Download Pintu App

Breakout Signals Emerge: Crypto Whales Are Quietly Accumulating These 3 Altcoins

Jakarta, Pintu News – The crypto crash that occurred in early November took many by surprise, contrary to expectations of a bullish month. Between November 4 and 5, sharp declines in various major tokens shook market sentiment and wiped out short-term gains. However, altcoins that were bought up by the “whales” (large holders) still attracted attention.

On-chain data shows that large holders have quietly started accumulating tokens that exhibit breakout patterns, early signs of divergence, and strong technical structures. All of this is an indication that big players may have started positioning for the next phase of recovery – with or without the participation of retail investors.

Aster (ASTER)

The first altcoin that whales started buying up after the early November crypto crash was Aster (ASTER), a project on the BNB Chain network that focuses on decentralized trading.

Read also: Donald Trump Vows to Make the U.S. the Global Hub for Bitcoin and Crypto Power

As of November 6, the ASTER whales have increased their holdings by 12.58%, and now control approximately 43.62 million ASTER tokens. This means they added about 4.9 million tokens, worth approximately $5.46 million based on the current price.

Interestingly, the number of tokens on exchanges also rose by 0.72%, suggesting that while the whales were quietly accumulating, some retail or early investors may have started taking profits – a pattern that often occurs when whales start buying altcoins in the early phases of a market recovery.

Technically, ASTER is still trading within a falling wedge pattern – a pattern that usually signals a bullish reversal as price action narrows. ASTER’s sharp decline on November 4 was followed by the appearance of a clear bullish divergence on the Relative Strength Index (RSI) indicator.

Between October 10 and November 3, the ASTER price formed a lower low, while the RSI formed a higher low, indicating that the selling pressure was beginning to ease. Since then, the price of ASTER began to gradually increase.

If this momentum continues, then a breakout above the $1.28 level, then $1.53 – about 36.8% higher than the current price – would confirm a reversal and open up opportunities towards the next target of $2.21. This would be a confirmation of the breakout from the wedge pattern and turn ASTER’s price structure fully bullish.

However, the key support level remains at $0.93. If this support fails to hold and the overall crypto market weakens, the price of ASTER risks dropping back to $0.81 or lower.

Bio Protocol (BIO)

The next altcoin that whales started buying after the early November crypto crash was Bio Protocol (BIO), a Decentralized Science (DeSci) project built on the Ethereum network. Despite a 44.2% drop in the past month, BIO’s price was trending steady on November 6 – indicating that the massive selloff is starting to subside.

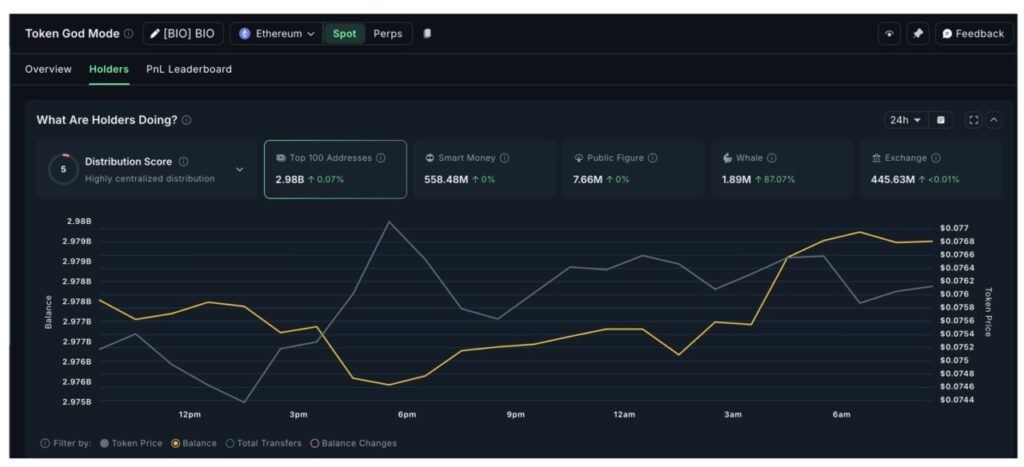

In the past day, whale BIO holdings increased by 87.07%, totaling 1.89 million BIO tokens. This means they have added around 880,000 tokens. Meanwhile, the mega whales – the 100 largest addresses – also increased their holdings by 0.07%, now holding around 2.98 billion BIO, or an increase of around 2.09 million tokens.

In total, whales and mega whales have accumulated nearly 2.97 million BIO tokens, with a value of around $226,000 – indicating a stealthy accumulation process at low price levels.

The current technical structure favors an accumulation phase. The On-Balance Volume (OBV) indicator – which measures accumulated buying and selling volume by adding volume on up days and subtracting it on down days – has been forming a downward trendline since late September.

Between September 21 and October 27, the OBV formed a series of lower highs, creating a clear line of resistance. On November 2, the OBV indicator briefly breached this line, which was followed by a price increase between October 31 and November 2. Although this breakout attempt initially failed, a new attempt is currently underway, signaled by the appearance of a green daily candle.

If this breakout of the OBV holds, then the first resistance to watch is around $0.097, which coincides with the 50% Fibonacci retracement level. Closing above this level could pave the way towards $0.12 and $0.16, while confirming a bullish move.

Read also: Dogecoin Hype Explodes After Elon Musk Says “It’s Time” – Is On-Chain Data Supportive?

However, if the price of BIO drops below $0.066, it will fall back below the OBV trendline – signaling that selling pressure could increase again. In this scenario, the bears could potentially push the price to a new low.

Maple (SYRUP)

The third altcoin that is being bought up by whales is Maple (SYRUP). Whale accumulation of SYRUP has increased significantly since November 4, right after the massive correction in the crypto market.

Two groups of whales were the main drivers of this accumulation. The first group, which holds between 100 million and 1 billion SYRUP, increased its holdings from 447.95 million to 448.18 million tokens – an increase of around 230,000 tokens in just two days.

Meanwhile, the smaller whale group, with holdings between 10 million and 100 million SYRUP, carried out a much more aggressive accumulation. They increased their holdings from 397.29 million to 425.09 million SYRUP, or about 27.8 million additional tokens.

In total, these two groups have added nearly 28 million SYRUP, valued at around $11.5 million, demonstrating the growing confidence of large holders in the token.

This massive accumulation was in line with strong technical signals. Between August 25 and November 4, the RSI (Relative Strength Index) indicator on the daily chart showed a bullish divergence – where the price was forming lower lows, while the RSI was creating higher lows. This is often an early sign of a potential uptrend reversal.

Moreover, the Chaikin Money Flow (CMF) indicator – which measures whether funds are flowing in or out of an asset – has just broken slightly above the downtrend line drawn since October 14. This indicates fresh inflows from big wallets, supporting whale-led accumulation.

Further confirmation of SYRUP’s price recovery will be seen if the CMF rises above the zero level, signaling continued buying momentum.

Price-wise, the first major resistance is around $0.46, about 13% higher than the current price of $0.41. If it manages to close above that level, SYRUP’s price could potentially head towards $0.53 or above. On the downside, strong support is at $0.36, and if it fails to hold, the price could drop back to $0.31 or lower.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins: Whales Are Buying After November Crypto Crash. Accessed on November 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.