Download Pintu App

3 Crypto with High Liquidation Risk This Week

Jakarta, Pintu News – Billion-dollar liquidation events have become commonplace in recent months. This phenomenon shows that traders are still often unprepared for market volatility. Some altcoins in the last week of November have the potential to cause similar surprises.

The following are altcoins that are expected to trigger massive liquidation, along with the reasons behind the potential, citing BeInCrypto’s report.

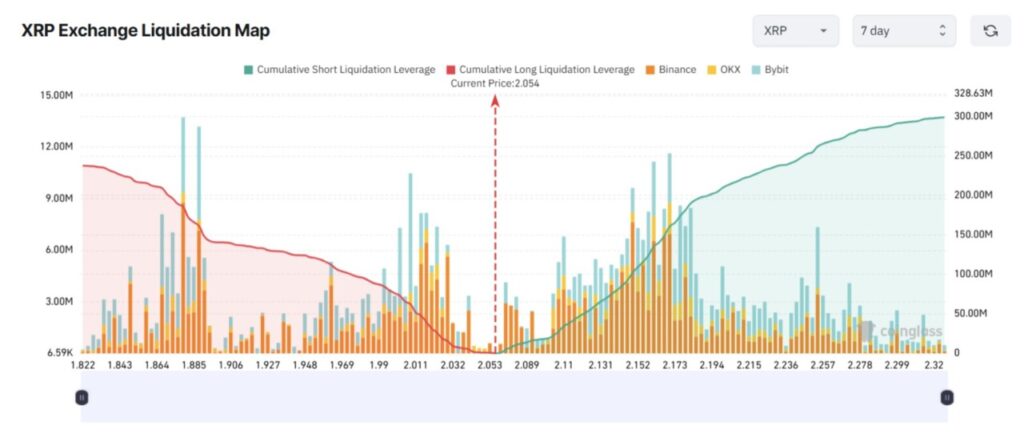

XRP

The XRP (XRP) liquidation map over the past 7 days shows a significant level of risk. If the price of XRP rises to $2.32 this week, approximately $300 million of short positions will be liquidated. Conversely, if the price drops to $1.82, approximately $237 million of long positions will be liquidated.

Read also: Crypto Price Predictions: ETH, XRP, and DOGE Show Signs of Recovery

Traders who open short positions in late November are at risk of liquidation due to several factors. One of them is the launch of Grayscale’s XRP ETF which will begin trading on the NYSE on November 24.

In addition, US-listed XRP ETFs have also recorded cumulative net inflows of over $422 million, despite the general market downturn.

However, other reports reveal that XRP whales have switched from accumulation to massive sell-offs in recent days. This selling pressure could push the price of XRP downwards and trigger liquidation of long positions.

These conflicting market forces can cause losses for both long and short traders, especially when the derivatives market starts to show signs of heating up again.

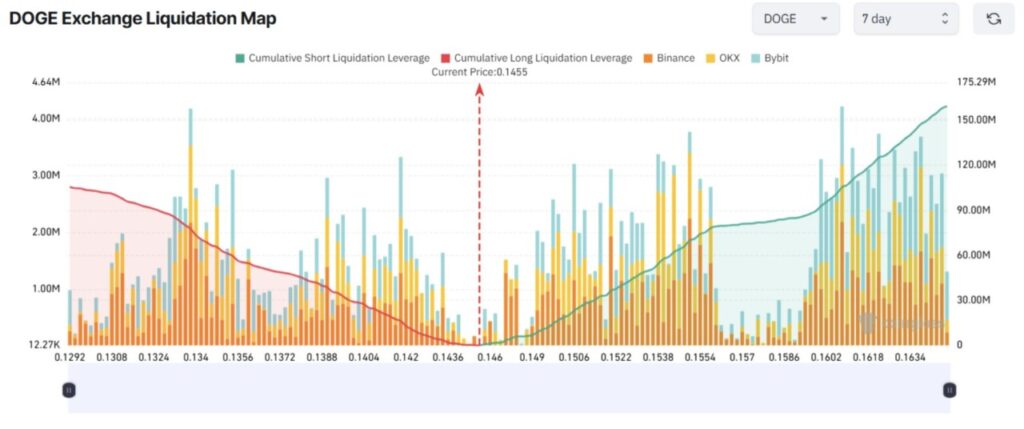

Dogecoin (DOGE)

Just like XRP, Grayscale’s Dogecoin (DOGE) ETF is also scheduled to launch on November 24. The launch is expected to boost positive sentiment towards the popular meme coin.

