Download Pintu App

Robinhood’s Crypto Revenue Soars to $268 Million in Q3

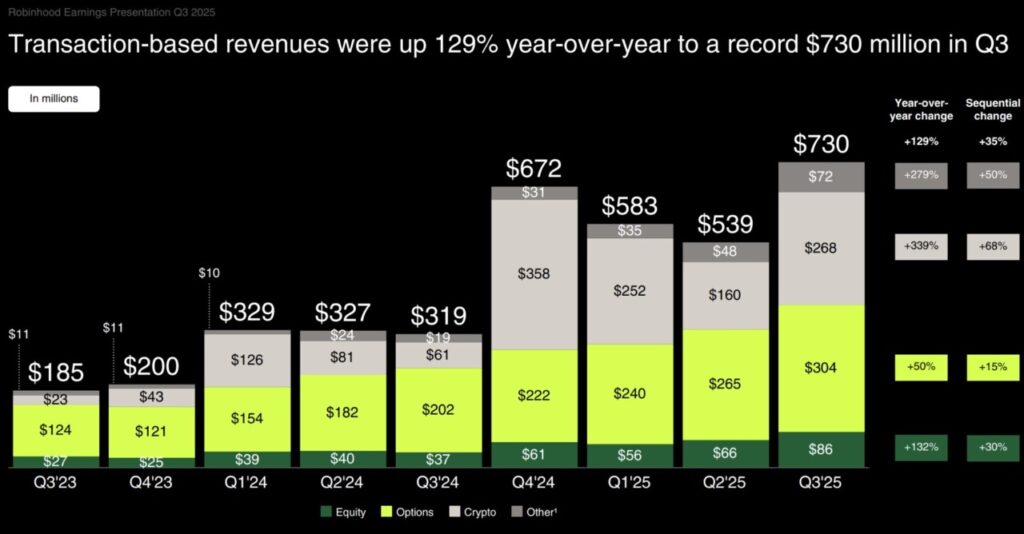

Jakarta, Pintu News – Robinhood Markets reported a strong surge in crypto trading activity during the third quarter, with crypto-related revenue increasing to $268 million – up more than 300% compared to the previous year.

Net revenue totaled $1.27 billion, driven by an increase in options and stock trading. The company also recorded growth in the number of funded accounts, indicating broader user engagement on its platform.

3rd Quarter Results Show Crypto Revenue Recovery

Robinhood (HOODX) revealed in its Q3 2025 financial report that its crypto-related revenue reached $268 million, a jump of more than 300% compared to the same quarter last year.

Read also: Worldcoin Introduces ‘Proof of Human’ ID at Major Global Events Like FIFA and NFL

Total net revenue rose 100% on an annualized basis to $1.27 billion, while transaction-based revenue increased 129% to $730 million, reflecting contributions from crypto, options ($304 million), and stock ($86 million) trading.

The number of customers with funded accounts increased by 2.5 million to 26.8 million, and the number of investment accounts increased to 27.9 million, based on the company’s report in the SEC Form 10-Q document.

Quarterly net profit surged 271% on an annualized basis to $556 million, while diluted earnings per share reached $0.61 – reflecting even revenue growth across business lines.

Market Reaction and Community Response

The market’s initial reaction to Robinhood’s financial report was mixed. Some analysts noted that crypto revenue fell short of Wall Street’s expectations, although options revenue exceeded estimates, according to a Yahoo Finance report.

Meanwhile, a section of the retail trader community gave a more positive response.

“$HOOD is the only platform that offers a wide range of products from crypto, stocks, options to prediction markets. They really try to keep users in their ecosystem,” said crypto commentator @samsolid57 on the X platform.

However, there are also other market participants who highlight concerns regarding user profiles, arguing that spreads and execution costs are still a drawback for traders with large portfolios. This is reflected in various public posts on X.

“Anyone with a large portfolio should not use HOOD. HOOD profits too much from spreads, execution is poor, and even worse for crypto,” said one commentator.

Read also: Bitcoin Price Touches $101,000 Today: Whale Buys 29,600 BTC in a Week

Regulatory Status and Expansion Plans

Robinhood reiterated that its crypto operations remain registered with the US Securities and Exchange Commission (SEC) and comply with custody and money laundering prevention requirements.

In the earnings conference call, executives confirmed plans to launch more crypto-related products and expand into international markets, although no launch schedule has been announced.

The company also stated that the development of staking features and enhancement of digital wallet services are still ongoing. Management emphasized that the main focus is to increase user engagement on their multi-asset platform, rather than chasing short-term volume spikes due to market volatility.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Robinhood Q3 Crypto Revenue Surges to $268 Million. Accessed on November 7, 2025

- Cointelegraph. Robinhood Q3 Crypto Revenue 300% Earnings Surpass Expectations. Accessed on November 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.