Download Pintu App

BlackRock Switches from Bitcoin to Ethereum: Latest Investment Strategy

Jakarta, Pintu News – In the latest development in the crypto market, BlackRock, one of the investment management giants, has made a significant shift in its crypto portfolio. The company sold $130 million worth of Bitcoin (BTC) and bought $69 million worth of Ethereum (ETH). These transactions took place between May 30 and June 2, marking a change in investment strategy that may have a lasting impact on market dynamics.

Bitcoin withdrawal by BlackRock

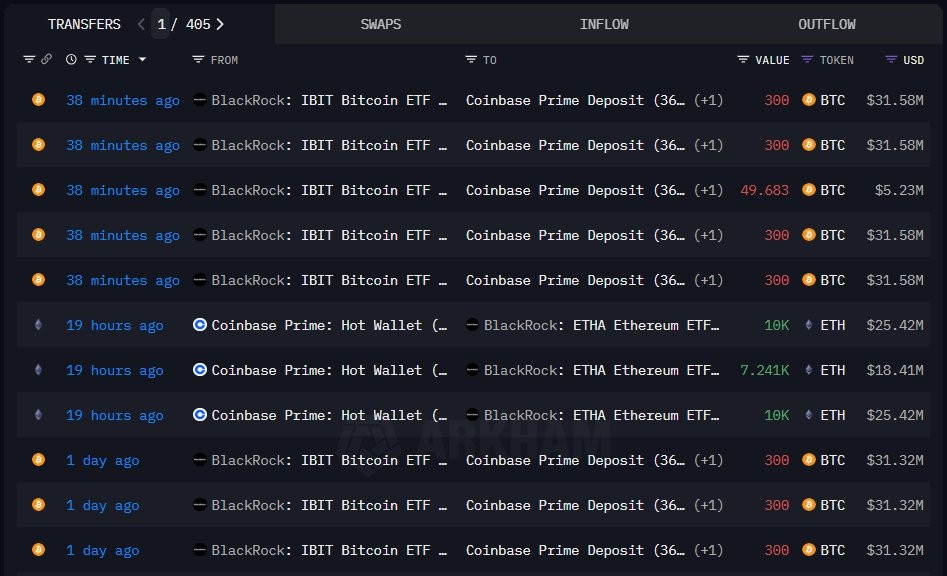

On-chain data shows that BlackRock has transferred 5,362 Bitcoin (BTC) to Coinbase Prime in a two-day period. These withdrawals began on May 30 with the sending of 4,113 Bitcoin (BTC) and continued with 1,249 Bitcoin (BTC) on June 2. The total value of Bitcoin (BTC) transferred amounted to approximately $561 million.

However, ETF flow reports confirm that withdrawals from BlackRock’s iShares Bitcoin Trust on June 2 amounted to $130.4 million. A larger withdrawal of $430.8 million was recorded on May 30. ETF withdrawals over these two days totaled $561 million, which corresponds to the volume of Bitcoin (BTC) moved on-chain.

Also Read: Pi Network (PI) Token is Ready to Flood! What Happens If the Price Falls Below IDR6,500?

Increased Investment in Ethereum

While reducing its Bitcoin (BTC) position, BlackRock added 27,241 Ethereum (ETH) to its wallet from Coinbase, worth approximately $69.25 million. During the same period, spot Ethereum (ETH) ETFs saw steady inflows, led by BlackRock and Fidelity.

BlackRock’s iShares Ethereum Trust recorded net inflows of $48.4 million on June 2. Fidelity’s Ethereum Fund received $29.78 million. No other Ethereum (ETH) ETF provider recorded inflows on the same day. Total Ethereum ETF (ETH) inflows for the day stood at $78.17 million.

Impact of Bitcoin Price Movement

Recently, the price of Bitcoin (BTC) reached an all-time high peak of $112,000 before dropping to around $103,000. On June 3, the price rebounded slightly to $106,600. This latest market decline has prompted some investors to lock in profits and rebalance their portfolios.

These Bitcoin (BTC) price movements are in line with the observed ETF outflows. Bloomberg ETF analyst Eric Balchunas notes that ETF redemptions usually force asset managers to reduce their positions. This is likely the reason behind BlackRock’s large drawdown of Bitcoin (BTC).

Conclusion

Despite recent withdrawals, BlackRock’s iShares Bitcoin Trust remains one of the largest holders of Bitcoin (BTC). The fund currently holds more than 661,000 Bitcoin (BTC), valued at around $70 billion. Since its launch, the fund has attracted total inflows of $48.439 billion.

Also Read: XRP is in Freefall! Is This a Sign of a Big Storm in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. BlackRock Offloads $130M Bitcoin, Accumulates $69M ETH. Accessed on June 4, 2025

- Featured Image: KITCO

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.