Download Pintu App

4 Privacy Coins that Liquidated in the Last 24 Hours

Jakarta, Pintu News – Four privacy coins have come under intense pressure in the past 24 hours after crypto markets recorded a massive wave of liquidations. The significant price declines in these privacy-focused assets came amid weakening trading volumes, rising sell-offs, and investor concerns over the direction of the cryptocurrency market ahead of the end of the quarter.

Daily price movements show a consistent bearish trend, signaling that market sentiment towards the privacy coin category is in a deep correction phase. This dynamic also highlights the sensitivity of privacy-featured assets to macro market turmoil and growing regulatory pressure.

Zcash (ZCASH) Price Plunges 13.04% in 24 Hours

The Zcash (ZEC) price chart over the past 24 hours shows a fairly sharp downward trend, reflecting strong selling pressure in the market. At the beginning of the period, the price moved around the $720 level before undergoing successive corrections. The first decline was gradual with small fluctuations, but the direction of movement remained skewed downward. This indicates a weakening of short-term sentiment despite the market’s attempts to defend the previous price zone.

Towards the middle of the period, the chart showed a more significant decline as the price fell from the $680 range to lower levels. There was an attempt at a rebound, but it was unable to maintain momentum and selling pressure dominated again. As a result, the price trajectory moved in a downward zigzag pattern with increased volatility. Any attempt at a quick recovery was responded to by the market with more aggressive asset disposals.

In the final phase of the chart, the price of ZEC continued to move down and reached a position around $616, reflecting a drop of more than 13% in 24 hours. This corresponded with a drastic drop in trading volume which fell by more than 50%, indicating reduced liquidity as well as a change in trader behavior. Despite this, the community sentiment indicator shows 72% of votes are still bullish, signaling that most users believe in a possible price recovery.

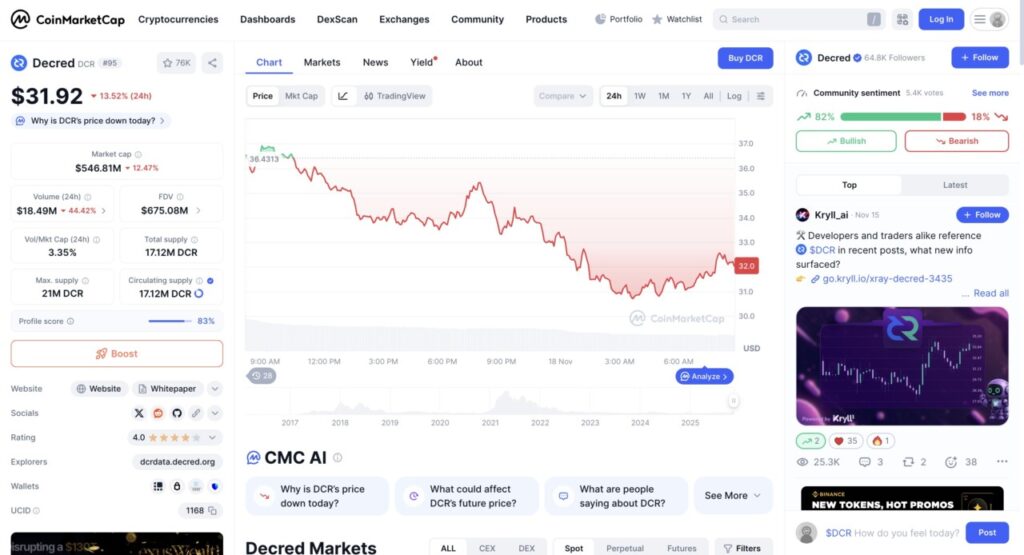

Decred (DCR) Price Drops 13.52% in 24 Hours

The Decred (DCR) price chart over the past 24 hours shows a consistent downward trend, in line with the strong selling pressure in the market. At the beginning of the period, the price moved around $36.43 before starting to enter a correction phase. The decline was gradual and formed a sustained downward pattern that depicted weakening buying momentum. Several small rebound attempts appeared, but did not result in a significant change in direction.

Midway through the period, the chart showed a sharper decline when the price dropped below the $34 level. The selling pressure became so dominant that any attempt at a quick recovery was pushed back to the downside. The price movement showed increased volatility, characterized by short but negatively directed fluctuations. This indicates that traders tend to take defensive positions amid unfavorable market sentiment.

