Download Pintu App

Bitcoin Hits $101,000 Today as Whale Accumulates 29,600 BTC in Just One Week

Jakarta, Pintu News – Large holders of Bitcoin (BTC) have quietly started accumulating again, signaling renewed confidence despite the market’s recent sharp correction that erased more than 20% from its recent highs.

At the time of writing, the price of Bitcoin is slightly above $101,000, having dropped to $99,600 two days ago.

Bitcoin Price Drops 1.53% in 24 Hours

On November 7, 2025, Bitcoin was trading at $101,997, equivalent to approximately IDR 1,710,873,909 — down 1.53% over the past 24 hours. During this time, BTC hit a low of IDR 1,685,269,556 and a high of IDR 1,745,330,986.

At the time of writing, Bitcoin’s market capitalization is around IDR 34,046 trillion, while 24-hour trading volume has increased by 2% to reach IDR 1,141 trillion.

Read also: Experts Share 3 Smart Strategies for Entering the Altcoin Market During November’s Market Jitters

Bitcoin Whales Signal New Hope for BTC Price

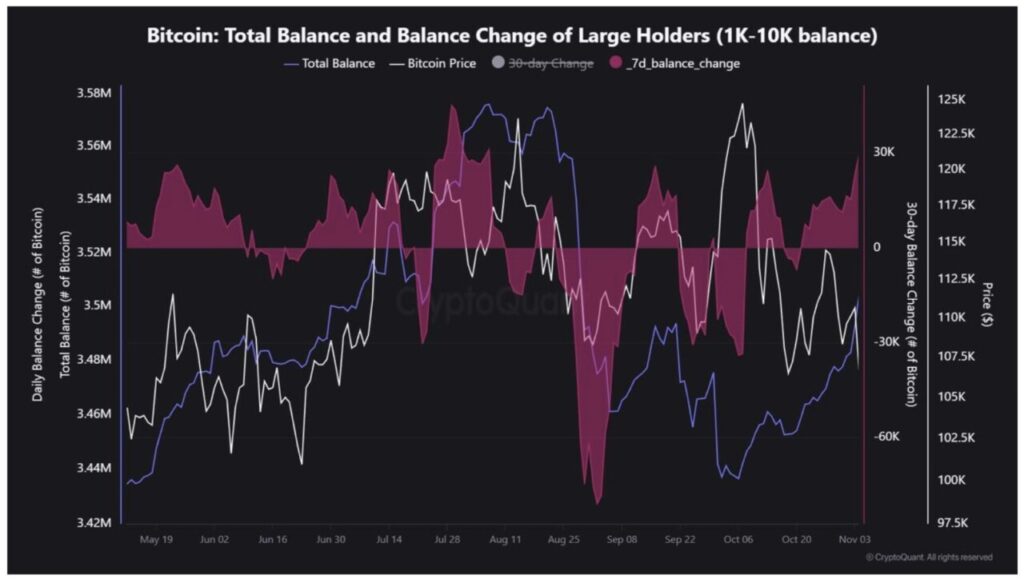

Based on data from CryptoQuant, wallets holding between 1,000 to 10,000 BTC have added around 29,600 Bitcoin in the last seven days.

Analyst JA Maartun noted that the total wallet balance belonging to these “whales” increased from 3.436 million to 3.504 million BTC. This marks the first major accumulation phase since late September.

This data suggests that large entities – typically institutions and early investors – are buying on the downside, rather than staying out of the market. Their actions are in stark contrast to the sentiments of retail investors who are now filled with fear in the wake of massive liquidations and outflows from ETFs.

More than $1 billion in leveraged positions were erased in the past week. Spot Bitcoin ETFs in the US also saw withdrawals of more than $2 billion, according to the latest market data.

This discrepancy-between accumulation by “smart money” and the caution of retail investors-historically often marks the end of a correction phase, not the beginning of a new downward trend. By absorbing about four times the weekly supply of mining proceeds, the whales tightened the liquid supply on exchanges and strengthened the support zone at $100,000.

This accumulation comes amid macroeconomic pressures. The Federal Reserve’s cautious stance on interest rate cuts has weakened interest in risky assets, which has contributed to Bitcoin’s recent price decline.

However, this also creates a liquidity vacuum-an opportunity that whales seem to be capitalizing on.

How will November End for Bitcoin?

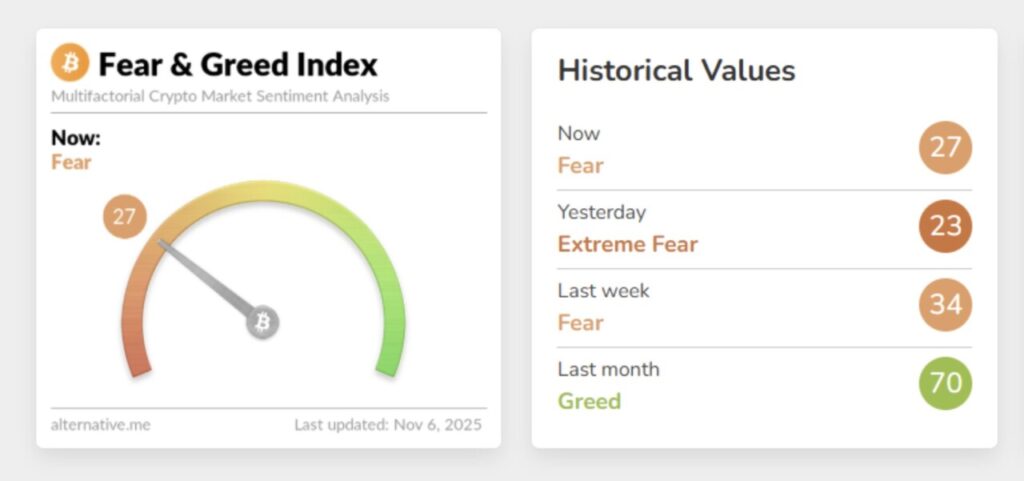

Technical indicators show that Bitcoin is consolidating in the range between $100,000 to $107,000, while the Fear & Greed Index is deep in the “Extreme Fear” zone.

Read also: ChatGPT Crypto Winter Predictions: Bitcoin Slumps Again After ‘Red October’

Historically, when large holders add exposure when market fears are high, price recovery usually occurs in a matter of weeks.

However, short-term volatility remains likely. Institutional outflows and ongoing unwinding of derivative positions may keep the market volatile before a sustained rebound.

If accumulation by the whales continues, this could be the basis for a medium-term price recovery towards the $115,000-$120,000 range.

The conclusion from this week’s whale activity watch is clear: while short-term traders are panicking, long-term holders are repositioning for the next big move. This consistent accumulation shows confidence that the market’s structural trend still remains strong-even if market sentiment has yet to catch up.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Supply Loss Capitulation Market Outlook. Accessed on November 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.