Download Pintu App

Ethereum Holds Steady at $3,600 — Is ETH Gearing Up for a Bullish Breakout?

Jakarta, Pintu News – Today, Ethereum (ETH) managed to recover and hold above the crucial support level of around $3,300, after experiencing a 12% correction in the last seven days.

As the second-largest crypto asset by market capitalization, Ethereum has reversed a sharp decline and is trading around $3,600. This movement reflects the emergence of renewed buying pressure, as market participants see opportunities at low price levels.

Then, how will Ethereum price move today?

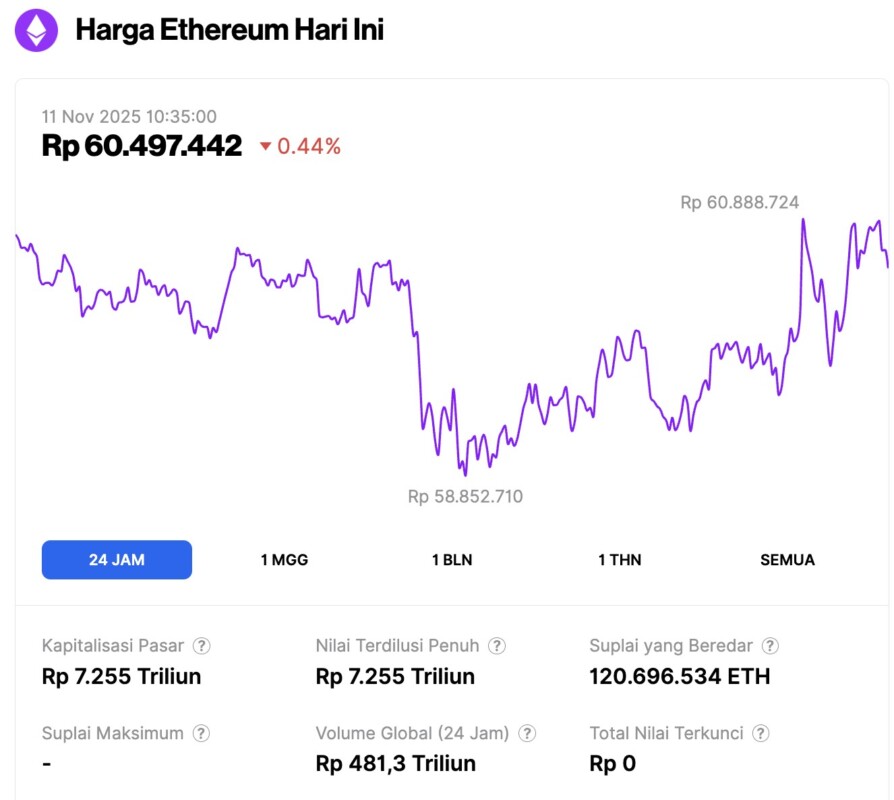

Ethereum Price Drops 0.44% in 24 Hours

As of November 11, 2025, Ethereum was trading at approximately $3,609, equivalent to IDR 60,497,442, reflecting a 0.44% decline over the past 24 hours. During this period, ETH fluctuated between a low of IDR 58,852,710 and a high of IDR 60,888,724.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 7,255 trillion, while its daily trading volume has risen by 8% to reach IDR 481.3 trillion over the same timeframe.

Read also: XRP Price Prediction: Ripple Starts to Recover, Ready to Experience a Big Rally Due to ETF Launch?

Ethereum Poised for Bullish Breakout as Whale Accumulation Increases

Ethereum’s recovery above the $3,600 level is seen as a bullish signal by technical analysts. If the price is able to stay above this level, ETH has the potential to retest the resistance zone around $5,000 in the next few weeks.

Market activity also shows caution, as price pressure in this area is often a precursor to major volatility.

On-chain analysis revealed a sharp accumulation pattern from large investors. According to a report by Ethereum treasury company Bitmine Immersion Technologies, more than 744,600 ETH have been added since the beginning of October-valued at around $2.53 billion.

This accumulation reflects the growing confidence of institutional investors, despite market uncertainty in the short term.

Ethereum ready for breakout amid market uncertainty

Market analyst Mikybull Crypto noted that ETH has managed to reclaim its moving average and is currently testing the area as support. He stated that a valid retest could pave the way for a rise towards the $6,000 level.

Meanwhile, another analyst, Ted, looks at the formation of liquidity clusters in the $3,300 and $3,700 areas. He notes that price movements beyond either of these zones often trigger a quick reaction in a particular direction.

Read also: Altcoin Season on Hold? $1.6 Trillion Hurdle Stops Altcoin’s Progress!

Global macroeconomic conditions also play an important role in determining Ethereum’s short-term direction. Market focus is currently on the debate over a possible government shutdown in the United States, which is expected to affect liquidity and investor sentiment.

Nevertheless, Ethereum still has a long way to go before it can solidify a strong bullish narrative. The price consolidation between $3,200-$3,400 reflects indecision among buyers and sellers. A decisive move past either side will determine the direction of the market until the end of the year.

Overall, Ethereum’s technical indicators and on-chain data point to the potential for a significant shift in market direction. Accumulation by whales, stable support around the $3,200 level, as well as liquidity positions, are strong indications that further recovery is highly likely if momentum is maintained.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Ethereum Recovers Above $3,300, Analysts Eye $6,000 Price Target. Accessed on November 11, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.