Download Pintu App

Dogecoin Climbs to $0.15 — Is the Bull Run Gaining Strength?

Jakarta, Pintu News – Dogecoin (DOGE) is showing signs of strength again as bullish momentum emerges across a number of key indicators. In CCN’s latest analysis, it was reported that DOGE had stabilized near the $0.14 support level.

By November 27, 2025, the price of DOGE had climbed back to $0.15, reflecting a steady recovery process from the previous low.

These moves indicate that the popular memecoin may be entering the early stages of a structural trend reversal, with buyers (bulls) preparing to test higher resistance levels – potentially even breaking through to $0.20.

The question now is, will the DOGE price be able to maintain this momentum?

Dogecoin Price Drops 2.64% in 24 Hours

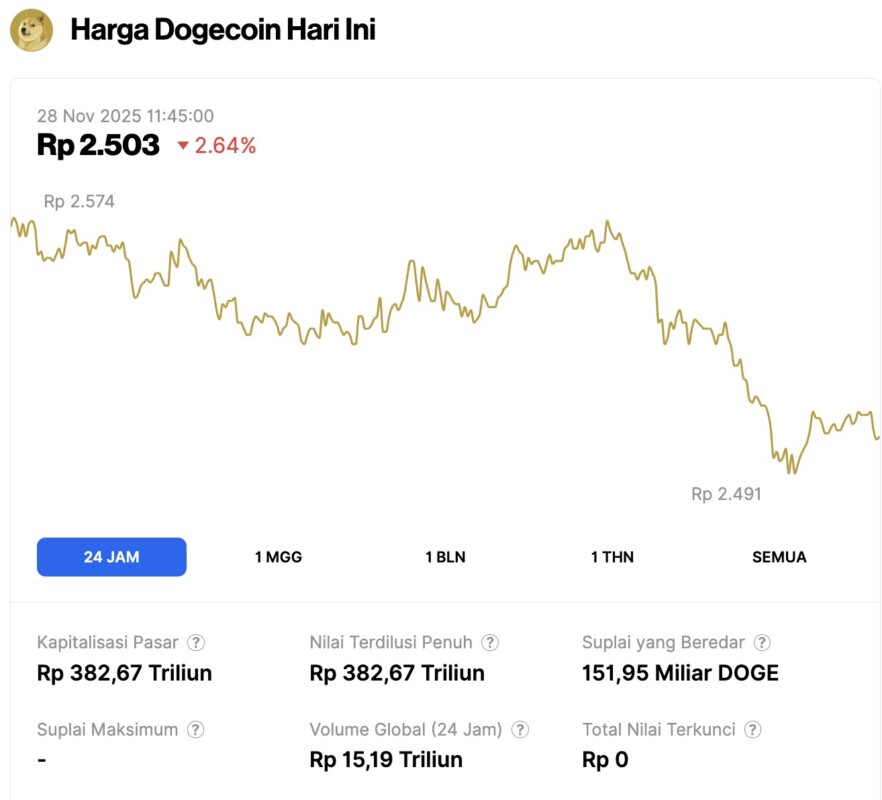

As of November 28, 2025, Dogecoin (DOGE) has slipped 2.64% over the past 24 hours, currently trading at $0.1508, or approximately IDR 2,503. During the same period, DOGE has moved within a daily range of IDR 2,574 to IDR 2,491.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 382.67 trillion, with a 24-hour trading volume of approximately IDR 15.19 trillion.

Read also: Ethereum Holds Steady at $3,000 Ahead of December’s Fusaka Upgrade

Dogecoin Starts to Recover: Bullish Signals Strengthen

Analysis on the 4-hour chart (27/11) of Dogecoin shows an increasingly clear bullish structure, especially evident from the Money Flow Index (MFI) which reflects increasing capital inflows and stronger buyer participation.

With the MFI value staying above the neutral zone of 50, it signals that capital is starting to flow towards accumulation, rather than distribution. The same can be seen in the Relative Strength Index (RSI), which currently stands at 57.19-indicating increasing buying pressure.

The consistent rise of the RSI above its signal line indicates that bullish momentum is building and buyers are slowly starting to take control of the market.

If the momentum indicators continue to strengthen as the price stabilizes, there is great potential that the Dogecoin price will break out of the consolidation phase and enter a more pronounced bullish trend.

Read also: 3 Most Shining Crypto on Thanksgiving Day – Will the Uptrend Continue?

Dogecoin (DOGE) Price Analysis: Bullish Signals Emerge, But Still Need Confirmation

Dogecoin price has managed to break out of the descending channel pattern and is now showing a potential trend reversal towards the next resistance level. Currently, DOGE is trading around $0.15 – an area that has been an important accumulation zone over the past week.

On the daily chart (27/11), the Moving Average Convergence Divergence (MACD) indicator has moved above the neutral line. In addition, MACD’s 12-day EMA has crossed the 26-day EMA from below, indicating a bullish reversal signal.

However, the MACD histogram only shows short green bars, signaling that the bullish momentum is still in its early stages of growth. Meanwhile, the Awesome Oscillator (AO) indicator is still in the negative area, but has started to print green histogram bars – indicating that selling pressure is starting to weaken.

This mixed signal suggests that although buyers are starting to enter the market, the strength of the uptrend has not been fully confirmed. As such, DOGE prices may still experience a minor correction before resuming a more pronounced rise.

Based on Fibonacci retracement analysis from the most recent swing low to swing high, DOGE is currently moving towards the Fib 0.236 level around $0.17. If this level is successfully broken, the price has the potential to rise further to $0.20, which is the Fib 0.382 area.

However, if buyers fail to push the price past the current zone, pressure from sellers could come back and bring the price of DOGE down to the previous support level around $0.13.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Bears Losing Grip as Bulls Target Price Recovery Toward $0.20. Accessed on November 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.