Download Pintu App

Justin Sun Committed to Burning SUN: Biggest Opportunity in Uptober

Jakarta, Pintu News – Justin Sun, a prominent figure in the crypto world, recently announced that the entire revenue from his decentralized exchange SunPerp will be used to buy back and burn SUN tokens.

This strategic move is expected to reduce the number of SUN tokens in circulation and sustainably increase market demand. With a market capitalization that has surpassed $665 million, SUN is now one of the major players in the DeFi space.

Justin Sun and SUN Buyback Commitment

Justin Sun has taken a big step by allocating the entire revenue from SunPerp to the buyback of SUN tokens. This decision will not only reduce the number of tokens in circulation but is also expected to increase their value in the market. By reducing supply, buying pressure in the market is expected to increase, which could lead to a rise in the price of SUN tokens.

This move also demonstrates Sun’s commitment to increasing the long-term value of the SUN token and the TRON ecosystem as a whole. With this strategy, Sun is not only focusing on short-term growth but also the greater stability and sustainability of the ecosystem, which will attract more investors and users to the platform.

Also Read: 5 Shocking Facts About AVAX: Up 10.52% in 24 Hours, Price Breaks IDR 583,000!

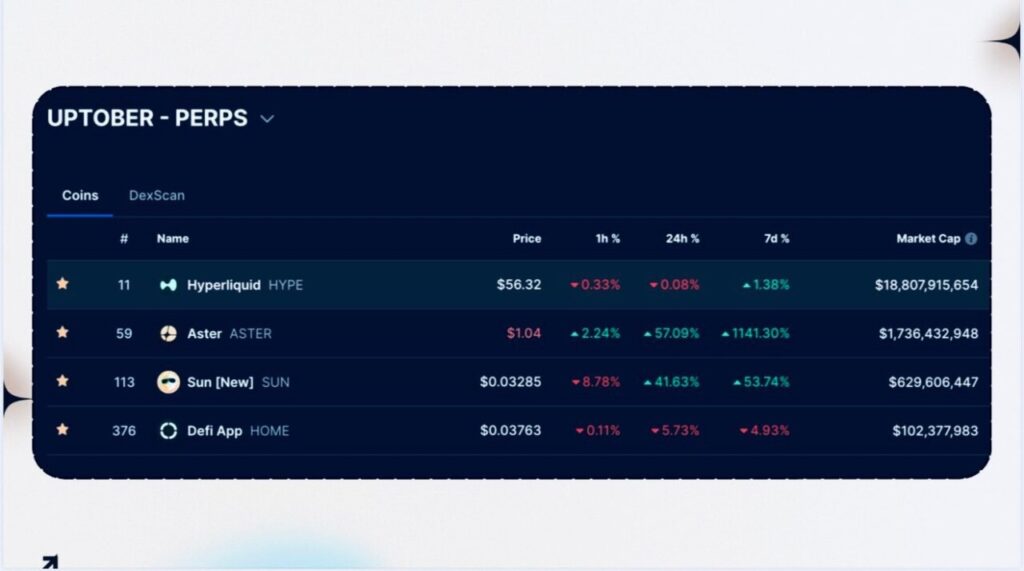

SUN as the Biggest Opportunity in Uptober According to Experts

Ben Gurion, a crypto expert, has highlighted SUN as the biggest opportunity in Uptober. According to him, Justin Sun’s commitment to buybacks and token burns is a solid basis for growth in the value of SUNs. This is because the move directly affects supply and demand in the market, two important factors in asset pricing.

SUN’s market capitalization, which has reached more than $665 million, shows the great potential in the DeFi ecosystem. With strong liquidity and token burning initiatives, SUN is expected to continue its positive trend, attracting more attention from investors and market analysts.

Cross-Chain Strategy and Integration with Traditional Sectors

In addition to the buyback commitment, Justin Sun also focused on TRON’s integration with crypto and traditional sectors. One example of this integration is TRON’s role in recording US GDP data for the Department of Commerce, demonstrating blockchain’s ability to support national-scale economic activity.

TRON has also relaunched its USDD stablecoin on Ethereum (ETH), which expands the adoption of decentralized stablecoins and strengthens its cross-chain presence. This move not only increases trust and utility in the TRON ecosystem but also opens up new opportunities in the interaction between blockchain and the traditional financial sector.

Conclusion

With a set of strategies focused on buybacks, token burning, and cross-sector integration, Justin Sun and TRON set a new standard in crypto ecosystem development.

These moves not only increase the value of SUN but also demonstrate the potential of blockchain on a broader scale. Investors and market watchers will be keeping a close eye on these developments, which may well determine the future direction for crypto and blockchain technology.

Also Read: 5 Facts on Hedera (HBAR) Price Pressure: Can it Survive Above IDR3,940?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Expert Says Sun is Uptober’s Biggest Play as Justin Sun Pledges 100% of Revenue on Buyback. Accessed on September 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.