Download Pintu App

3 Altcoins at High Risk of Liquidation this Week

Jakarta, Pintu News – Although altcoin season is not yet fully back, some altcoins showed stronger performance than the general market in the second week of November. However, these tokens also have the potential to trigger massive liquidation for short-term traders.

Which altcoins fall into this category, and what risks are inherent in trading their derivatives?

XRP

Short-term trader sentiment towards XRP (XRP) remains highly optimistic ahead of the launch of the Spot XRP ETF by Canary Capital on November 13. Additionally, five spot XRP ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have been listed on the DTCC list. This reinforces investor confidence that approval of several XRP ETFs could be forthcoming.

Read also: XRP Price Prediction: Ripple Starts to Recover, Ready to Experience a Big Rally Due to ETF Launch?

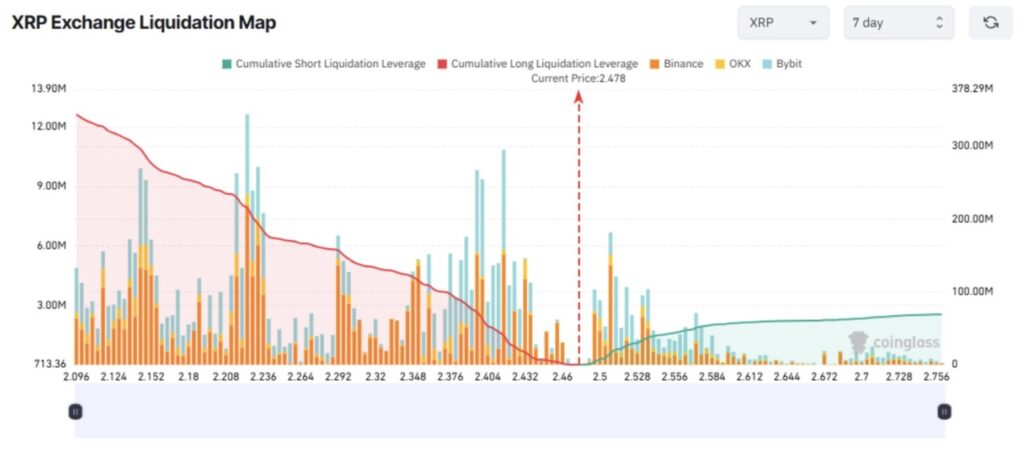

The last 7-day liquidation map shows a large concentration of potential liquidation of long positions, indicating that many traders expect a rise in XRP price this week.

However, analysis from the BeInCrypto page shows a sharp decline in the number of new XRP addresses over the past week, signaling weakening interest from new investors. In addition, the MVRV Long/Short Difference indicator has also decreased, which increases the likelihood of a price correction.

If the price of XRP drops to around $2.10 this week, long positions risk liquidation of over $340 million. Conversely, if the price rises to $2.75, short positions are expected to be liquidated to the tune of around $69 million.

Zcash (ZEC)

The Zcash (ZEC) price rally showed no sign of slowing down in the second week of November. After touching $750 and correcting to around $658, many traders still expect the ZEC price to increase towards $1,000.

