Download Pintu App

XRP Price Outlook for 2025: Is a Year-End Surge on the Horizon?

Jakarta, Pintu News – XRP (XRP) is currently stagnant after a volatile period that mirrored the movements in the third quarter. Despite increased market activity, the altcoin remains in a narrow price range.

However, historical patterns indicate a possible change in direction, as XRP is again showing previously frequent signals ahead of a stronger performance in the fourth quarter.

XRP Reflects Historical Pattern and Potential Rebound Ahead of Year-End

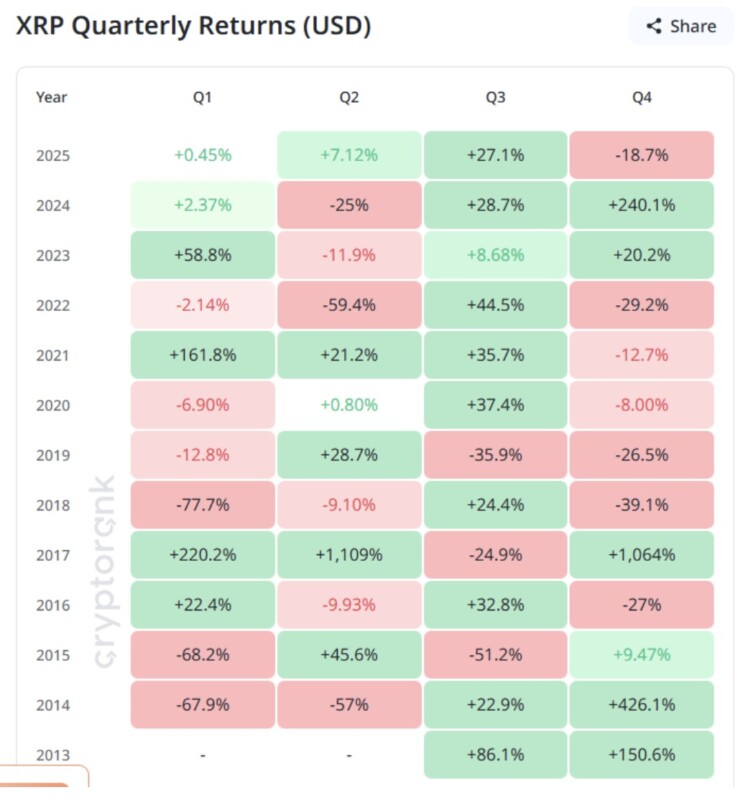

The fourth quarter has historically been the strongest period for XRP, with returns averaging 134% in the past 12 years. While a surge of such magnitude is not expected in the next few weeks, this trend highlights XRP’s long-term seasonal strength as well as the signals that often precede a price reversal to the positive.

Read also: Zcash Could Overtake XRP? Arthur Hayes Makes Bold Claim Amid 45% ZEC Rally!

This historical performance places XRP as one of the few major cryptocurrencies to consistently get a boost from year-end momentum.

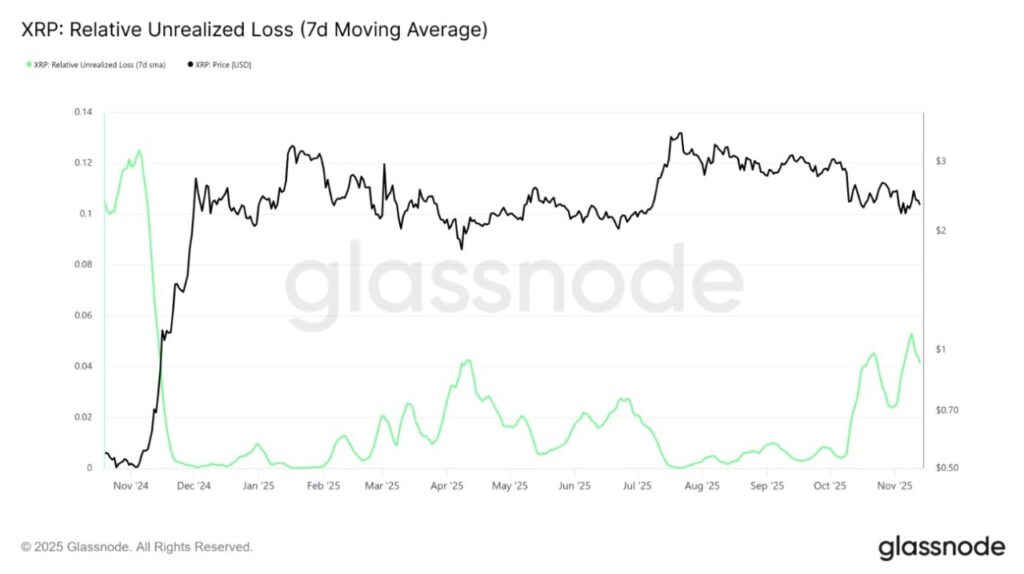

Currently, unrealized losses are increasing again – a condition that has often triggered sharp rebounds in the past. Similar patterns were recorded in November 2024, April 2025, and June 2025, each of which was followed by an upward price movement.

If this pattern repeats, XRP could potentially experience a recovery driven by renewed buying pressure. The spike in unrealized losses reflects heightened market tension – a dynamic that historically precedes breakouts, when investors push prices to recoup lost value.

Meanwhile, the MVRV Long/Short Difference indicator showed a decline towards the neutral zone, signaling that long-term investors’ profits are starting to shrink. This is often a signal that the behavior of short-term holders is starting to change. If the indicator falls below the neutral point, short-term profit-taking is likely.

However, this phase is usually followed by a recovery of the indicator into positive territory. As long-term holder gains rebound, XRP tends to follow suit with continued price gains. This pattern suggests a potential configuration for further strengthening, if the market cycle repeats the previous pattern.

XRP Price Awaits Strong Trigger for Breakout

XRP is currently trading at $2.29 after several weeks of consolidation following a 22% drop in October.

Read also: Is the Crypto Market in a Bear Market? Here’s What the Experts Say

This flat movement reflects market caution, but also shows resilience as market participants continue to defend key levels amid short-term uncertainty.

Technical indicators are currently signaling a bullish outlook, with a chance to break $2.50 – an important psychological level. If it manages to cross this point, XRP could potentially test the next resistance at $2.64, and even advance towards $3.02, which would allow for a full recovery of October’s losses.

However, this stagnation pattern has lasted for 34 days, similar to the phase late last July that also followed a 22% drop. If the pattern repeats, XRP will likely remain moving within the $2.20 to $2.50 range, and a significant breakout may be delayed until a stronger momentum push emerges.

FAQ

What is XRP?

XRP is a digital currency used in the Ripple network to facilitate cross-border money transfers quickly and efficiently.

What is the current price of XRP?

Currently, XRP is trading at $2.29.

Why is the fourth quarter considered a strong period for XRP?

Based on historical data, XRP tends to show strong performance in the fourth quarter, with average returns reaching 134% over the past 12 years.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Price Prediction: What to Expect Before the Year Ends. Accessed on November 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.