Download Pintu App

Is ISM Losing Its Influence or Showing Bitcoin Super Cycle 2026?

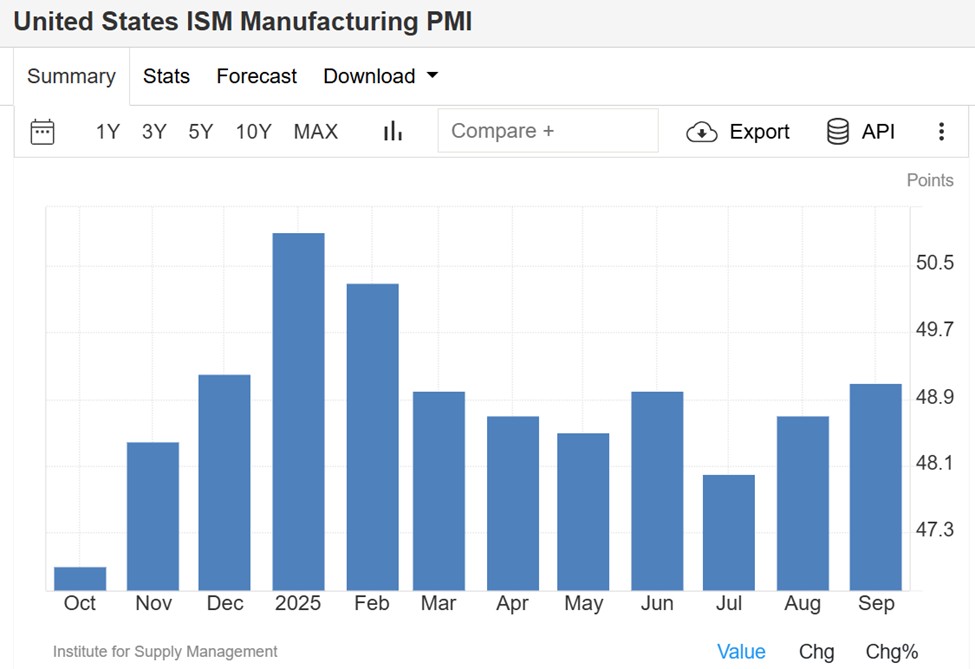

Jakarta, Pintu News – A battle of opinions between macro analysts regarding the Purchasing Managers’ Index (ISM) sparked a new discussion among crypto traders about a possible Bitcoin (BTC) peak in 2026. While some traditional economic indicators are beginning to have their accuracy questioned, the ISM continuing to show contraction has fueled speculation about a longer-than-usual extension of the Bitcoin (BTC) bull market.

Debate on the Relevance of ISM

Julien Bittel of Global Macro Investor (GMI) criticizes the use of some indicators often relied upon by Wall Street as outdated or misinterpreted. GMI has developed a US Coincident Business Cycle Index that incorporates predictive elements, including early signals from the labor market. This index begins to show improvement in mid-2022, months before ISM and other metrics show a recovery.

On the other hand, Henrik Zeberg, a macro strategist, advises caution in taking survey-based indicators as the real picture. Zeberg argues that the market needs to be more vigilant and not rely too much on the ISM which has shown contraction for more than seven months without being followed by a real recession.

Also Read: 7 Altcoins that Cross-Chain with XRP Most Often

ISM Correlation with Bitcoin Cycle

The relationship between ISM movements and Bitcoin (BTC) cycle peaks has been a hot topic among macro investors such as Raoul Pal. This correlation has now come to the attention of the crypto community, with analysts such as Colin Talks Crypto and Lark Davis arguing that ISM stagnation could mean that the Bitcoin (BTC) bull market will last longer than its typical four-year cycle.

A weak ISM often indicates a delayed economic recovery and a longer market expansion. While there are current headwinds ranging from tariffs to sluggish global demand, this prolonged contractionary phase may be prolonging the overall business cycle, rather than ending it. This could mean a more gradual and sustainable upward trend in Bitcoin (BTC) prices.

Market Outlook and Economic Implications

Crypto markets are often seen as an alternative barometer for global economic sentiment, and an extension of the Bitcoin (BTC) bull cycle could provide new insights into macroeconomic dynamics. If the ISM continues to show weakness, this could be an indicator that investors may seek safe haven assets like Bitcoin (BTC) in the face of economic uncertainty.

Moreover, this discussion of a longer 2025-2026 Bitcoin (BTC) cycle illustrates how digital assets are increasingly integrated with the traditional economy. This shows that crypto is not just a speculation, but also has an increasingly important role in macroeconomic analysis.

Conclusion

With the growing debate over the validity and relevance of the ISM in the current economic context, as well as its correlation with the crypto market, investors and analysts are faced with a new paradigm in analyzing economic indicators. Whether this will change the way Bitcoin (BTC) is viewed as an investment asset or is just a temporary phase, time will tell.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. ISM PMI and Its Predictive Power for Bitcoin Cycle Extension. Accessed on October 27, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.