Download Pintu App

Ethereum Foundation Sells 1,000 ETH, What’s the Reason?

Jakarta, Pintu News – As the price of Ethereum (ETH) reached over $4,500, the Ethereum Foundation announced the sale of 1,000 ETH, worth approximately $4.5 million. The move is part of a more efficient financial management strategy, using DeFi tools to minimize price volatility and slippage.

Repeat Sales, Strategy or Threat?

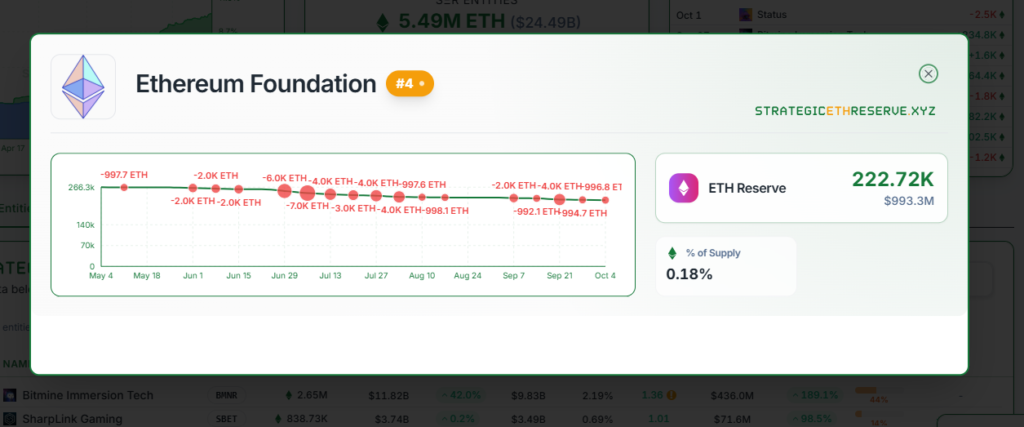

The latest sale by the Ethereum Foundation used the TWAP feature of the CoWSwap platform, aimed at reducing price volatility and minimizing slippage. This marks the 17th sale of Ethereum (ETH) by the foundation in 2025, with the remaining balance now standing at around 222,720 ETH, worth approximately $1 billion.

These frequent selling activities have sparked concerns among community members, who argue that it could create bearish sentiment and reduce investor confidence. While some critics question the policy of repeated sales during bullish momentum, there are also those who see this as an important step in responsible financial management.

Also read: XRP’s Large Holdings Shrink, Are Bearish Signals Starting to Show?

DeFi Alternatives: A Solution Without Selling ETH?

Crypto researcher Naly suggested that the Ethereum Foundation could “highlight the power of DeFi” by using decentralized tools to generate liquidity without having to sell tokens directly. Naly proposed an alternative: “Deposit ETH in Aave, earn interest, borrow stablecoins, and fund operations using DeFi-generated capital.”

This method will allow the Ethereum Foundation to retain exposure to potential ETH price increases while still accessing liquidity for operational costs. This approach could also reduce the negative impact of asset sales on market prices.

Transparency in Sales: A Positive Step?

Several community members have praised the Ethereum Foundation’s transparency in publicly announcing their sales. This practice is considered uncommon among other large crypto organizations, and is considered a positive step that demonstrates the foundation’s commitment to clarity and accountability.

Despite criticism, this transparency is expected to build further trust in the community and show that the Ethereum Foundation is committed to using best practices in the management of their assets and funds.

Conclusion

With frequent ETH sales, the Ethereum Foundation seems to be trying to strike a balance between short-term liquidity needs and long-term growth potential. The decision to use DeFi tools in this process not only demonstrates adaptation to the latest technology but also provides an example of how large organizations can operate in an ever-evolving crypto ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum Foundation Offloads ETH Amid Market Recovery. Accessed on October 6, 2025

- Featured Image: U Today

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.