Download Pintu App

Big Investments Continue to Flow into Bitcoin Until 2026, How is the Market Today? (10/22/25)

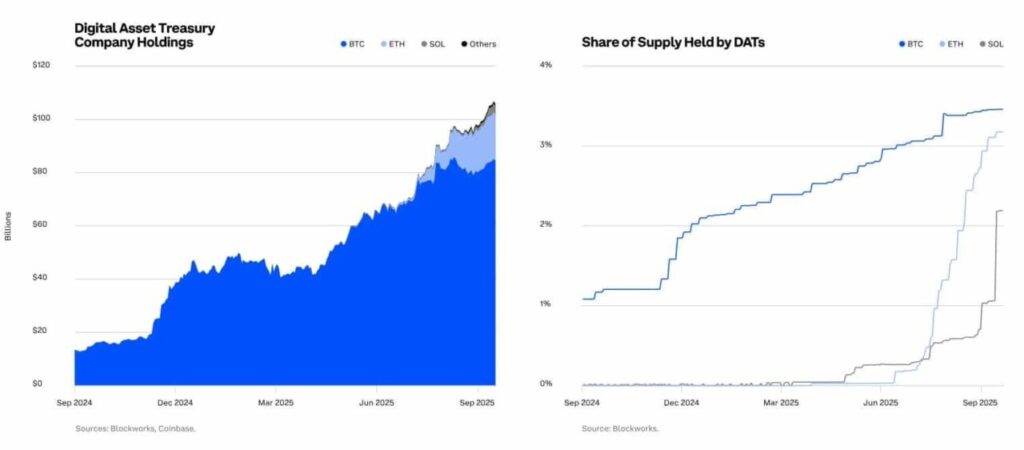

Jakarta, Pintu News – At a time of global economic uncertainty, financial institutions do not seem to have reduced their confidence in Bitcoin (BTC). A recent survey by Coinbase shows that most financial institutions are still optimistic about the future of Bitcoin (BTC), with predictions that the cryptocurrency’s value will continue to rise until 2026. However, views on current market conditions are divided.

Institutional Optimism on the Future of Bitcoin

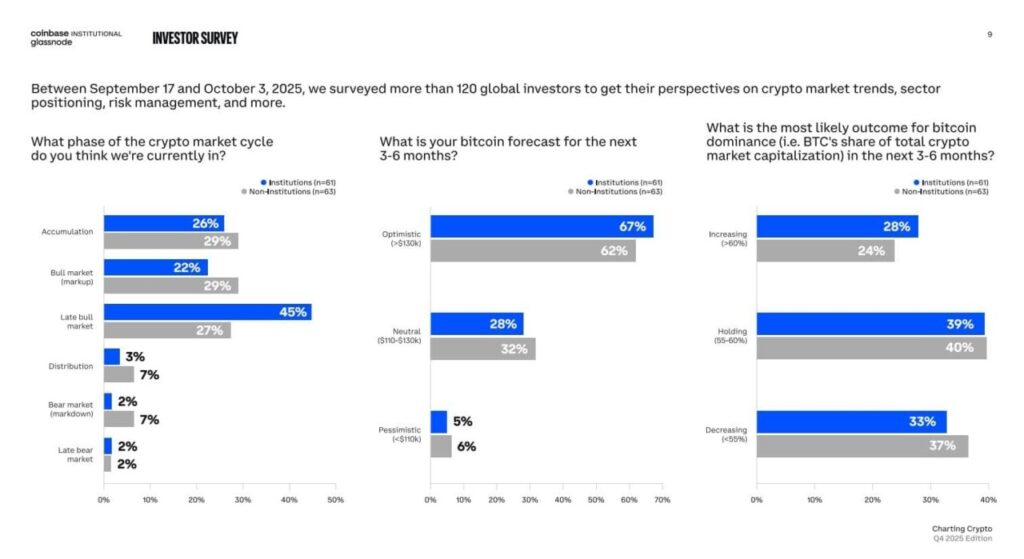

A survey conducted by Coinbase titled “Navigating Uncertainty” revealed that around 67% of financial institutions predict an increase in the price of Bitcoin (BTC) until 2026. However, there is a difference of opinion regarding the current phase of the market. About 45% of the respondents think that the market is already in the final stages of the bull cycle, while others still see room for further growth.

David Duong of Coinbase emphasized that market liquidity is still strong and the overall outlook remains positive. However, investors are starting to be more cautious following the recent volatility. This has not diminished the strong confidence of big players such as Tom Lee of BitMine and Michael Saylor of Strategy who continue to buy Bitcoin (BTC) and Ethereum (ETH) in times of price drops.

