Download Pintu App

Bitcoin Hits $124K Today — Standard Chartered Says It Could Reach $200K

Jakarta, Pintu News – Standard Chartered predicts that Bitcoin (BTC) has the potential to reach a new record high by the end of 2025. The bank’s head of digital asset research, Geoff Kendrick, stated that Bitcoin’s prospects are getting stronger.

According to him, this was driven by high investor demand and the positive momentum of exchange-traded funds (ETF) products that continue to increase.

Bitcoin Price Gains 0.32% in 24 Hours

As of October 6, 2025, Bitcoin was trading at $124,143, equivalent to IDR 2,048,628,629, marking a 0.32% increase over the past 24 hours. During this period, BTC hit a daily low of IDR 2,019,025,161 and a high of IDR 2,064,814,522.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 41,070 trillion, while 24-hour trading volume has surged 87% to reach IDR 1,220 trillion.

Read also: Bitcoin Surges to a Record High of $125,000 Amid US Government Shutdown

Standard Chartered’s $200,000 Bitcoin Target Contrasts with Market Projections of $150,000

In a note shared with renowned financial journalist Walter Bloomberg, Standard Chartered’s Head of Digital Asset Research Geoff Kendrick mentioned that Bitcoin’s price movements are heavily influenced by global macroeconomic conditions.

According to him, if the US government shutdown lasts longer, Bitcoin could actually benefit due to its correlation with Treasury term premiums. Currently, more and more investors are looking at Bitcoin as a hedge instrument amid fiscal and political uncertainty.

Currently, Bitcoin is trading at around $124,143, down slightly after hitting a new ATH of $125,700 on Sunday (5/10). Standard Chartered projects that Bitcoin price will soon break $135,000, before continuing its rise to reach $200,000 (IDR 3.32 billion) by the end of 2025.

Meanwhile, Citigroup has a more aggressive outlook, estimating that the price of Bitcoin could rise to $231,000 in the next 12 months.

Kendrick added that the strong correlation between Bitcoin and US Treasury movements is one of the main driving factors. A rise in the term premium usually reflects investors’ growing concerns about the government’s financial condition, which in turn drives interest in alternative assets such as Bitcoin.

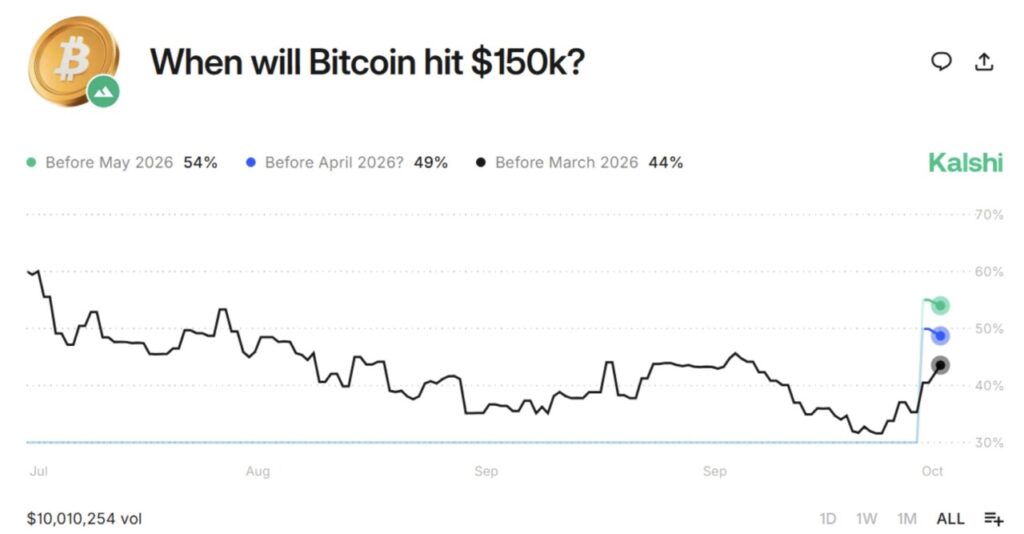

However, not all markets are as optimistic. Based on data from the Kalshi prediction platform, traders estimate that Bitcoin’s chances of breaking the $150,000 level are still limited: only 44% chance before March 2026, rising to 49% before April 2026, and 54% before May 2026.

This divergence of views suggests that while the fundamentals and long-term sentiment towards Bitcoin are getting stronger, the market remains cautious in estimating the speed at which the price of the world’s largest cryptocurrency will rise.

Read also: 3 Cryptos Poised to Challenge Their All-Time Highs in October 2025

ETF Inflows Drive Standard Chartered’s $200,000 Bitcoin Projection

In an exclusive interview with Decrypt, Standard Chartered’s Head of Digital Asset Research Geoff Kendrick revealed that the current inflow into Bitcoin ETFs is significantly changing the dynamics of the crypto market.

According to him, this trend is the foundation for Bitcoin to reach new record highs. Kendrick thinks that institutional adoption through ETF products is creating favorable conditions for a major rally, although prices are still experiencing short-term fluctuations.

To date, the total funds poured into Bitcoin ETFs have reached $58 billion, with $23 billion of that recorded just this year. In the past week alone, spot Bitcoin ETFs attracted inflows of $2.2 billion, as BTC prices broke through the $120,000 level.

Kendrick estimates that there will be an additional inflow of around $20 billion into the ETF until the end of December 2025-an amount that, according to him, will be enough to support the price target of $200,000 per BTC. On the other hand, JPMorgan also thinks Bitcoin is still undervalued, and projects a rally towards $165,000 in the near future.

Standard Chartered’s analysis adds that Bitcoin’s price movement this time deviates from the historical post-halving pattern. In previous cycles, BTC prices usually weakened about 18 months after the halving event. However, after the April 2024 halving, Bitcoin showed strong resilience and continued to rise until October 2025.

This phenomenon shows that support from ETFs and institutional investors has fundamentally changed Bitcoin’s market behavior-shifting the narrative from a speculative asset to an increasingly globally recognized mainstream investment instrument.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Standard Chartered Sees Bitcoin Soaring to $200,000 by Year-End on ETF Boom. Accessed on October 6, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.