin market provides a solid foundation for Binance Coin (BNB) to continue to grow and possibly become a top choice for investors seeking security in their crypto investments.

Also Read: XRP Faces Hurdle at $2.4: Can Bulls Break Through? (4/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. BNB remains strong even as the crypto market struggles – Here’s why. Accessed on March 4, 2025

- Featured Image: Freepik

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.