Download Pintu App

Data Signals Imminent Bitcoin Short Squeeze Amid Growing Speculation of a “Bullish” US CPI

Jakarta, Pintu News – After experiencing strong selling pressure, Bitcoin (BTC) is now preparing for a possible short squeeze to gain liquidity at higher price levels.

Market analysts are starting to get optimistic ahead of the release of the US Consumer Price Index (CPI) data for September scheduled for this Friday. Meanwhile, Michael Saylor signaled that there will be another big Bitcoin buy in the near future.

Potential Short Squeeze on Bitcoin

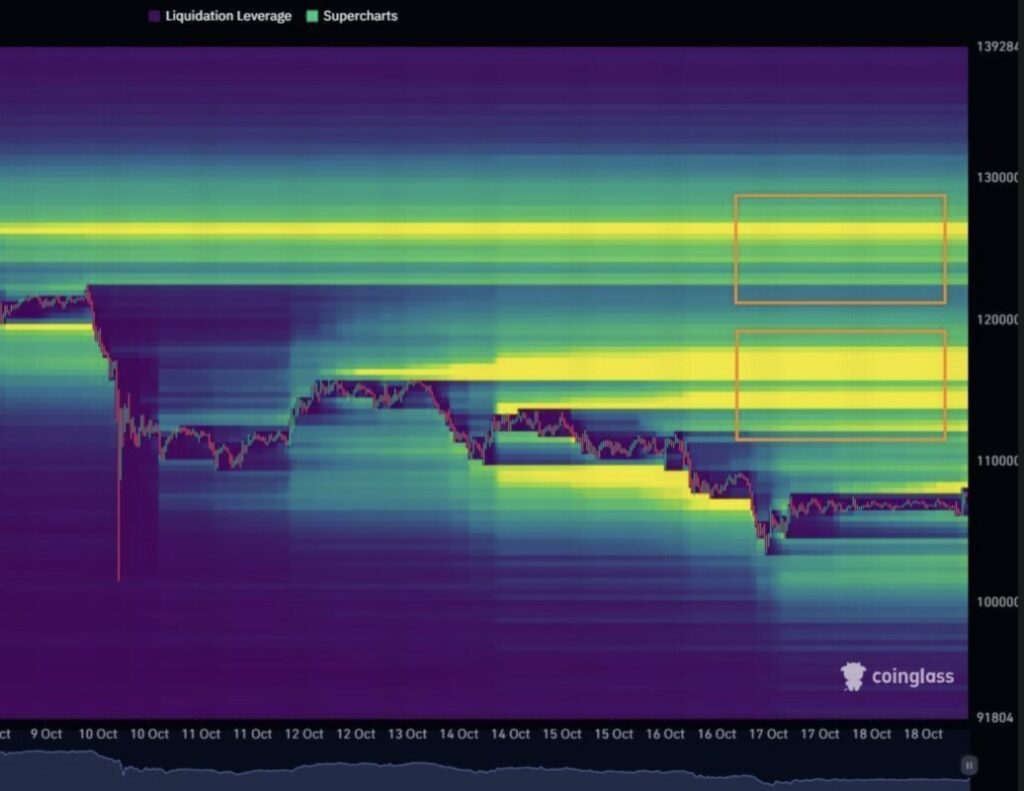

According to data from Coinglass, there is currently a potentially large short squeeze forming in the Bitcoin market, with significant amounts of liquidity concentrated above current price levels. Experts believe that the market is likely to move towards areas of high liquidity.

Read also: Bitcoin Surges to $109,000 Today, Signaling a Potential Breakout Ahead

Therefore, Bitcoin’s next move is likely to be up from current levels. In addition, some analysts believe that liquidity from gold could start shifting to Bitcoin, following the massive rally in the precious metal. The current BTC/Gold ratio is signaling that the market may have bottomed out.

Analysts Highlight Bitcoin’s Bullish Signals

Crypto analyst Ted Pillows highlighted the surge in Coinbase Bitcoin premium-atrend that suggests bullish signals ahead. He added that if this premium continues to increase into next week, it could be the trigger for a major rally in Bitcoin.

The rise in Coinbase premium usually reflects increased demand from US institutions and retail investors compared to other global exchanges.

However, uncertainty in the crypto market has also increased recently, partly due to Donald Trump’s announcement of 100% tariffs on China in early October. This has shaken the “Uptober” rally that had previously shown a positive start to the month.

On the other hand, Michael Saylor is preparing to make his next big BTC purchase. Currently, his company has pocketed 820,000 BTC with a value of around $69 billion, and an average purchase price of around $64,000 per BTC.

A chart marking previous purchases with orange dots indicates that the next big purchase could happen as soon as Monday, October 20.

Read also: XRP Gains Momentum as Trading Volume Surges 50% and DEX Activity Hits Multi-Month High

US CPI Data Release to Take Place Despite Government Shutdown

An unusual development occurred this week: the United States Consumer Price Index (CPI) inflation data is still scheduled to be released on Friday, despite the US government shutdown.

This data release comes just five days before the Fed’s policy meeting on October 29, a crucial moment where officials are considering whether to continue cutting interest rates.

The US Department of Labor has confirmed that no other economic reports will be rescheduled or released until the shutdown ends.

This fueled market speculation that the CPI data for September could show “bullish” results and potentially influence the Fed’s next policy decision. Currently, experts are already forecasting a possible 25 basis points rate cut this month.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Data Shows Bitcoin Short Squeeze Likely with Speculation of Bullish US CPI. Accessed on October 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.