Download Pintu App

What is Spoofing in Trading & Crypto? Beware of Order Book Manipulation Tactics

Jakarta, Pintu News – Spoofing is a form of market manipulation that often occurs in the trading world, including the cryptocurrency market. This tactic utilizes fake orders to create the impression of unreal demand or supply, with the aim of influencing the psychology of other market participants.

In a crypto market that tends to be volatile and is still in the developmental stages of regulation, spoofing practices can cause great harm especially to less vigilant retail investors.

1. What is Spoofing?

Spoofing in trading refers to the practice of placing large buy or sell orders that are not intended to be executed. Once the order has influenced the market price in the desired direction, the perpetrator then cancels the order. In other words, spoofing manipulates market perception to artificially push prices up or down.

Spoofing is generally used by large market participants (whales) who have enough capital to “move” market sentiment through large volumes, albeit fake.

Also Read: 7 Ways to Buy and Sell Tokenized Gold at the Door, Starting from Rp11,000 and Can be 24/7

2. How does Spoofing Work?

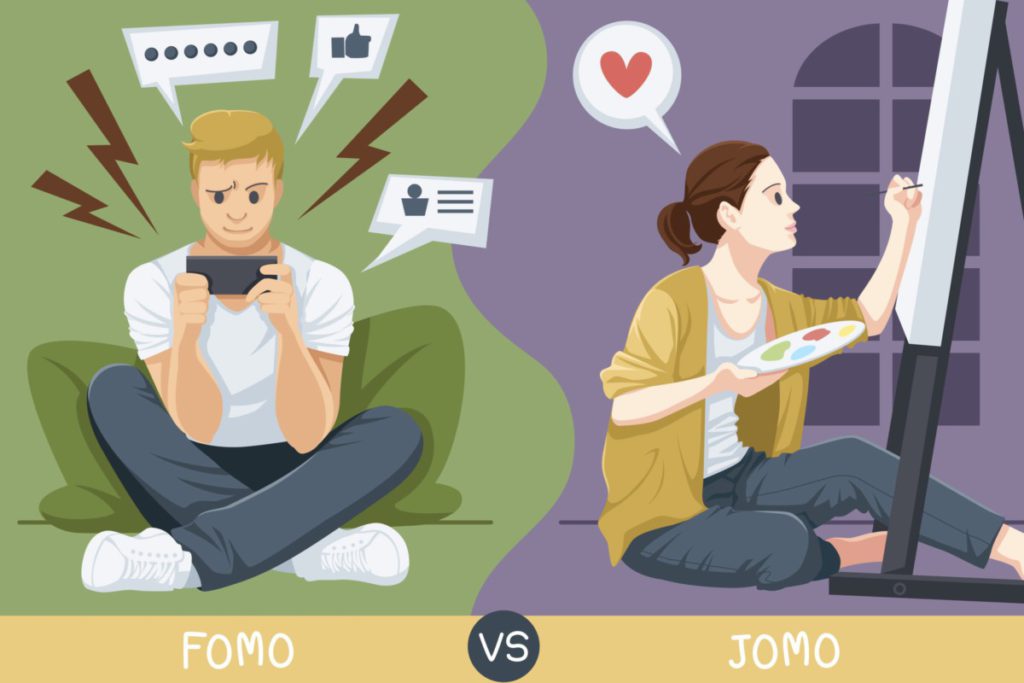

Spoofing capitalizes on investor emotions-such as fear of missing out (FOMO) or panic selling-tocreate price momentum. Here’s an example of a spoofing scenario:

- Step 1: The spoofer places a large buy order below the current market price, as if there is huge buying pressure.

- Step 2: Other traders think there will be a price increase and start buying.

- Step 3: Prices move up due to demand pressure.

- Step 4: The spoofer cancels the buy order and instead sells the asset at a higher price.

Conversely, spoofing can also be used to bring down prices in the same way, but through fake large sell orders.

3. Difference between Spoofing and Phishing

While both are risky practices, spoofing is different from phishing:

| Aspects | Spoofing | Phishing |

|---|---|---|

| Destination | Market price manipulation | Stealing personal data |

| Methods | Fake orders on the stock exchange | Emails, fake websites, manipulative messages |

| Victims | Market traders/investors | Individual crypto account users |

| Risk | Financial loss due to misleading pricing | Loss of wallet/account access |

4. Examples of Spoofing in the Crypto World

One of the most famous examples was Bitcoin in 2017, when its price spiked above $18,000 and then dropped dramatically. Investigations revealed spoofing and wash trading practices that amplified the price volatility.

Another example is when a perpetrator places a large sell order on an exchange with no intention of selling, which makes traders panic and sell at low prices-creating an instant flash crash.

5. Spoofing Risks for Investors and Markets

Spoofing can have various negative impacts:

- Prices Do Not Represent Fundamentals

Price movements do not reflect true supply and demand. - Traders Tricked into Buying or Selling at the Wrong Price

Spoofing can make investors rush into costly decisions. - Lose Trust in the Market

If it continues to happen, spoofing can make investors, especially beginners, lose faith in the crypto ecosystem.

6. How to Avoid Spoofing in Trading & Crypto

Here are some practical steps you can take:

- Use Regulated and Credible Crypto Platforms

- Don’t Just Look at the Order Book

Be wary of large volumes that suddenly appear-they could just be fake orders. - Focus on Fundamental and Technical Analysis

Avoid impulsive decisions just because you see short-term order movements. - Beware of Unusual Price Movements

If prices suddenly spike or drop dramatically without any major news or sentiment, there may be market manipulation behind it. - Use Tools or Bots to Detect Suspicious Activity

Some platforms provide real-time data to detect unusual transaction patterns.

Also Read: A Complete Guide to Saving Digital Gold in 2025 – Simple, Safe, Can Start from Rp11,000!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ: Spoofing in Crypto and Trading

Q: What is spoofing in trading?

A: Spoofing is the practice of placing a large number of fake orders to manipulate the price movement of assets in the market.

Q: Can spoofing happen with Bitcoin?

A: Yes. Bitcoin and other cryptocurrencies are particularly vulnerable to spoofing due to the volatility and lack of regulation on some exchanges.

Q: Is spoofing the same as wash trading?

A: No, it is not. Spoofing manipulates the order book, whereas wash trading creates fake transaction volume through buying and selling by the same party.

Q: Is spoofing punishable by law?

A: Yes. In the US, spoofing is illegal and punishable by up to 10 years in prison according to the CFTC.

Q: What should I do if I suspect spoofing?

A: Report it to the platform you are trading on, and consider using an exchange that has reporting and user protection features.

Reference:

- Nathan Reiff. Cryptocurrency Spoofing: How It Works, Protecting Yourself. Accessed November 25, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.