Download Pintu App

Antam Gold Price 1 Gram, Tuesday, October 28, 2025

Jakarta, Pintu News – The price of 1 gram of Antam gold is IDR 2,282,000 according to the official website of Precious Metals, Tuesday, October 28, 2025. This price shows a stable trend amid the movement of the rupiah exchange rate and world gold prices which tend to strengthen towards the end of October 2025. Check the buying price and selling price of 1 gram Antam gold today in detail in the following article!

Today’s 1 Gram Antam Gold Purchase Price is IDR 2,282,000

The chart above shows the price movement of 1 gram gold bars at the Graha Dipta boutique (Pulo Gadung) during the period October 21-28, 2025. In the past week, gold prices have seen a gradual decline after stabilizing in the middle of the period.

At the beginning of the week, the gold price was at around IDR 2,327,000, but then fell to reach IDR 2,282,000 per gram on October 28, 2025 at 08:07 am, registering a decline of IDR45,000 compared to the previous day. After a mild rise on October 24-25, the chart shows a weakening trend again towards the end of the week.

Overall, the trend reflects selling pressure in the global gold market, likely triggered by the strengthening US dollar and profit-taking from investors after the price rally earlier in the month. Despite the correction, gold prices are still within a stable range, signaling the market has not experienced a major sentiment shift.

Read also: World Gold Price Today, Tuesday, October 28, 2025

Today’s Selling Price of 1 Gram Antam Gold is IDR 2,147,000

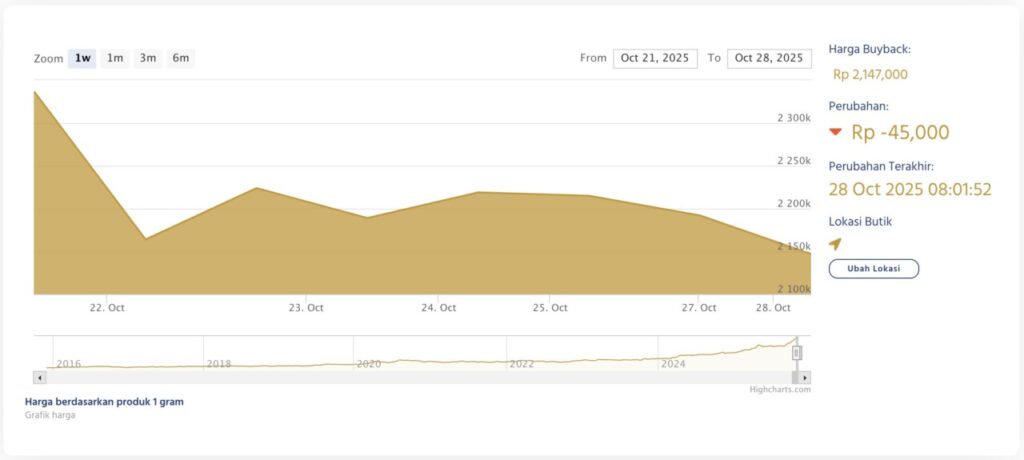

The chart above shows the movement of the buyback price of 1 gram gold bars during the period October 21-28, 2025. Throughout this week, buyback prices have shown a gradual downward trend, signaling pressure on the global gold market.

At the beginning of the period, the buyback price was above IDR 2,190,000, but then continued to decline until it reached IDR 2,147,000 on October 28, 2025 at 08.01 WIB, or a decrease of IDR 45,000 compared to the previous week. The chart pattern shows that there was a slight increase on October 23-24, before weakening again in the last two days.

The decline reflects a correction in domestic gold prices that was likely influenced by the strengthening US dollar and rising global bond yields, two factors that often pressure precious metal prices. Even so, the relatively moderate fluctuations suggest the gold market is still stable without major turmoil.

Digital Gold: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Precious Metal Website

- Featured Image: Marketeers

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.