Download Pintu App

Ethereum Falls to $4,000 on October 15 – Is the Uptrend Losing Steam?

Jakarta, Pintu News – Ethereum (ETH) took a dive on Tuesday (Oct 14), dropping more than 8% from Monday’s high above $4,300 to around $3,940. Despite this correction, traders remain optimistic that ETH prices will rise again as long as key support levels hold.

Then, how will Ethereum price move today?

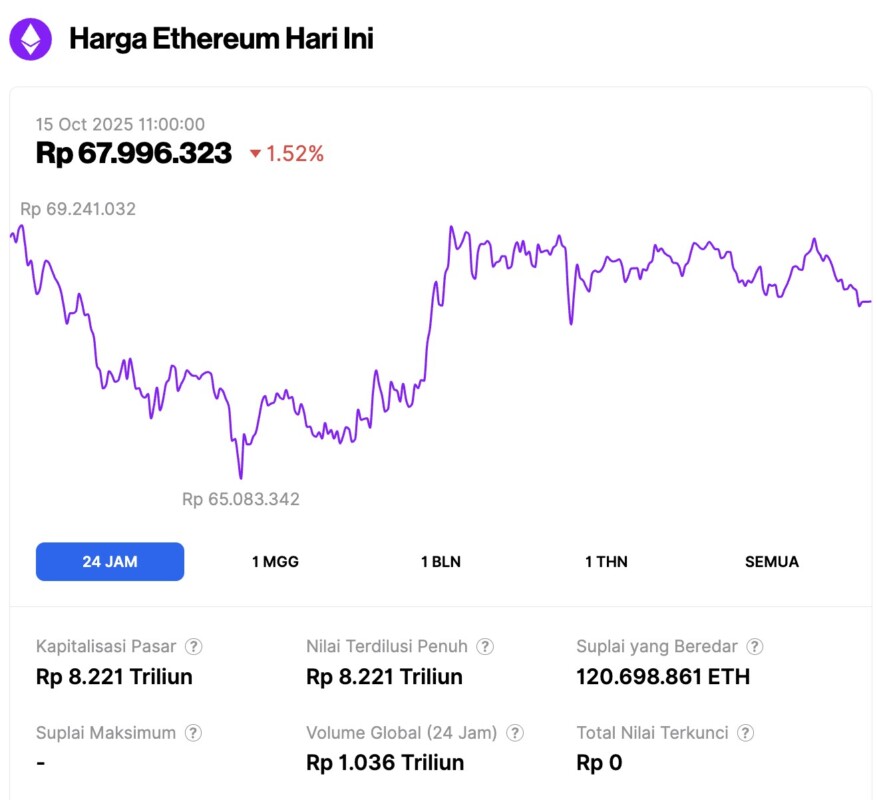

Ethereum Price Drops 1.52% in 24 Hours

On October 15, 2025, Ethereum was trading at approximately $4,084, or around IDR 67,996,323 — down 1.52% over the past 24 hours. During this time, ETH dipped to a low of IDR 65,083,342 and reached a high of IDR 69,241,032.

At the time of writing, Ethereum’s market capitalization stands at approximately IDR 8,221 trillion, while its 24-hour trading volume has surged by 35%, reaching IDR 1,036 trillion.

Read also: Bitcoin Price Plunges to $112,000 Today as Investor Confidence Remains Shaky

