Download Pintu App

Risk Market Downturn and Bitcoin: Is Recovery Imminent?

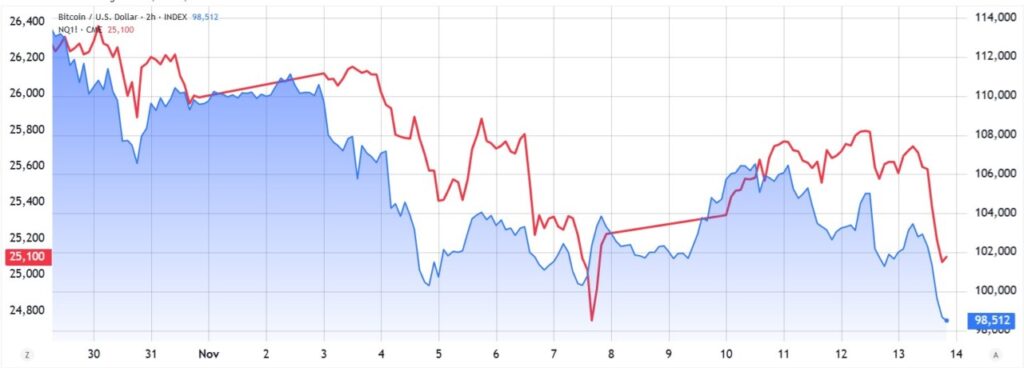

Jakarta, Pintu News – Growing global economic uncertainty has affected the value of Bitcoin and other risk markets. Various US macroeconomic factors and disappointments from major companies’ financial reports have added pressure to the market.

Disappointing Company Financial Performance

Disney and several other big names in the consumer sector reported financial results that fell short of expectations, adding weight to a market already depressed by the prolonged US government shutdown.

Disney (DIS) shares fell 8% after announcing lower-than-expected quarterly results, mainly affected by their streaming and movie theater segments. Other companies such as DoorDash (DASH), Dollar Tree (DLTR), and Starbucks (SBUX) also saw declines after reporting disappointing earnings.

Also Read: Shocking Prediction from Donald Trump’s Son: Bitcoin Will Break $1 Million!

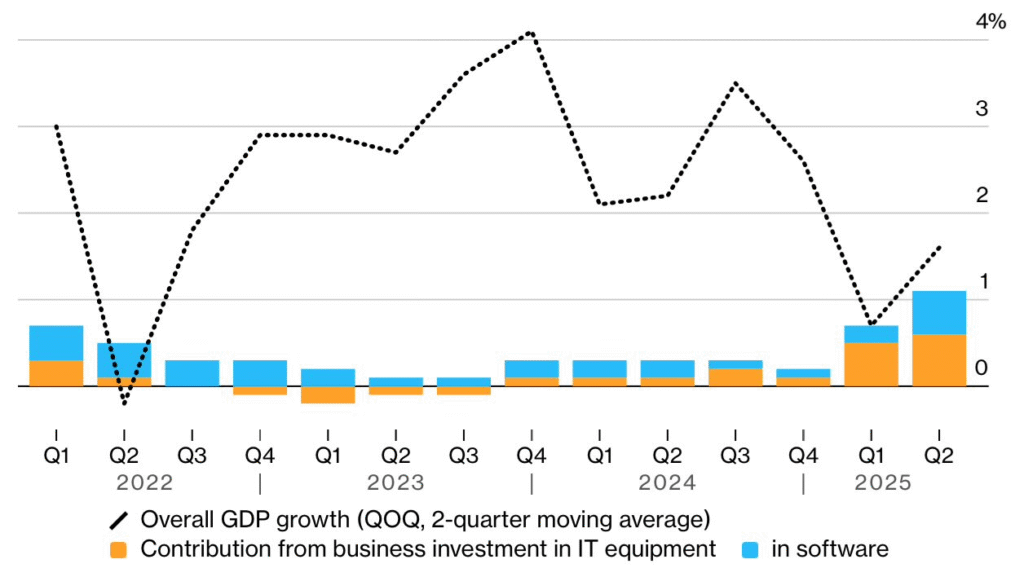

US Macroeconomic Issues and AI Investment Concerns

Tesla (TSLA) suffered further declines after the company was forced to recall more than 10,500 units of its standalone energy storage system due to reports of overheating.

TSLA shares were already under pressure after announcing plans to build the Optimium humanoid robot line with a capacity of 10 million units in Austin. On the other hand, traders’ expectations for the US Federal Reserve’s monetary policy also declined, with the chance of an interest rate cut below 3.5% by January 2026 falling to 20%.

The Government Shutdown and Its Impact on Economic Data

US President Donald Trump signed a temporary government funding bill to end the government shutdown, but some October economic reports may not be published. This adds uncertainty to the economic outlook.

RBC analysts expressed their concerns over the interpretation of the US job market data, given that furloughed and essential employees will be counted as unemployed. Although some analysts argue that the US Gross Domestic Product (GDP) could take a 2% hit, others believe that most of the negative effects will be reversed once federal spending returns to normal.

Conclusion

Investors are currently facing reduced visibility into the economic outlook, which could affect stock market valuations and the US government’s chances of injecting liquidity through tax cuts or stimulus checks. Until such clarity is achieved, Bitcoin (BTC) will likely continue to reflect broader economic uncertainty, which is compounded by the lack of consistent and reliable data.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

- Why is Disney stock down?

- Disney (DIS) shares fell 8% on the back of their lower-than-expected quarterly earnings report, mainly affected by poor performance in the streaming and movie theater segments.

- What caused Tesla to do a product recall?

- Tesla (TSLA) was forced to recall more than 10,500 units of their energy storage system due to reports of the devices overheating.

- How will the government shutdown affect US economic data?

Placeholder polylang do not modify

- What is the impact of the Federal Reserve’s lowering of monetary policy expectations?

Placeholder polylang do not modify

- Will Bitcoin recover soon?

- Bitcoin (BTC) will likely continue to reflect broader economic uncertainty until there is more clarity regarding economic conditions and US government policies.

Reference

- Cointelegraph. 3 Reasons Why Bitcoin and Risk Markets Sold Off, Is a Recovery on the Horizon? Accessed on November 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.