ETF expert Nate Geraci calls the launch of the Grayscale Dogecoin ETF (with ticker GDOG) an important milestone. He sees it as clear evidence of the major changes in cryptocurrency regulation over the past year.

“Grayscale Dogecoin ETF. The first DOGE ETF under the Securities Act of 1933. Many people may laugh at this, but in my opinion, it’s very symbolic. The best example of a major shift in crypto regulation. Oh yeah, GDOG has probably become one of my favorite tickers,” Geraci said.

If this positive sentiment pushes the price of DOGE above $0.16 this week, the total liquidation of short positions could reach $159 million.

However, other reports suggest that whales have sold around 7 billion DOGE in the past month. If this selling pressure continues, it could hamper the price recovery, or even lead to further declines.

If DOGE falls below $0.13, the liquidation of long positions could exceed $100 million.

Read also: Dogecoin Price Prediction: Will DOGE Rise from the Selling Pressure?

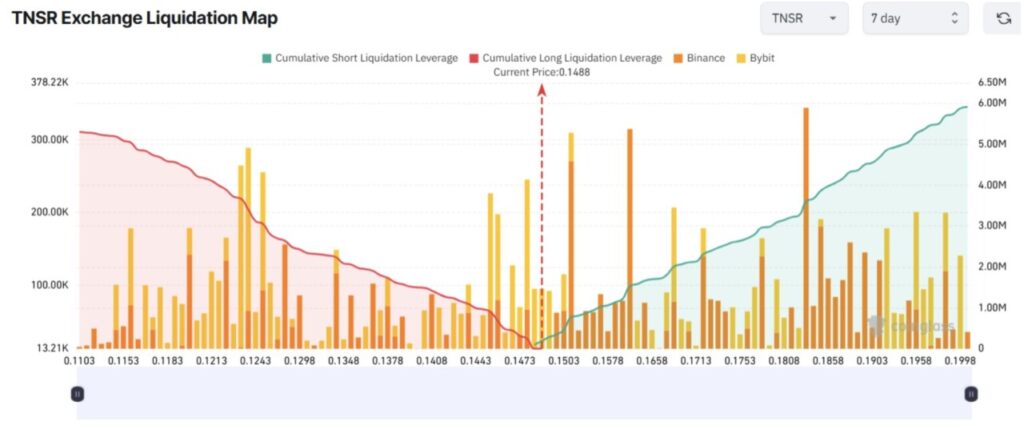

Tensor (TNSR)

Tensor Token (TNSR) recorded a price surge of over 340% last week, attracting huge attention from traders. However, after peaking at $0.36, the price of TNSR quickly corrected by about 60%.

Simon Dedic, founder of Moonrock Capital, thinks this price spike is suspicious. He called the price movement an indication of an “insider pump.”

Neither Tensor nor Coinbase have responded to the allegations. However, other analysts note that the top 10 wallets control about 68% of the total TNSR supply. This concentration creates huge risks and increases price volatility.

These factors could greatly affect TNSR’s price movements in the next few days. If the price increases to $0.19, the potential liquidation of short positions could approach $6 million. Conversely, if the price drops to $0.11, the liquidation of long positions could exceed $5 million.

FAQ

What is liquidation in the context of cryptocurrency?

Liquidation in the context of cryptocurrencies is the process of forced closure of trading positions when the value of an asset falls below a specified margin level, often resulting in huge losses for traders.

How will the Dogecoin ETF affect the price of DOGE?

A Dogecoin ETF could increase demand and liquidity for DOGE, potentially influencing the price by increasing exposure and accessibility for institutional and retail investors.

Why is price volatility important for cryptocurrency investors to monitor?

Price volatility is important to monitor as it can significantly affect the value of an investment in a short period of time, influencing trading decisions and risk management strategies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Facing Liquidation Risk in the Final Week of November. Accessed on November 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.