Download Pintu App

Google Finance Now Integrates Predictive Market Data, What’s the Impact?

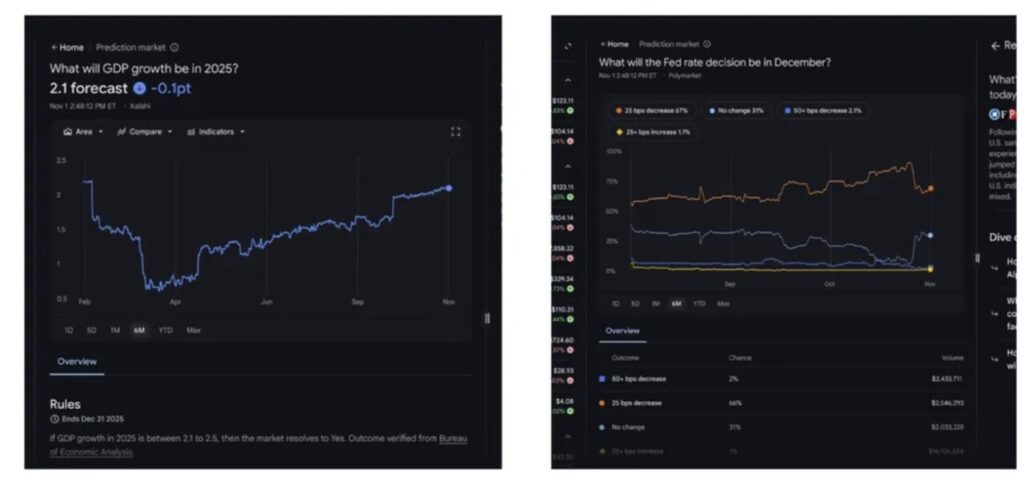

Jakarta, Pintu News – Google Finance has expanded its market tracking tool by integrating data from US prediction markets Kalshi and Polymarket. This move marks a new era where traditional finance is starting to come together with decentralized market insights. Read the full information here!

Introduction of Predictive Market Data

Recently, Google Finance added data from Kalshi and Polymarket prediction markets, which is their first foray into event-based financial tracking. Users can now view live opportunities related to major events such as elections, inflation reports, and crypto regulation results alongside traditional assets.

This suggests that crowd-based predictions are starting to be considered relevant in the broader financial ecosystem. The use of this data allows investors and analysts to gain a broader perspective on the potential outcomes of various global events. As such, they can make more informed and strategic investment decisions.

Also read: Japan Starts a State-Supported Bitcoin Mining Race, Here are the Details!

Closing the Gap Between Traditional and Decentralized Finance

This integration blurs the lines between traditional financial data and decentralized information flow. For years, prediction markets have only been recognized within the crypto community as a niche platform. However, by displaying this data through Google Finance, prediction-based insights are now normalized alongside stock and commodity information.

The recognition of prediction markets by a platform as large as Google Finance signals an important shift in the way the financial industry views predictive tools. It also indicates significant growth potential in the adoption of new financial technologies by the wider public.

Also read: Miami Mayor Claims 300% Profit from Bitcoin Salary, Is it Really that Profitable?

Regulatory and Market Impact

The move comes amid US regulators’ debate over how to classify event contracts. Kalshi’s regulated model differs considerably from Polymarket’s decentralized operations, which previously faced enforcement action from the CFTC. However, both platforms are growing in popularity, especially as crypto-familiar investors explore event trading as a hedge against macro uncertainty.

If major platforms like Google continue to integrate prediction market data, it may prompt further policy clarity from regulators. It could also pave the way for more innovation and adoption in financial technology focused on prediction and event analysis.

Conclusion

Google Finance’s integration of predictive market data is not only a technological development, but also an indication of a paradigm shift in financial decision-making. By accessing broader and more diverse insights, market participants now have better tools to navigate an increasingly complex and connected financial world.

crypto updates about crypto projects and blockchain technology. You can also learn crypto from scratch through Pintu Academy and stay up-to-date with the latest crypto markets such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Google Finance to Integrate Kalshi and Polymarket Prediction Markets. Accessed on November 7, 2025

- Featured Image: Google

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.