Ethereum Loses $115 Million from ETH Long Positions

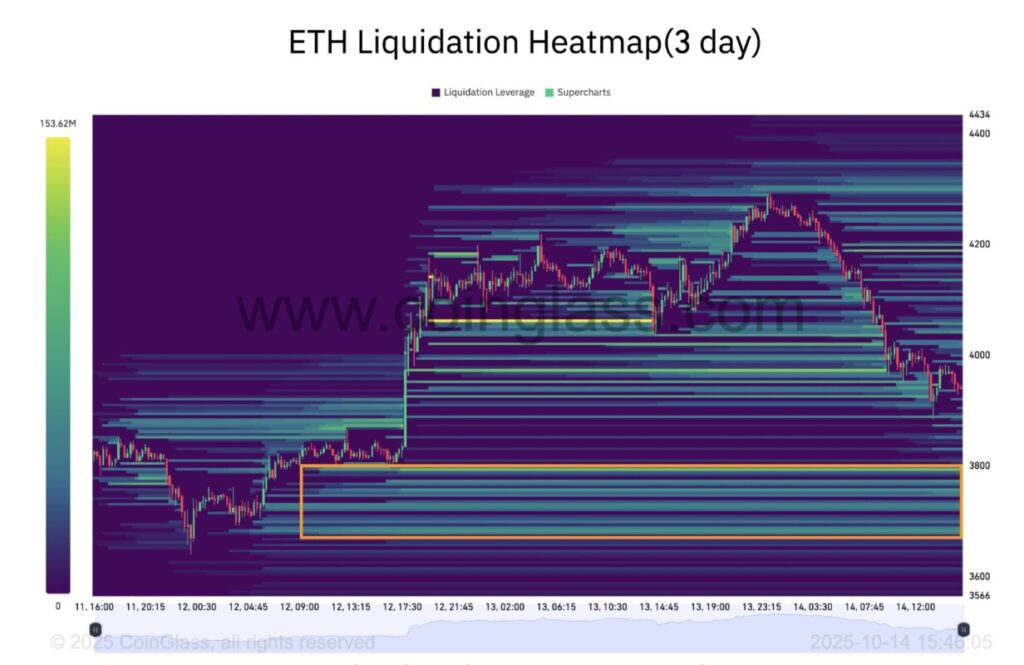

Ethereum’s price drop today was accompanied by massive liquidations in the crypto market. According to data from CoinGlass, over $650 million of leveraged crypto positions have been liquidated in the last 24 hours (10/14), with $455 million coming from the liquidation of long positions. Ether’s long position liquidation alone stands at $114.5 million, and this number is growing as of this report.

This means that traders who went long did not expect the price of Ether to drop below $4,000. The largest liquidation occurred on the OKX crypto exchange, involving the ETH/USD pair worth $5.5 million.

CoinGlass’ liquidation heatmap shows several zones of buying interest below the current market price, with over $743 million worth of buy orders in the $3,670 to $3,800 price range. This indicates that the ongoing correction may be contained within this price range.

Is Ethereum’s Uptrend Over?

Market analysts state that the ETH price is currently undergoing a technical correction to retest key support levels before resuming its uptrend.

MN Capital founder Michael van de Poppe said that Sunday’s drop brought the ETH/BTC pair down to the 0.032 level – which he said was the “ideal zone to buy.”

“$ETH has touched the ideal zone for buying and I think it’s time for a trend change,” van de Poppe wrote in a post on X on Tuesday.

Another analyst, Daan Crypto Trades, said that although the 0.032 level is “holding up pretty well,” the ETH/BTC pair needs to break above 0.041 for the uptrend to continue.

Meanwhile, Titan of Crypto analysts highlighted that the relative strength index (RSI) on the ETH/USD pair has broken out of a long-term downtrend that has lasted for several years. This hints at a potential major breakout that may be imminent.

If the movement pattern (fractal) follows the one in July 2020, Ethereum price is expected to continue its uptrend with a target between $8,000 to $10,300 based on Fibonacci levels.

Read also: Which Coins Are Crypto Whales Buying During the Market Crash?

“#ETH breakout is preparing,” he wrote.

On the other hand, an anonymous analyst by the name of Chimp of the North predicted that ETH’s price decline might be arrested around $3,800. He shared a chart showing that the altcoin is likely to retest the $3,800 support level before rallying back towards $5,000 or more.

As reported by Cointelegraph, ETH is expected to return to the $4,500 level in the coming days after the Ethereum futures market begins to stabilize following Friday’s crypto flash crash.

Ethereum Bull Flag Target: $10.000

From a technical point of view, the price of ETH is still in a bull flag pattern on the weekly time frame – a formation that is bullish in nature and usually forms after the price has experienced a sharp increase, then entered a consolidation phase in a downward channel.

Currently, Ethereum is retesting the lower boundary of the flag pattern, which is around $3,870 that serves as immediate support. The bull flag pattern will be confirmed if the price manages to break the upper trend line at $4,440. If this breakout occurs, then the uptrend could potentially continue with a technical target of $10,050 – an increase of about 164% from the current price.

However, the RSI indicator has dropped from 74 to 54 in the past seven weeks. This indicates that the current correction may still continue, as profit-taking takes place in the market.

If the daily candlestick closes below the $3,800 support level, then Ethereum price risks falling further, first to the 20-week SMA at $3,700, and then to $3,500.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Ethereum drops 8%, but traders say ETH price breakout to $10K is ‘loading’ Accessed on October 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.