Whales Lead the Accumulation Wave

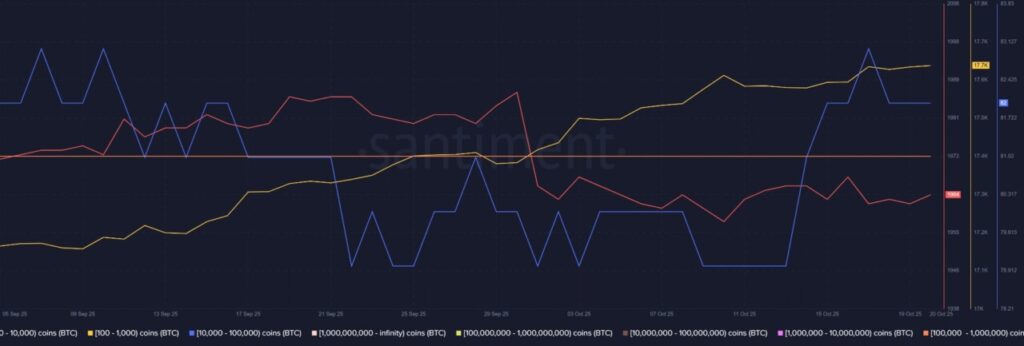

Although institutional views are divided, on-chain data shows a more optimistic picture. Bitcoin (BTC) outflows from exchanges remained strong throughout October, suggesting that accumulation is continuing despite market caution. Data from Santiment also shows that large holders with 10,000 to 100,000 BTC have increased their balances in the third quarter.

This supports Coinbase’s view that liquidity remains solid and long-term conviction is still strong. This accumulation signals that large investors are preparing for the next phase of growth. This suggests that the market may still have untapped potential.

Conviction on Speculation

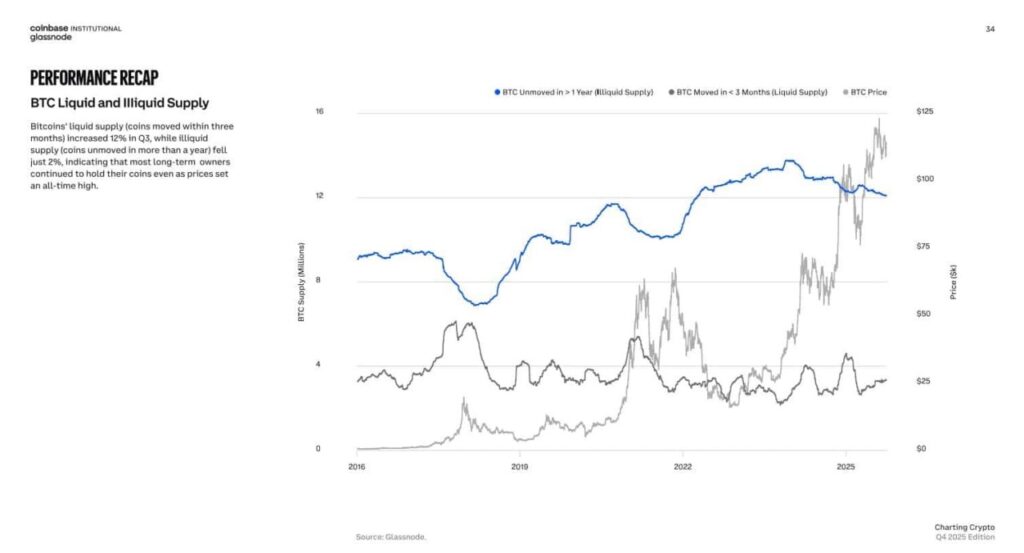

The report noted that the illiquid supply of Bitcoin (BTC) fell by only 2% in the third quarter, despite the price hitting new highs. This suggests that most long-term holders (LTH) are not selling their assets. Data from Glassnode supports this, showing more coins have been untouched for more than a year.

Following Coinbase’s outlook for 2026, Bitcoin (BTC) is in a phase of steady accumulation. Investors continue to hold, supply is shrinking, and long-term conviction is driving the market rather than just hype. This signals a new era where intrinsic value and long-term adoption take precedence over short-term speculative gains.

Conclusion: Bitcoin’s Future Is Still Bright

Despite the current uncertainty and volatility in the market, data and surveys show that large institutions and long-term investors remain optimistic about the future of Bitcoin (BTC). With ongoing accumulation and strong conviction from whales, the outlook for Bitcoin (BTC) until 2026 still seems very positive. This suggests that Bitcoin (BTC) is still an attractive asset for those seeking long-term growth.

Also Read: John Bollinger’s Legendary Prediction: Ethereum & Solana Set to Surge in Late 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Big Money Backs Bitcoin Through 2026, But the Market is Split Today. Accessed on October 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.