Download Pintu App

Extreme Crypto Fear Grips the Market as Sentiment Turns Sharply Negative—What’s Driving the Shift?

Jakarta, Pintu News – Crypto market sentiment has again entered dangerous territory with the Crypto Fear and Greed Index indicator plummeting into the “Extreme Fear” zone, reflecting investors’ growing concerns over the direction in which digital assets are moving.

Amidst the turmoil engulfing Bitcoin (BTC) and altcoins, the big question arises: what exactly triggered this change in sentiment, and where is the market headed next?

Fear and Greed Index Reaches “Extreme Fear” Point amid Crypto Market Correction

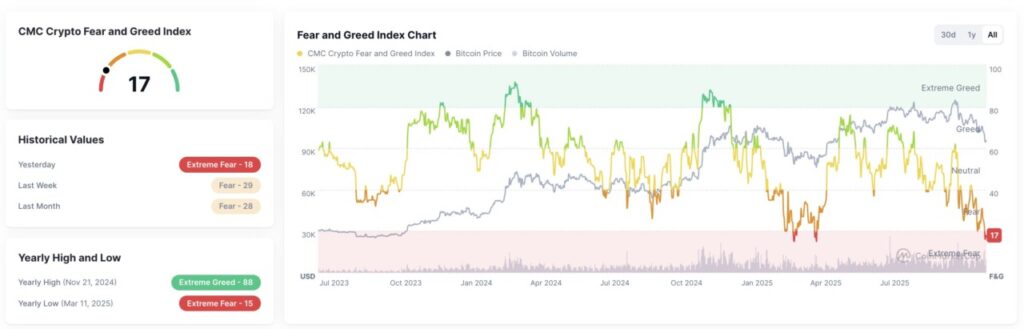

Currently, the Crypto Fear and Greed Index stands at 17, signaling “Extreme Fear”. This number reflects a very negative market sentiment amidst continued crypto price pressure.

Read also: Death Cross Confirmed: Will Bitcoin Hit Bottom or Fall Deeper?

Compared to the previous day which recorded a value of 18, today’s index shows a further decline. In comparison, last week’s value was at 29 and last month’s 28, both still in the “Fear” category.

Historical charts confirm that Bitcoin’s price volatility spikes and shrinking trading volumes contributed to the index’s decline.

The Bitcoin price, which had previously touched the “Extreme Greed” zone in November 2024 when the index reached 88 (the highest annual value), has now reversed course towards the zone of deep fear. The lowest point of the index for the year was recorded on March 11, 2025 with a value of 15, very close to the current position of the index.

These conditions reflect significant market panic and investors’ tendency to shun risky assets. Historically, periods of extreme fear have often coincided with high selling pressure, but in previous cycles have also signaled a reversal when selling pressure peaked.

Crypto Market Holds Steady

According to BeInCrypto, the overall crypto market capitalization is currently at around $3.20 trillion, staying within a narrow range between $3.21 trillion and $3.16 trillion.

This stability reflects the reduced volatility over the weekend and shows that buyers are still defending key levels, despite uncertainty among major digital assets.

Maintaining support at $3.16 trillion is important for recovery opportunities. If market conditions remain stable, this level could serve as a buffer against a deeper correction. Conversely, if prices break below this support, selling pressure could intensify and push the decline towards $3.09 trillion.

If the market capitalization manages to break resistance above $3.21 trillion, the potential for an increase towards $3.26 trillion is open. If the momentum continues, the market could be pushed up to $3.31 trillion, reflecting the growing confidence and demand for the flagship cryptocurrency.

Read also: Hyperliquid Strengthens On-Chain Trading Infrastructure Through HIP-3 Launch!

Bitcoin Stays in Critical Support Zone

Bitcoin is currently trading around $95,494, holding near the psychological level of $95,000 over the past few days. This zone is a key fulcrum in preventing a deeper correction and sustaining short-term stability, as investors continue to monitor market conditions and changes in global liquidity.

If Bitcoin drops below that level, the price risks heading towards $91,521, which would deepen previous losses and indicate increased bearish pressure.

However, if BTC is able to break $98,000, this could be the start of a gradual recovery. A sustained move above that level could potentially pave the way back to $100,000. A recovery above that threshold would dismiss the bearish outlook and restore the confidence of market participants who are waiting for stronger trend reversal signals.

FAQ

What is theFear and Greed Index?

The Fear and Greed Index is a measurement tool that shows the sentiment of the crypto market, where low numbers indicate extreme fear and high numbers indicate extreme greed.

What is the total crypto market capitalization today?

Currently, the overall crypto market capitalization currently stands at around $3.20 trillion.

What is the current Bitcoin price?

Bitcoin is currently trading around $95,494, holding near the $95,000 psychological level for the past few days.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Is The Crypto Market Down Today? Accessed on November 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.