In the final phase of the observation, the DCR price reached a level of around $32, reflecting a decline of more than 13% in 24 hours. Trading volume also fell by more than 44%, indicating weak market participation and short-term liquidity. Despite this, the community sentiment indicator showed that around 82% of the votes were still bullish. This pattern illustrates the existence of long-term conviction despite the price being under pressure.

Also read: 10 Crypto Cross-Chains that Have the Potential to Rise in 2026

ZKsync (ZK) Price Drops 12.93% in 24 Hours

The ZKsync (ZK) price chart in the last 24-hour period shows a fairly sharp downward trend, signaling the dominance of selling pressure in the market. At the start of the chart, the price briefly hovered around $0.054 before beginning a gradual correction. This initial phase still shows moderate volatility with some minor up-and-down fluctuations, but the tendency to weaken has started to appear. This indicates that the buying momentum is not strong enough to withstand the increasing market pressure.

Midway through the period, the chart showed a more consistent continued decline as the price moved from around $0.050 towards lower levels. The recovery attempts that emerged were shallow and unable to push the price back to the previous zone. Every time there was a small uptick, selling pressure soon emerged and pushed the price down again. This price pattern reflects the weak market sentiment and lack of support from short-term traders.

By the end of the observation period, the price of ZK fell to around $0.045, a drop of almost 13% in 24 hours. Trading volume also saw a significant drop of over 40%, signaling reduced transaction activity and weakened market interest. Nonetheless, the community sentiment indicator showed 82% of the votes were still bullish, illustrating that most of the community still believes in the long-term potential of ZKsync despite the current pressure.

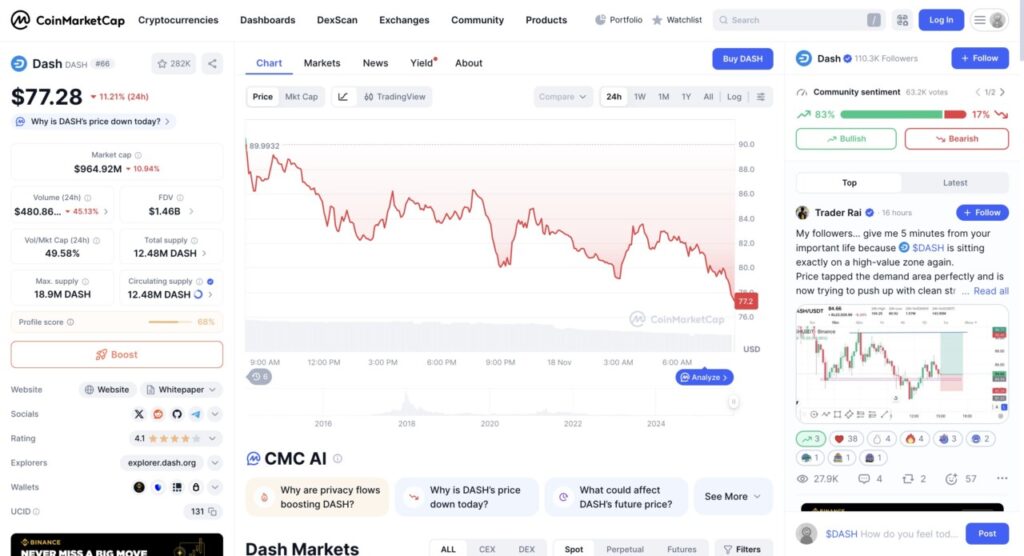

Dash (DASH) Price Plunges 11.21% in 24 Hours

The Dash (DASH) price chart in the last 24-hour period shows a fairly clear downward trend with consistent selling pressure. At the beginning of the period, the price was around $89.99 before starting to correct. The price movement in the initial phase showed moderate volatility with some small upward fluctuations, but selling pressure remained more dominant. This condition shows the limited buying momentum to maintain the previous price level.

Entering the mid-period, the price of DASH moved in a steady downward pattern as the price dropped from the $87 range to the lower area. Although there were several attempts at recovery, any short gains were quickly clawed back by the sell-off. This trend signaled that the short-term sentiment was bearish and traders were unwinding positions rather than adding to holdings. The descending zigzag pattern that formed also shows the market’s uncertainty in maintaining a certain price zone.

In the final phase of the observation, the Dash price dropped to around $77.2, reflecting a decline of more than 11% in a day. Trading volume also saw a significant drop of over 45%, indicating weakened market participation and short-term liquidity. However, the community sentiment indicator showed that around 83% of users were still bullish, illustrating optimism towards a potential price recovery.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinmarketcap

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.