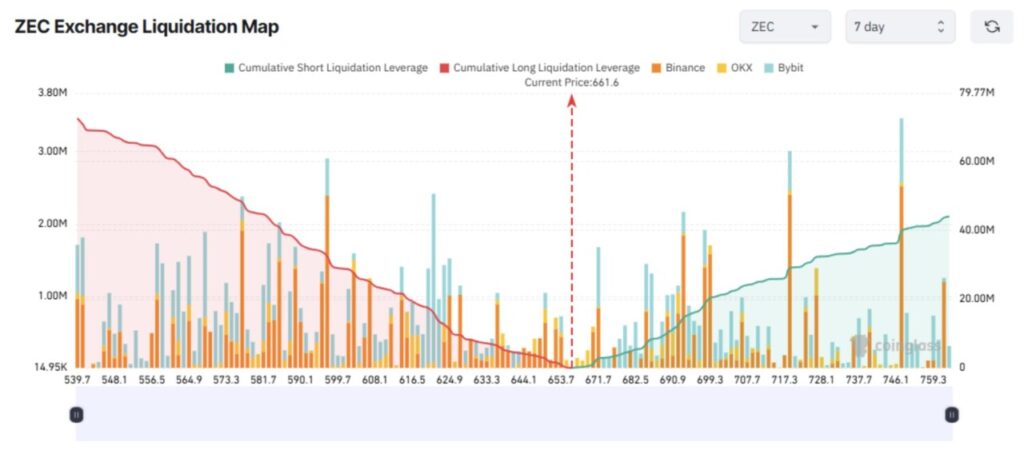

The liquidation map for the past seven days shows that short-term derivatives traders are starting to allocate more capital and leverage to long positions. This means that they are at risk of incurring large losses in the event of a price correction this week.

If the price of ZEC drops to $540, a long position worth over $72 million could be liquidated. Conversely, a price spike to $760 could lead to the liquidation of short positions of around $44 million.

Analysts warn that ZEC is likely to form a classic parabolic trend pattern after its 10-fold rally, which may mark the final phase of the pattern.

“I just sold 90% of my ZEC. I still believe in the privacy thesis, but parabolic charts rarely hold in the short term without significant corrections. Too much short-term FOMO in my opinion,” said investor Gunn.

Read also: Solana Price Prediction: SOL Potential to Break $220? Here’s Why

Starknet (STRK)

Starknet (STRK) surprised the market in the second week of November with a daily surge of 30%, successfully recovering losses from the previous month’s sharp decline.

Some analysts suggest that STRK may be breaking a long-term resistance line, which could be the start of a strong new bullish trend.

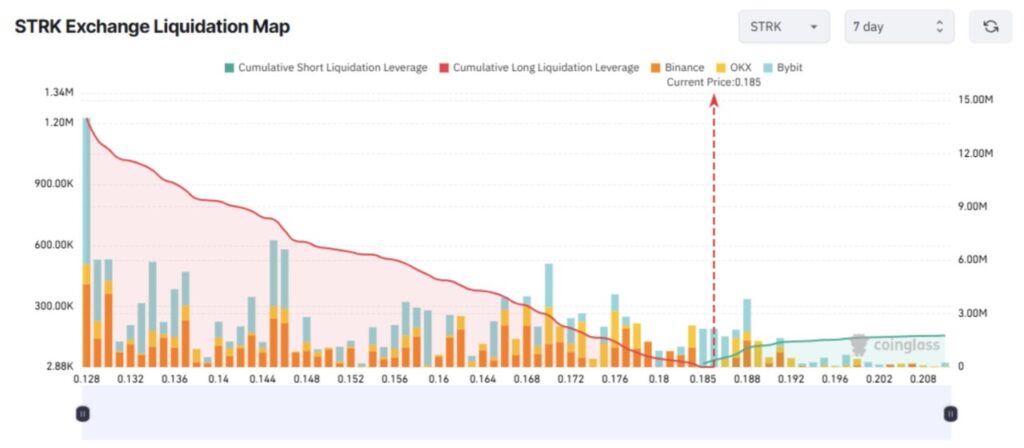

The liquidation map data reflects this short-term bullish sentiment, with a greater dominance of potential liquidation of long positions over shorts.

However, according to a report by CryptoRank, STRK is among the top seven altcoins to experience a large token unlock this week. More than 127 million STRK tokens will be released into the market, which has the potential to add significant selling pressure and disrupt leveraged long positions.

If the price of STRK drops to $0.128, around $14 million of long positions are at risk of being liquidated. Conversely, if the price breaks $0.20, around $1.78 million of short positions could be liquidated.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Major Liquidation Risk in the 2nd Week of November. Accessed on November 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.