Download Pintu App

Biggest Bitcoin ETF withdrawal since July, will it deepen the November 2025 price crisis?

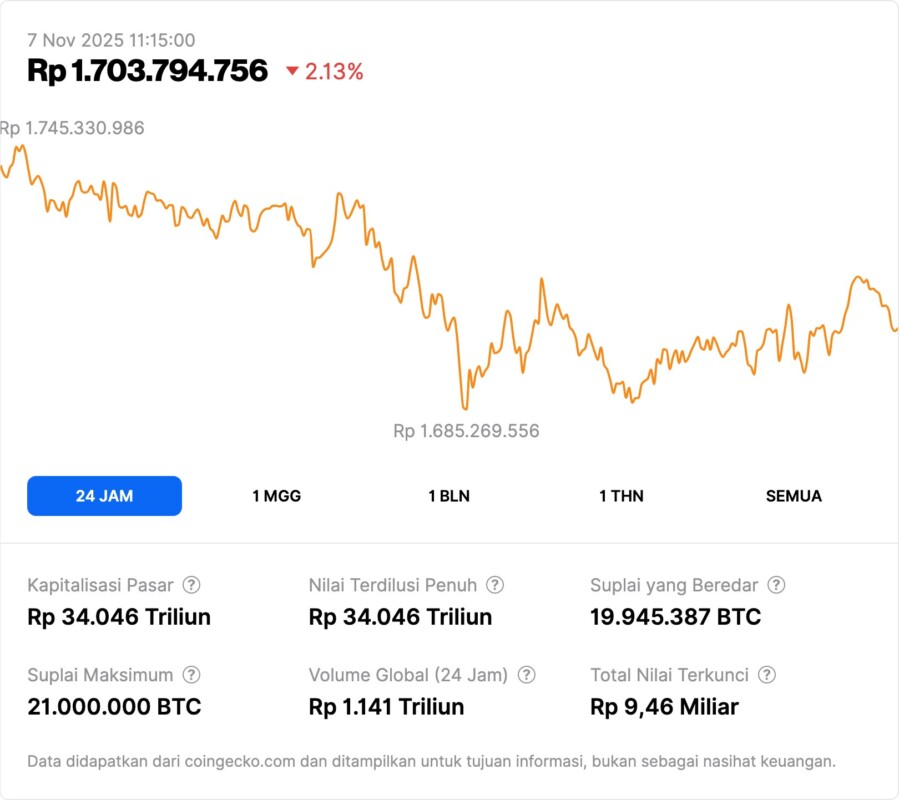

Jakarta, Pintu News – Bitcoin’s (BTC) price drop below $100,000 has caught the attention of global markets. With withdrawals from ETFs reaching $577 million and large liquidations, many are wondering what’s next for the cryptocurrency. The following analysis will delve deeper into the dynamics affecting the current Bitcoin (BTC) price and its potential recovery.

Triggers for Bitcoin Price Decline

Bitcoin’s (BTC) price drop below $100,000 was triggered by a combination of ETF withdrawals and massive liquidations. In a single day, $577 million was withdrawn from ETFs, the largest since July. This suggests that institutional investors are starting to take advantage of the previous price increase.

In addition, there was a liquidation of $492 million which added pressure to the price of Bitcoin (BTC). These large withdrawals reflect the uncertainty in the market as well as investors’ quick reactions to changing market conditions. Although these withdrawals created selling pressure, there are other indicators that point to a potential recovery in Bitcoin (BTC) price in the future.

Also Read: XRP’s Drastic Decline: Is It the Right Time to Buy?

US Market Confidence and Retail Investors

Retail investors in the United States are starting to show signs of restoring confidence after the previous price drop. Buying activity on major exchanges has begun to increase, signaling Bitcoin (BTC) accumulation by traders. The Coinbase Premium Index, which measures the price difference on Coinbase with overseas exchanges, has risen to -0.9, approaching the neutral to bullish zone.

Although retail market sentiment is not yet fully bullish, data shows an increase in investor confidence. This can be seen in the way traders have started accumulating Bitcoin (BTC) at price levels they consider to be a discount, showing optimism towards price recovery.

Historical Levels and Potential Recovery

The recent market decline has pushed Bitcoin (BTC) price to the intersection of the 365-day Moving Average (MA), a zone that is historically significant for identifying major price reversals. This indicator has consistently marked important turning points for Bitcoin (BTC).

A similar pattern was seen in August 2024, when Bitcoin (BTC) rebounded after trading near this level. Now, with Bitcoin (BTC) back in the same zone, there are strong indications of another potential rally. However, the sustainability of this rally remains to be watched, given external factors such as continued selling by institutional investors.

Conclusion

Although there are some indicators pointing to a potential recovery, the withdrawal of funds by institutional investors remains a major obstacle. Going forward, the dynamic between retail accumulation and institutional selling will largely determine the direction of Bitcoin (BTC) price. Market watchers should continue to monitor these indicators to gain a better understanding of possible future price movements.

Also Read: Dogecoin’s Drastic Drop in Early November 2025: What Should Investors Know?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Will Bitcoin’s largest ETF withdrawal since July deepen BTC’s crash?. Accessed on November 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.