Download Pintu App

10 DeFi Cryptos That Are Likely to Rise in 2026

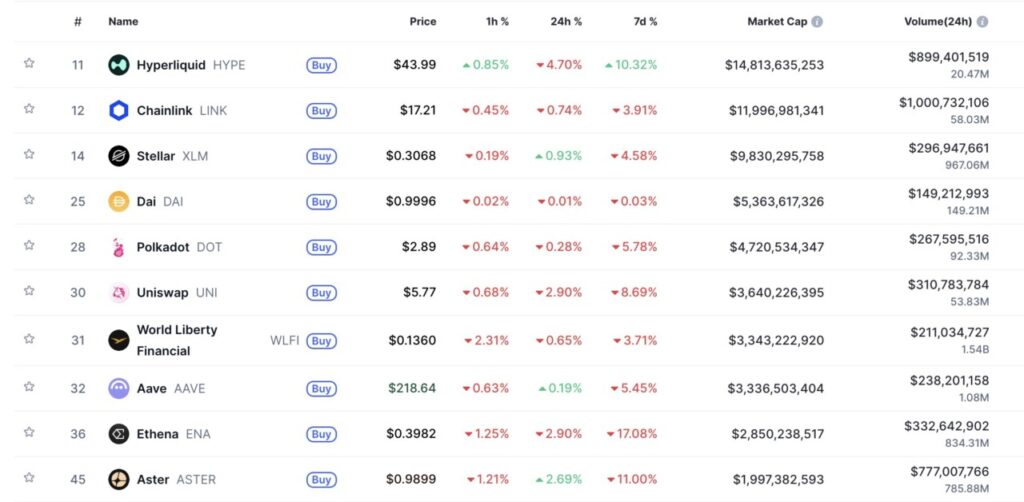

Jakarta, Pintu News – The decentralized finance (DeFi) sector continues to grow rapidly and become an important pillar in the crypto ecosystem. As 2026 approaches, a number of assets with the highest market capitalization on CoinMarketCap are considered to have great potential to rise thanks to technological innovation and widespread adoption. Here are the top 10 DeFi cryptos that are likely to register significant growth in the coming year!

1. Hyperliquid (HYPE)

Hyperliquid (HYPE) is a next-generation decentralized exchange (DEX) protocol focused on efficiency, speed, and high liquidity in crypto derivatives trading. The platform is designed to rival centralized exchanges by delivering a high-speed trading experience through an optimized on-chain order book mechanism. Hyperliquid utilizes the Layer-1 performance-oriented blockchain model to overcome the throughput limitations that conventional DEXs often experience.

The HYPE ecosystem is also supported by its native token, which is used for governance, transaction fees, and incentives for liquidity providers. The technological advantage lies in the ability to process thousands of transactions per second without compromising decentralization. With the increasing adoption of derivatives trading in DeFi, Hyperliquid has the potential to become one of the important platforms in the sector, especially due to its focus on user experience and liquidity efficiency.

2. Chainlink (LINK)

Chainlink (LINK) is a decentralized oracle network that connects real-world data with smart contracts across multiple blockchains. Its function is crucial because most blockchains cannot access external data directly. By using independent nodes, Chainlink provides secure, transparent, and verifiable data for DeFi applications, insurance, gaming, and more.

LINK tokens are used to pay for data services within the network as well as incentivize node operators. Chainlink continues to expand its ecosystem by introducing features such as the Cross-Chain Interoperability Protocol (CCIP) that enables interblockchain communication. Thanks to its reputation as a critical infrastructure in the crypto world, Chainlink is one of the projects that has strong fundamental value and a vital role in strengthening the reliability of the decentralized financial system.

3. Stellar (XLM)

Stellar (XLM) is a blockchain network designed to facilitate fast and low-cost cross-border money transfers. Founded by Jed McCaleb, co-founder of Ripple, Stellar focuses on financial inclusion and global payment efficiency. It uses the Stellar Consensus Protocol (SCP) cons ensus algorithm that allows transactions to take place quickly without requiring high-energy mining like Bitcoin.

XLM tokens serve as a value bridge between currencies and are used to pay transaction fees on the Stellar network. In recent years, Stellar has been widely used by financial institutions and non-profit organizations to facilitate international remittances and distribution of digital aid. With a vision of expanding global financial access, Stellar continues to strengthen its position as one of the most stable and functional blockchain networks in the payments sector.

4. Dai (DAI)

Dai (DAI) is a decentralized stablecoin developed by MakerDAO on the Ethereum (ETH) network. The value of DAI is kept close to US$1 through a system ofcollateralized debt positions using crypto assets such as Ether and other stablecoins. Unlike centralized stablecoins that rely on dollar depository institutions, DAI is fully managed by transparent smart contracts and a community of users.

