Download Pintu App

Bitcoin (BTC) Breaks $115,000, Fear & Greed Index is Neutral!

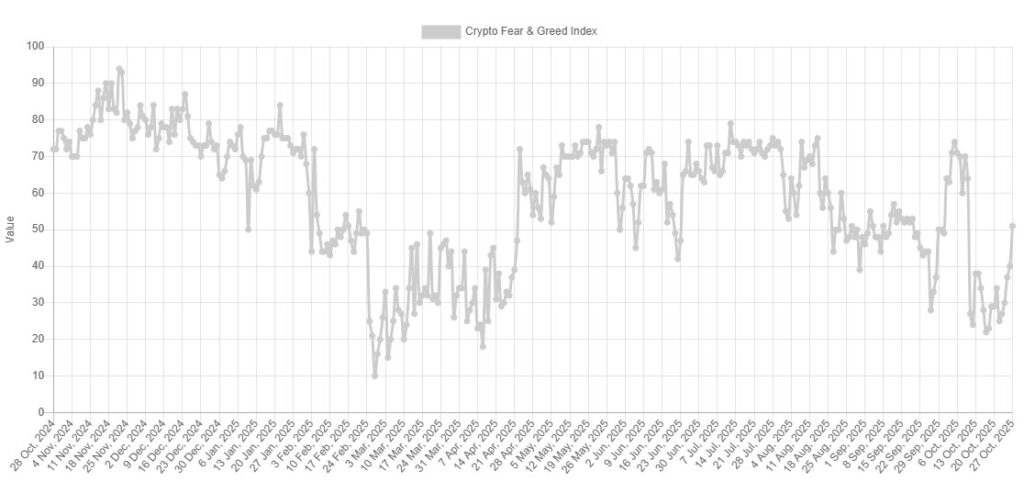

Jakarta, Pintu News – After experiencing a significant price increase, Bitcoin (BTC) has now broken through the $115,000 mark. This price movement has not only increased the value of the digital currency but also affected the overall market sentiment. The Fear and Greed Index, an indicator that measures trader sentiment in the cryptocurrency market, now shows a neutral value. This signals a major shift in investor perception of the market.

Fear and Greed Index: A Measurement of Market Sentiment

The Fear and Greed Index, developed by Alternative, is an important tool for understanding the psychology of the cryptocurrency market. It combines data from five key factors: trading volume, market capitalization dominance, volatility, social media sentiment, and Google trends.

Currently, the index registers a value of 51, indicating that market sentiment has returned to the neutral zone after a long period of fear. The index is very useful for investors to assess the right time to make investment decisions.

When the index shows ‘fear’, this could be a signal for some investors to buy at lower prices. Conversely, when the index shows ‘greed’, this could be interpreted as the market may be overheating, and some may consider selling their assets.

Also Read: 5 Shocking Ethereum (ETH) Predictions from Robert Kiyosaki that Made Crypto Hunted by Whales

Recent Bitcoin (BTC) Price Movements

Bitcoin (BTC) is currently trading at around $114,900, representing a 3.6% increase in the last seven days. This rise is part of a broader recovery in the cryptocurrency market, which has also seen increases in other digital currencies. This price recovery has fueled optimism among investors and market analysts.

These price increases have also led to a significant increase in the overall market value for Bitcoin (BTC). With an ever-increasing market capitalization, Bitcoin (BTC) is strengthening its position as a leader in the cryptocurrency market. This rise has also attracted new attention from both institutional and retail investors, who see the long-term potential of investing in digital currencies.

Future Outlook of Bitcoin (BTC)

With a return to the neutral zone on the Fear and Greed Index and a steady rise in price, the future of Bitcoin (BTC) looks bright. Investors and analysts alike are watching closely to see if this positive trend will continue. Along with increasing adoption and recognition from the traditional financial sector, Bitcoin (BTC) is further asserting its position as a digital asset that is not only attractive but also has potential for long-term growth.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Fear & Greed Index Neutral as BTC Breaks $115,000. Accessed on October 29, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.