Download Pintu App

3 On-Chain Indicators Signal BTC is Poised for a Rally

Jakarta, Pintu News – In the past 24 hours, the price of Bitcoin (BTC) has dropped by 2.86%, trading at around $109,000.

Although it still lags behind Ethereum (ETH) and other cryptocurrencies that have reached new record highs, some on-chain and technical signals suggest that Bitcoin (BTC) may be gearing up for a price surge.

According to the analysis of Ananda Banerjee, technical and on-chain analyst at BeInCrypto, these indications are similar to the rally that occurred earlier this month, signaling significant upside potential. Check out the full analysis below!

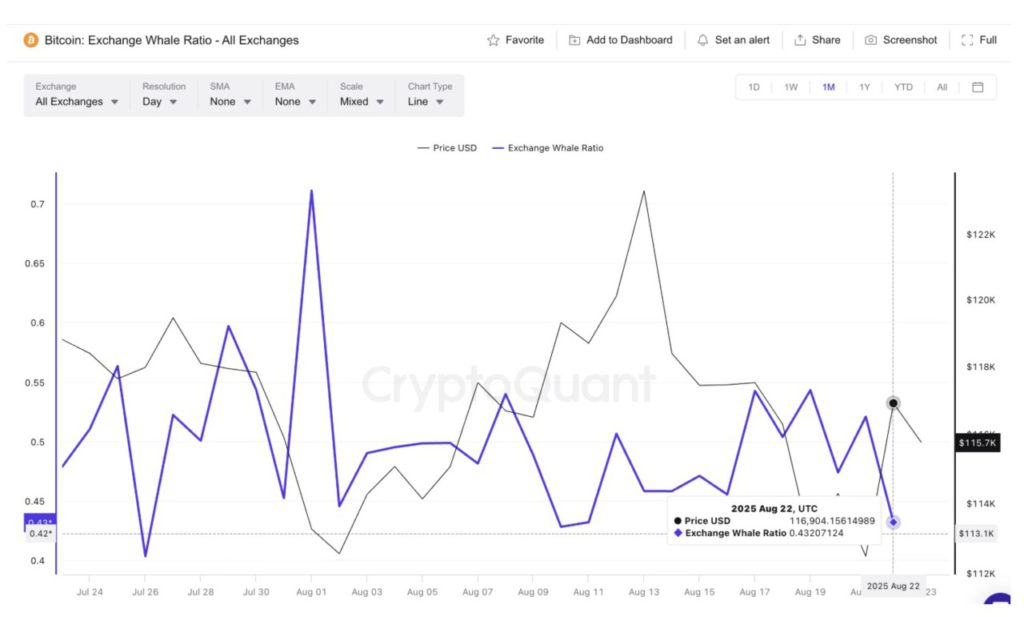

Reduced Selling Pressure from Whales

Over the past few weeks, Bitcoin (BTC) price has seen a slowdown as whales move their capital to other assets, leaving retail buyers to drive the market. This makes observing whale selling activity crucial.

The Whale Exchange ratio, which measures the proportion of the 10 largest inflows compared to all inflows to the exchange, showed a decline from 0.54 on August 19 to 0.43 on August 22, which was the lowest point in almost two weeks.

This drop is similar to the one on August 10, when the ratio fell to 0.42. That movement preceded a sharp rise in Bitcoin (BTC) price from $119,305 to $124,000, a gain of about 3.9%. If this pattern repeats, it is possible that the Bitcoin (BTC) price will experience a similar rise, perhaps even reaching a new record high.

Read also: 3 Strong Indicators that Push HBAR to be the ‘Star’ in the Crypto Bull Run

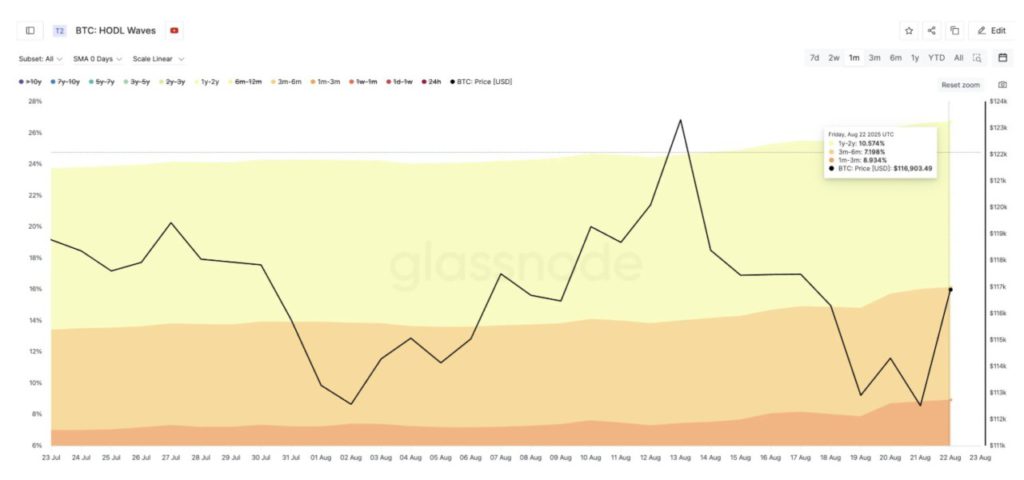

Accumulation by HODLer

With Bitcoin (BTC) selling pressure easing, the next question is whether medium- and long-term holders are accumulating. The HODL Waves metric, which tracks the percentage of Bitcoin (BTC) supply held in different age groups, showed an expansion of positions by key groups over the last month.

Widespread accumulation during this period of volatility suggests there is strong conviction in the market. The combination of lower whale outflows and accumulation by long-term holders suggests that the market may be preparing for a significant surge in Bitcoin (BTC) prices.

Read also: 3 Crypto Picks of the Whales in Late August 2025

Bitcoin Price Levels Determine Breakout Path

The technical picture combines these signals. As of August 23, 2025, Bitcoin (BTC) is trading slightly above strong support at $115,400. Critical resistance is at $117,600, with $119,700 as the main trigger for Bitcoin (BTC) price to surge towards and even exceed previous record highs.

On the other hand, a drop below $114,100, especially $111,900, would turn the momentum bearish in the short term. If the Whale Exchange ratio repeats the August 10 pattern, Bitcoin (BTC) price could rise nearly 4% from current levels.

This would push the price past $119,000, straight into breakout territory. From there, the stage would be set for a retest of the record highs, validating the idea that this rally is delayed, not canceled.

Conclusion

With various indicators pointing to potential upside, market participants and investors may need to consider their positions in Bitcoin (BTC). The combination of decreased whale selling pressure and accumulation by long-term holders offers a strong bullish picture for the future of Bitcoin (BTC) price.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price: Whale Selling Pressure at All-Time High. Accessed on August 26, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.