Also read: 10 Crypto DEXs That Could Potentially Rise by 2026

As a stablecoin, DAI plays an important role in the DeFi ecosystem as it provides price stability amidst crypto market volatility. DAI is used for lending, derivatives trading, and risk management without relying on traditional intermediaries. The decentralized mechanism and openness of its system make DAI a clear example of a stablecoin that promotes security and independence from centralized authorities.

5. Polkadot (DOT)

Polkadot (DOT) is a multi-chain platform that allows different blockchains to interact with each other in an integrated ecosystem. Built by Gavin Wood, co-founder of Ethereum, Polkadot is designed to overcome blockchain fragmentation by delivering a high-level interoperability system. The protocol relies on Relay Chain as the main network and parachains that perform specialized functions.

DOT tokens have three main functions: staking for network security, governance to determine the direction of development, and bonding to connect new parachains. Polkadot is one of the projects that is considered important in the evolution of Web3 because it enables efficient interblockchain data communication. With more and more projects building on top of Polkadot, the ecosystem continues to grow rapidly and attract the interest of institutional investors.

6. Uniswap (UNI)

Uniswap (UNI) is one of the largest DEXs in the crypto world that allows users to exchange ERC-20 tokens without intermediaries. Built on the Ethereum blockchain, Uniswap uses an automated market maker (AMM) model to price assets based on liquidity in the trading pool. This system allows anyone to become a liquidity provider and earn returns from transaction fees.

UNI tokens are used for protocol governance, allowing the community to participate in decision-making regarding updates and liquidity policies. Uniswap has also extended its network to various Layer-2s such as Arbitrum and Optimism to lower gas fees and speed up transactions. As a pioneer in the DEX ecosystem, Uniswap remains a key symbol of the efficient and transparent growth of the DeFi sector.

7. World Liberty Financial (WLFI)

World Liberty Financial (WLFI) is a new crypto project that aims to bring a more inclusive and transparent global financial model. WLFI combines elements of DeFi, stablecoins, and community governance systems to create an ecosystem that enables financial access without geographical boundaries. The project focuses on asset tokenization and cross-blockchain interoperability to create a more open digital financial market.

Also read: 10 Coin Memes that Have the Potential to Rise in 2026

The WLFI token is used as a governance tool as well as a means to access decentralized financial products within its ecosystem. With an approach that emphasizes transparency and regulatory compliance, WLFI attempts to bridge the gap between traditional finance and the blockchain world.

8. Aave (AAVE)

Aave (AAVE) is a DeFi protocol that allows users to borrow and lend crypto assets without traditional intermediaries. With a secure smart contract system, Aave creates a decentralized money market where liquidity providers can earn interest and borrowers can access funds with digital assets as collateral. The platform supports various assets such as Ethereum (ETH), USD Coin (USDC), and DAI.

The AAVE token is used for governance and liquidity protection, and gives its holders voting rights in community decision-making. Aave is also known for its innovative features such as flash loans-instantunsecured loansthat must be repaid in a single blockchain transaction. Thanks to its reputation for security and efficiency, Aave is becoming one of the key foundations in the global DeFi ecosystem.

9. Ethena (ENA)

Ethena (ENA) is a decentralized finance protocol that focuses on managing digital assets with high stability through a combination of derivatives and stablecoins. One of its best-known products is USDe, a synthetic dollar that maintains a stable value without reliance on traditional banking. Ethena aims to create a more transparent and decentralized non-custodial stablecoin alternative.

The ENA token serves as a governance tool and incentivizes users who provide liquidity or participate in the ecosystem. With the growing interest in non-bank stablecoin solutions, Ethena occupies an important position in the evolution of decentralized finance. Its focus on stability and transparency makes it an attractive project for users seeking a balance between innovation and asset security.

10. Aster (ASTER)

Aster (ASTER) is a blockchain project focused on cross-chain interoperability and scalability. The network is designed to enable decentralized applications (dApps) to run on various blockchain ecosystems such as Ethereum, Polkadot, and Binance Smart Chain. With cross-chain smart contract capabilities, Aster helps developers create more flexible and efficient applications.

ASTER tokens are used for staking, payment of network fees, and as incentives for validators and users. Aster also provides an environment for Web3 developers to build dApps that can be accessed by users from different networks without technical barriers. With the vision of creating global blockchain connectivity, Aster is one project that has the potential to accelerate the adoption of blockchain technology in various industry sectors.

Conclusion

These ten DeFi cryptos show strong potential to drive the growth of the decentralized finance ecosystem in 2026. With technological innovation and increasing adoption, these assets could be an attractive option for investors looking for opportunities in the DeFi sector, while still needing to consider the high crypto market risk.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Finance Feeds. Top 7 Crypto That Could 100x by 2026 – Next Bull Run List. Accessed November 2, 2025

- Coinmarketcap

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.