Download Pintu App

Bitcoin Faces $904 Million Profit Withdrawal, Will the Positive Trend Last?

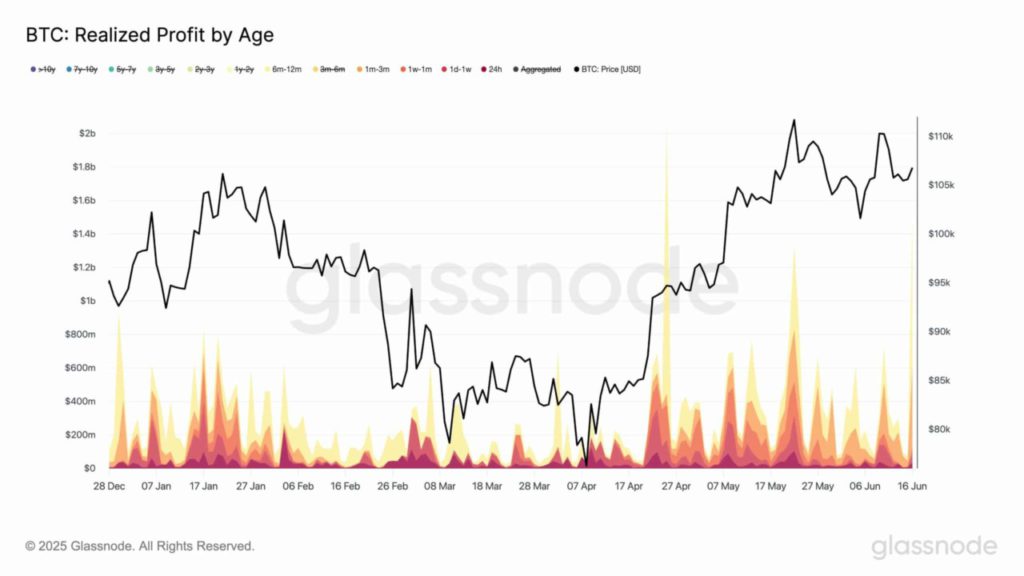

Jakarta, Pintu News – In recent months, Bitcoin (BTC) has shown a significant positive trend, but there has been a profit withdrawal driven by new holders. The continuous rise in Bitcoin (BTC) price has encouraged short-term and long-term holders to realize their profits.

This has created strong selling pressure in the market, especially from newer holders. The question now is, can Bitcoin (BTC) maintain its momentum amid this wave of selling?

Dynamics of Sales by New Holders

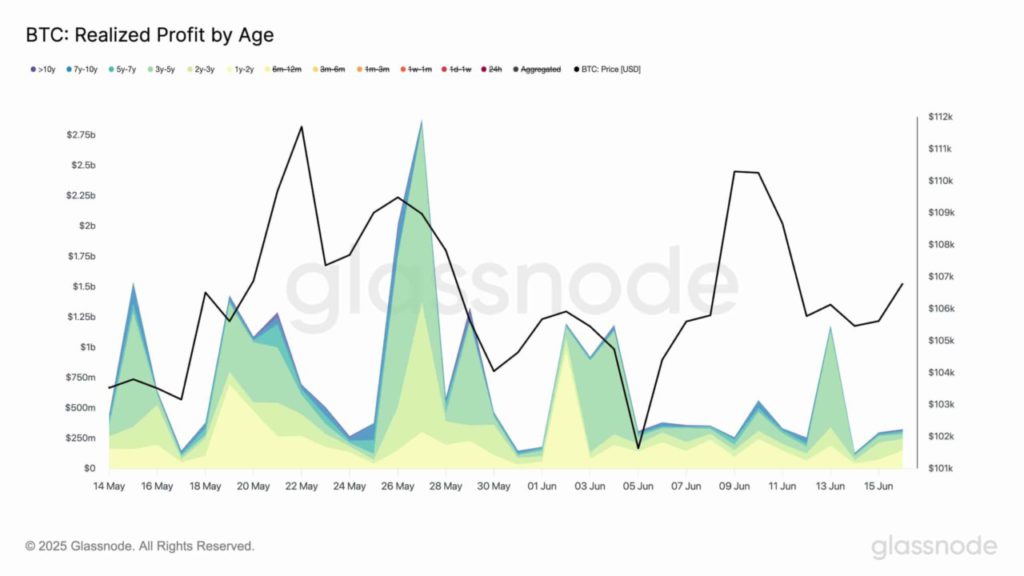

New Bitcoin (BTC) holders who bought in the last six to twelve months are a major factor in the current selling pressure. According to data from Glassnode, this group has realized a profit of $904 million in just one day, which is 83% of the total profit realized that day.

This marks one of the highest daily profit realizations of the year, only slightly below the peak that occurred in April. This aggressive selling by new holders has led to a drop in the price of Bitcoin (BTC) from $108,990 to $106,853. This decline suggests that the bullish momentum previously seen is starting to weaken, and new holders are re-entering the market consolidation phase.

Also Read: Ethereum (ETH) Prepares for a Surge: Bullish Signs Strengthen

Old Holder Behavior

On the other hand, long-time holders of Bitcoin (BTC) showed a different behavior. Data shows that holders with a holding period of more than 12 months only realized gains of $324 million, down drastically from $1.2 billion at last week’s peak.

This drop indicates a decrease in sales activity among existing holders, which could be a sign of increased trust and confidence in the long-term value of Bitcoin (BTC).

The SOPR indicator for existing holders also showed a decline from 3.4 to 1.8, indicating that while there were some sales, the activity was more restrained. This could be a signal that existing holders prefer to hold onto their assets, waiting for further price increases.

Implications for the Future of Bitcoin

With the difference in behavior between new and old holders, the Bitcoin (BTC) market is currently in an uncertain phase. If this trend continues, where new holders continue to sell while old holders hold on, Bitcoin (BTC) may continue to be in a consolidation phase.

In this scenario, existing holders will probably absorb the selling pressure, while new holders will limit any significant price movement to the upside. To see a breakout above $107,000 and a sustained push towards $110,000, will largely depend on a reduction in profit realization by new holders. Only time will tell if Bitcoin (BTC) can maintain its positive trend or if selling pressure will overwhelm the market.

Conclusion

The dynamic between new and old holders of Bitcoin (BTC) will largely determine the future direction of the price. While there is significant selling pressure from new holders, the trust and resilience of old holders may be the key to maintaining the value of Bitcoin (BTC). Market watchers should continue to monitor these indicators to gain a better understanding of the potential future price movements of Bitcoin (BTC).

Read More: Will Selling Pressure Shake Chainlink’s Bullish Dominance?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin faces $904M profit-driven pullback; can BTC’s rally sustain?. Accessed on June 19, 2025

- Featured Image: Bitcoinist

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.