Download Pintu App

New Bitcoin Whale Now Trapped in $6.9 Billion Loss: Here’s What Happened! (10/23/25)

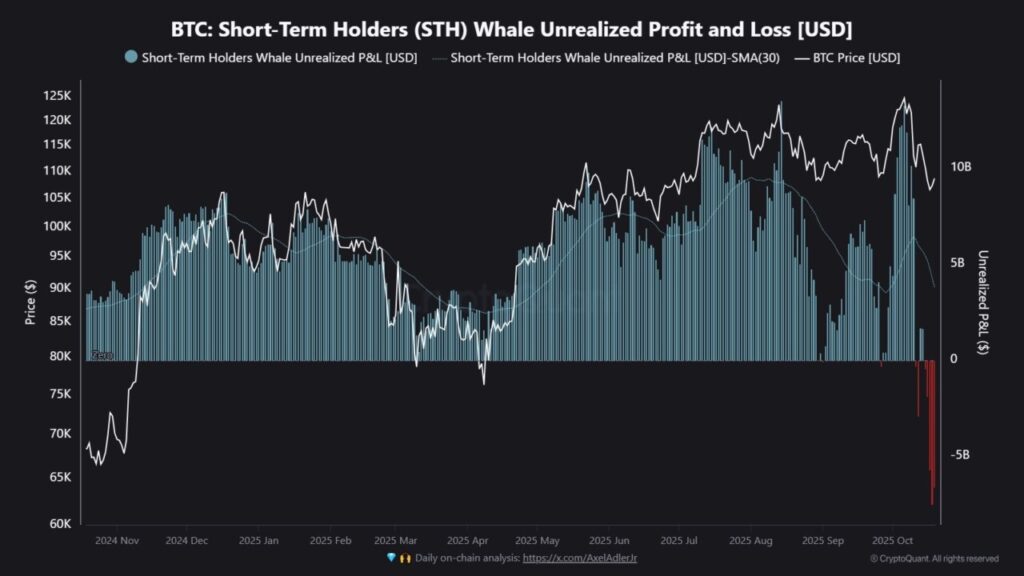

Jakarta, Pintu News – The recent bearish Bitcoin (BTC) market has dragged short-term whale investors into losses unprecedented since two years ago. On-chain data shows that unrealized losses by this group have reached a staggeringly high number.

Short-Term Bitcoin Whales Take Huge Losses

According to the latest analysis from on-chain analytics firm CryptoQuant, Bitcoin (BTC) whales that fall under the category of short-term holders are now facing huge losses. These short-term holders are investors who bought their Bitcoin (BTC) in the last 155 days. This group, often referred to as the new whales, owns more than 1,000 Bitcoin (BTC) which is equivalent to $110.8 million at current exchange rates.

The chart shared by the firm shows that the net profit and loss balances of these short-term whales are now trending negative. This shows that they are now incurring a sizable net loss of around $6.95 billion. This is the largest amount of losses recorded since October 2023.

Read More: Bitcoin (BTC) Price Prediction: Influenced by the Fed’s Interest Rate Decision on October 29, 2025

Real Capitalization and its Impact on the Market

Realized Capitalization, or Realized Cap, is an indicator that measures the total capital that investors have invested into Bitcoin (BTC). For new whales, this Realized Cap reflects the massive capital that entered the network in the last 155 days. Currently, new whales control about 45% of the whales’ total Realized Cap, a new record.

The fact that this capital is now held at a net loss indicates significant stress among large investors. This Real Capitalization growth occurred while long-term holders, who owned Bitcoin (BTC) for more than 155 days, began distributing their holdings.

Bitcoin Price Movement and Its Implications

In the past 30 days, 337,300 Bitcoin (BTC) has left the wallets of long-term holders. Although new capital continues to come in to absorb these sales, the pressure experienced by short-term whales could begin to weaken demand for Bitcoin (BTC).

Currently, the price of Bitcoin (BTC) is hovering around $111,000, down 1.7% in the past week. This situation suggests that the market may start to lose its strength, especially if large investors continue to feel the pressure.

Conclusion

The current state of the Bitcoin (BTC) market provides an important snapshot of the dynamics taking place among major investors and their impact on the price. A deep understanding of these movements is essential for anyone involved in the cryptocurrency market.

Read More: Ethereum Price Prediction: Here’s the Long-Term & Short-Term Bullish Potential

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Newbie Whales Face $6.9 Billion Losses in 2023. Accessed on October 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.