Download Pintu App

Bitcoin Turns Green Today as Spot Selling Activity Picks Up

Jakarta, Pintu News – The price of Bitcoin (BTC) has dropped below $90,300 and is now trading around $89,900 after a sharp decline that saw 30-day losses reach 16%. Traders are divided between hoping for a price recovery or bracing for a deeper drop.

However, chart and on-chain data show one simple thing: if Bitcoin price does not return to key levels soon, it is likely that the next low could form even lower, perhaps even below $80,000.

Then, how will the Bitcoin price move today?

Bitcoin Price Rises 2.78% in 24 Hours

On November 19, 2025, Bitcoin was trading at $92,410, equivalent to IDR 1,551,355,829 — marking a 2.78% increase over the past 24 hours. During this period, BTC reached a low of IDR 1,504,795,602 and a high of IDR 1,572,942,327.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 30,866 trillion, while its 24-hour trading volume has decreased by 13% to IDR 1,569 trillion.

Read also: How Far Will Bitcoin Price Fall? Here’s How Analyst Ted Pillows Predicts

Spot Sales Increase as Reserves on Exchanges Rise

The selling pressure on Bitcoin is now changing character. Previously, the decline in BTC price was mostly triggered by the forced liquidation of long positions, but the pressure is now starting to subside.

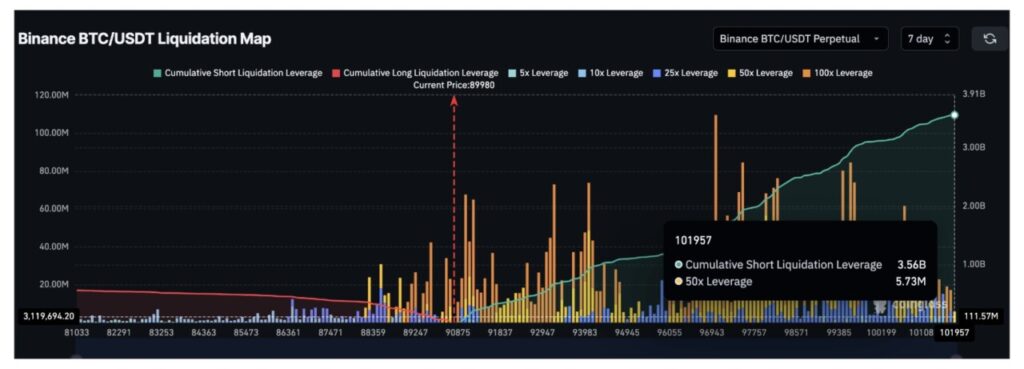

On Binance alone, the liquidation of long positions for the BTC/USDT pair was recorded at around $558 million, while the liquidation of short positions reached around $3.56 billion – more than six times as much. This shows that a lot of the leverage from the long side has been erased. As liquidation starts to diminish, the price drop reflects real selling rather than forced selling.

And this is in line with BTC reserve data on exchanges.

Between November 13 and 18, Bitcoin reserves across exchanges increased from 2,380,595 BTC to 2,396,519 BTC. This means that 15,924 BTC entered the exchanges in just five days – equivalent to about $1.43 billion based on current prices.

This is the highest inflow in recent weeks and signals a deliberate spot sell-off, possibly out of panic. BTC holders are moving their coins to exchanges for sale or preparing to sell them.

The shift from a liquidation-driven price drop to a spot sell-off is important, as it usually makes the price drop more manageable, but also more durable. This also explains why the Bitcoin price is still under pressure even though leverage has started to ease.

Weak pockets of support make Bitcoin price vulnerable

To understand where the Bitcoin price can stabilize, we look at the UTXO Realized Price Distribution (URPD) indicator. URPD shows at what price holders last bought their coins. These areas usually serve as support zones as holders tend to defend their purchase price.

However, the area between $89,600 to $79,500 has very thin support. Only a few coins last changed hands in this range, meaning that few holders are motivated to defend those price levels.

This is why missing the $90,300 level is a dangerous signal. If Bitcoin is unable to break this level again, the chart and URPD map show that the price is left open to a wide weak zone, which could drop to near $80,000.

Read also: Whale Crypto Buys 150,000 $LINK, Chainlink Price to Soar?

The trend-based Fibonacci structure also supports this view. Since October 6, Bitcoin has been moving down in a wedge pattern. The lower trendline looks weak as it has only two clear touch points.

Price is now approaching the line again, and in case of a downward breakout, the next target is at the Fibonacci extension level of $79,600 – which also coincides with the gap in the URPD.

Short-term support in the range of $82,000-$84,500 is the last buffer before this weak zone, according to the URPD cluster. If Bitcoin continues to close below $90,300, then this area will be the next logical test level.

A reversal scenario is still possible, but it requires a gradual price recovery. First, Bitcoin needs to break $90,300 again – which signals a rejection of the downtrend.

After that, the next challenge is to break $96,800. And finally, a move above $100,900 would turn the short-term sentiment bullish.

FAQ

What caused the recent Bitcoin price drop?

Bitcoin’s price drop is due to the change from liquidation of long positions to deliberate spot selling, where coin holders move Bitcoin to exchanges for sale.

How much Bitcoin hit exchanges between November 13 and 18?

A total of 15,924 BTC, or about $1.43 billion, came onto exchanges in the period, signaling an increase in spot sales.

What will happen if Bitcoin can’t reclaim the $90,300 level?

If Bitcoin cannot reclaim the $90,300 level, the price could be exposed to a weak zone stretching to below $80,000, according to URPD data and Fibonacci structure.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Bottom Under $80K, Risk to Reclaim This Level. Accessed on November 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.