Download Pintu App

Shiba Inu Price Forecast: Can the $0.0000095 Support Level Hold Against a Deeper Market Correction?

Jakarta, Pintu News – Shiba Inu (SHIB) is attracting attention again, but this time not just because of its status as a meme coin. The past few weeks have shown a volatile picture for the SHIB price, shifting sentiment from recovery hopes to caution at a crucial support zone.

Amidst the market saturation that has engulfed the meme coin sector, traders continue to monitor every technical movement, wondering if the Shiba Inu price can truly escape the clutches of the bearish trend, or if it will experience further declines.

Shibarium TVL

One of the main issues affecting the current price of Shiba Inu is the performance of Shibarium, SHIB’s proprietary layer-2 solution.

Read also: Dogecoin Price Sees Minor Pullback – Is a Bearish Trend Emerging?

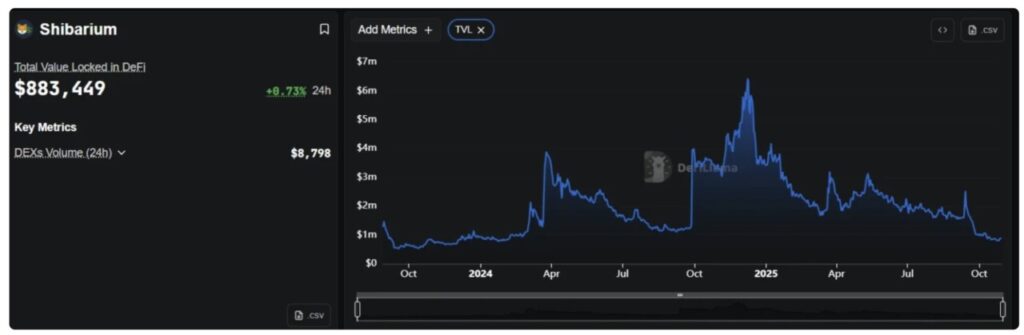

According to data from DeFiLlama, the total value locked (TVL) on the Shibarium network currently stands at just $883,449 – barely managing to stay above the $1 million mark. This figure has been steadily declining since its peak in February when it touched more than $6 million.

This low TVL indicates that DeFi adoption on Shibarium is still very minimal, which is not enough to prove the long-term usability narrative for SHIB. Additionally, the low DEX volume – only $8,798 in the last 24 hours – further confirms that on-chain activity is currently very sluggish.

SHIB Price Analysis

According to the chart, the current price of SHIB stands at $0.00001018, having decreased by -1.14% in the last 24 hours. Trading volume during the same period stood at $151 million, down 2.89%, indicating waning enthusiasm from both buyers and sellers.

Price briefly touched a daily low at $0.00001002 before bouncing, but failed to break resistance at its daily high at $0.00001041.

Read also: Shiba Inu soars! Here are 5 reasons the Ethereum rally is the main driver of the SHIB price increase

One important technical point is that SHIB has dropped below its 7-day moving average (7-day SMA) at $0.00001021. This drop, coupled with the rejection at the 23.6% Fibonacci retracement level at $0.000011688, is a sign that selling pressure from the bearish side still dominates.

The MACD indicator shows weak bullish momentum, while the RSI is around the 41 mark, meaning there is still room for further downside.

Most crucially, traders are still actively defending the important support level at $0.0000095. However, the recovery attempt is stuck below the 200-day SMA at $0.000012712. The presence of the “death cross” pattern since September also reinforces the sentiment that the bearish trend still rules the market for now.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Shiba Inu Price Prediction, Will $0.0000095 Support Prevent a Breakdown? Accessed on October 30, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.