Download Pintu App

SUI Predicted by Analyst Ali Martinez to Experience Movement Towards IDR40,750

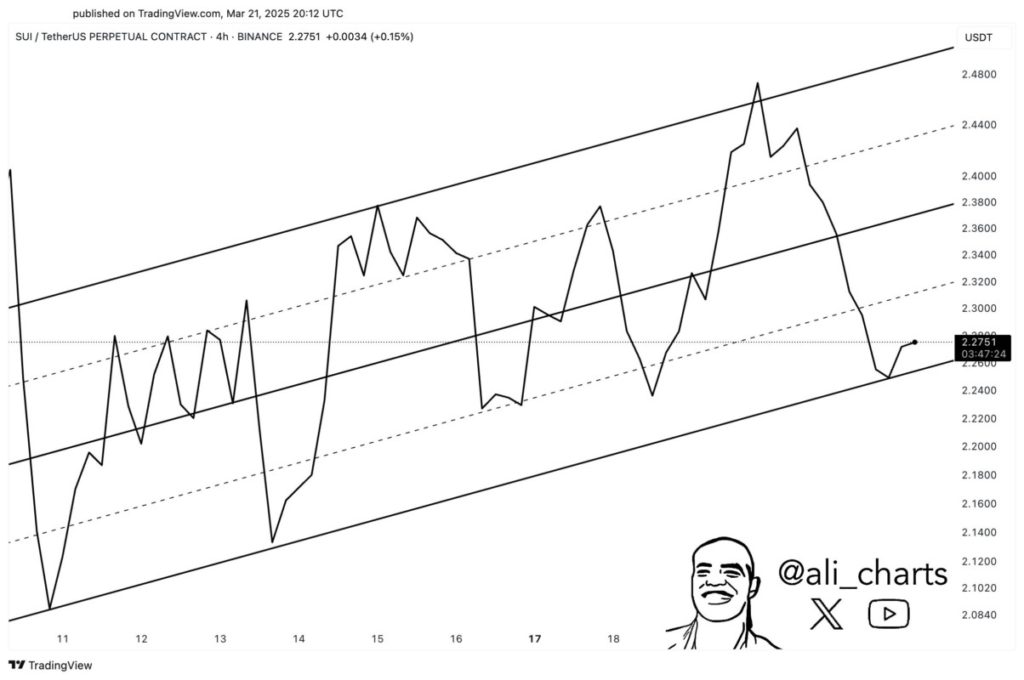

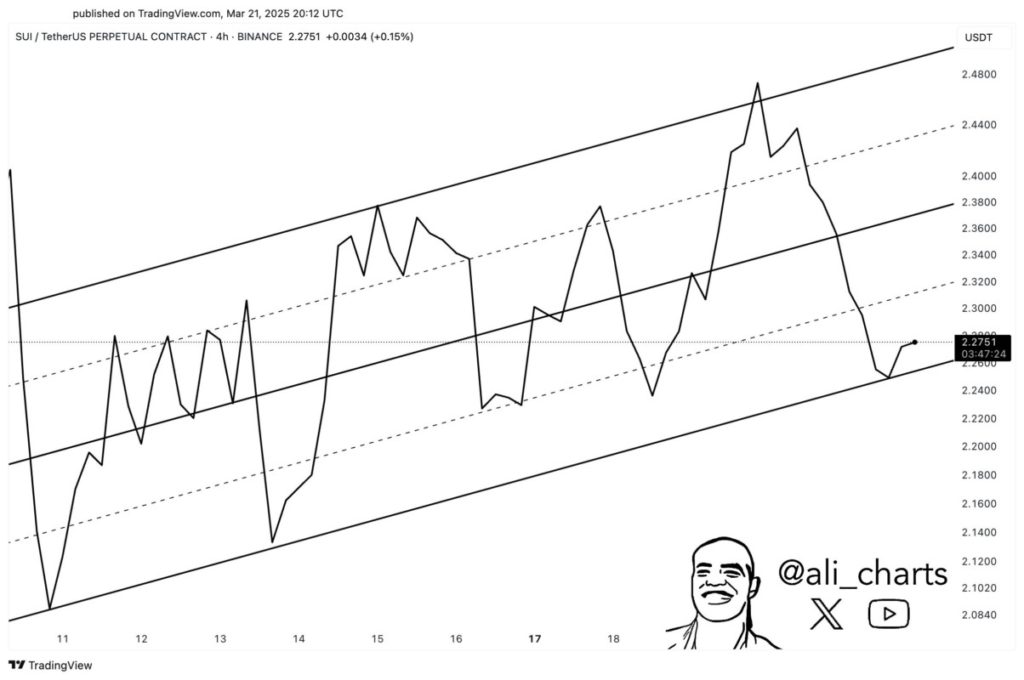

Jakarta, Pintu News – SUI, the native token of the Sui network, is currently showing significant upside potential. Market analysts identified an ascending channel pattern on the SUI price chart, which could lead to a move towards the next resistance level. If the key support can be maintained, SUI has the potential to reach higher price targets in the near future.

Upward Channel Pattern and its Implication to SUI Price

Crypto analyst Ali Martinez notes that since March 11, SUI has been moving in an ascending canal pattern, characterized by two parallel trend lines sloping upwards. These lines serve as support and resistance boundaries, keeping the price movement within a certain range. This pattern is usually considered bullish as it indicates the dominance of buyers in the market.

Based on Martinez’s analysis, SUI recently retested the rising channel’s support line at $2.26 (approx. IDR36,838). As long as SUI does not experience a sharp drop below this support level, there is upside potential towards $2.50 (approx. IDR40,750), which is the upper resistance line of the rising channel.

Read More: Solana (SOL) Price Movement Faces Important Barriers and Supports March 2025

Breakout Potential and Next Price Target

If strong market demand pushes SUI to break above this up channel, the next price target could be $3.00 (approx. IDR48,900). However, in the event of a significant price drop below the $2.26 support, SUI’s price could drop to $1.75 (approx. IDR28,525).

At the time of writing, SUI is trading at around $2.28 (approx. IDR 37,164), reflecting a gain of 0.84% in the last 24 hours. However, the asset’s trading volume decreased by 31.69%, indicating a decrease in market participation.

Recent Developments and Their Impact on SUI Prices

The SUI community is showing enthusiasm after Canary Capital filed an application for an SUI spot ETF with the US Securities and Exchange Commission (SEC). This move follows the registration of a trust for SUI-based funds in Delaware in early March. The outlook for spot ETFs is considered very bullish as it promises institutional investment, as seen with Bitcoin and Ethereum last year.

Although SUI experienced a 30.21% drop on the monthly chart due to the strong bearish influence in recent weeks, the token remains a major highlight in the current cycle.

Between the fourth quarter of 2024 and early January 2025, SUI experienced impressive price gains, reaching a new record high of $5.35 (approx. IDR 87,205). With the cycle likely still ongoing, some analysts are in favor of SUI’s bullish potential, describing the current downtrend as a good buying opportunity.

Conclusion

SUI is currently in an important phase that could determine the direction of its price movement going forward. The bullish channel pattern formed indicates a potential price increase towards the next resistance level. However, investors should remain wary of a possible decline if the key support cannot be maintained. Recent developments, such as the SUI spot ETF filing, may affect market sentiment and subsequent price movements.

Read More: Chainlink (LINK) Tests Critical Support, Potential Price Recovery on Investors’ Eyes

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Semilore Faleti/NewsBTC. SUI Poized For Price Rally? Ascending Channel Suggests A Move Toward $2.50. Accessed March 24, 2025.

- Featured Image: Finance Feeds

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.