Download Pintu App

Michael Saylor’s Strategy: $21 Billion Fundraising Plan to Buy Bitcoin

Jakarta, Pintu News – Michael Saylor, founder and chairman of Strategy (formerly MicroStrategy), has once again shown his commitment to Bitcoin (BTC) by announcing plans to raise up to $21 billion (Rp342.3 trillion). These funds will be used to buy more Bitcoin as well as support the company’s working capital needs.

On March 10, 2025, Strategy announced a new sales agreement that allows the company to issue and sell shares of Series A perpetual strike preferred stock. This program, known as the ATM Program, will be executed in stages taking into account the trading price and volume of shares at the time of sale.

Strategy 21/21: Strategy’s Ambitious Mission for Bitcoin

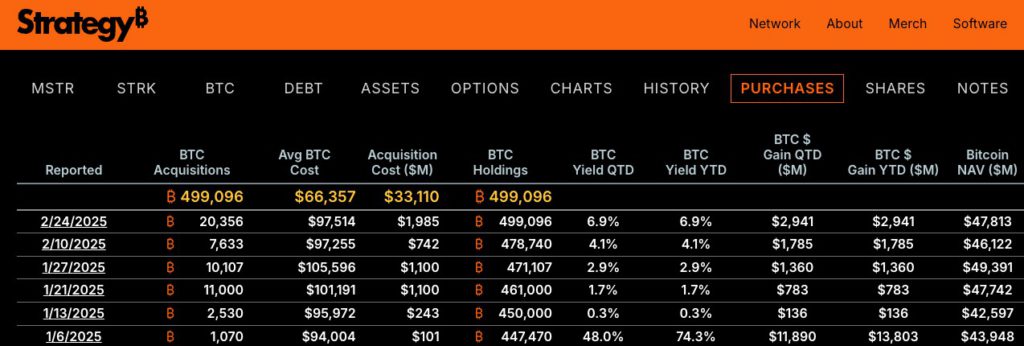

Currently, Strategy holds around 499,096 BTC, which when converted to rupiah is equivalent to IDR 673.1 trillion (at a Bitcoin price of around $82,972 or IDR 1.35 billion per BTC). The Bitcoin was purchased with a total investment of $33.1 billion (IDR539.6 trillion), with an average price per BTC of $66,423 (IDR1.08 billion).

The strategy is part of the company’s long-term plan called the “21/21 plan”, where it plans to raise $21 billion in equity and $21 billion in fixed income securities in the next three years. With this, the company hopes to continue adding Bitcoin holdings as part of its investment strategy.

Also Read: MicroStrategy Stock Downside Risk Amid Crypto Market Volatility

Bitcoin Investment Return Target in 2025

By 2024, Bitcoin Strategy’s investment yield will reach 74%, reflecting significant growth in the value of the company’s BTC holdings compared to the number of shares outstanding. For 2025, the company is targeting an investment return of 15%, which it hopes to achieve through a more aggressive Bitcoin accumulation strategy.

Since the beginning of 2025, Strategy has made six Bitcoin purchases, with a total of 52,696 BTC acquired since January 13. With this approach, Strategy has further established itself as the public company with the largest Bitcoin holdings in the world.

Michael Saylor and His Strategic Role in Bitcoin Adoption

Since first adopting a Bitcoin strategy in August 2020, Michael Saylor has become one of the biggest proponents of Bitcoin in the financial industry. His move to make Bitcoin the main asset of the Strategy has inspired other large companies, such as Tesla led by Elon Musk and Japan’s Metaplanet, to jump on the Bitcoin investment bandwagon.

In addition, Saylor also encouraged the United States government to increase its national Bitcoin reserves in the Strategic Bitcoin Reserve. He recommends that the US government own up to 25% of the total Bitcoin supply or increase BTC holdings from 200,000 BTC to 525,000 BTC as part of a national financial strategy.

Conclusion

Michael Saylor’s strategy to raise up to $21 billion reflects his strong belief in Bitcoin as the Strategy’s main asset. With more and more traditional institutions starting to adopt BTC, this move could have a huge impact on the cryptocurrency ecosystem as a whole. However, the success of this strategy remains dependent on external factors, such as Bitcoin price volatility and government regulations in different countries.

Also Read: Shiba Inu (SHIB) and the Challenges to a Price Rally in the Cryptocurrency Market (11/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Michael Saylor’s Strategy to Raise $21 Billion to Purchase Bitcoin. Accessed March 11, 2025.

- Featured Image: Business2Community

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.