Download Pintu App

XRP Bounces Back with V-Shape Recovery on the Back of New ETF and Positive Technical Signals

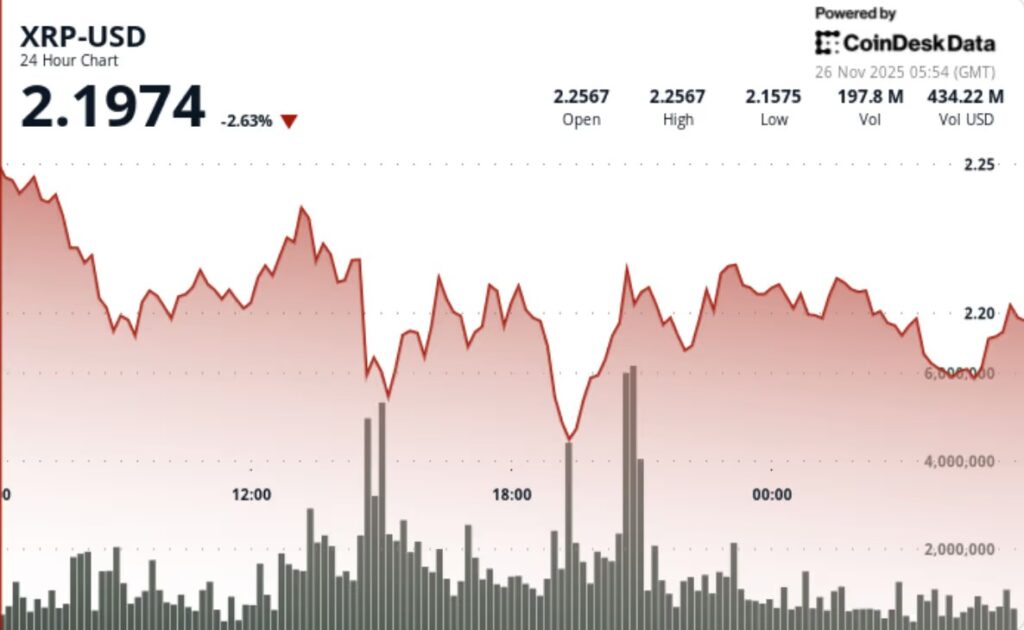

Jakarta, Pintu News – After a period of selling pressure in early November, XRP is now showing strong recovery signals. The price managed to break the $2.20 resistance, supported by a surge in volume and the launch of XRP ETFs by two major asset managers.

Market Background

On November 27, 2025, two XRP ETFs were launched on NYSE Arca:

- Franklin Templeton’s XRPZ

- Grayscale’s GXRP

They raised $164 million in the first day alone, making them one of the most successful altcoin ETF launches so far. This opens up a new avenue for institutional investors to gain exposure to XRP through regulated channels.

This ETF comes after a massive distribution phase of whale and derivative pressure earlier in the month. However, this new inflow signals a rotation of institutional capital that is now starting to stabilize sentiment.

Also Read: JPMorgan Predicts Oil Price Fall to $30 by 2027

XRP Technical Analysis

- XRP printed a V-shaped recovery on the intraday chart, surging from mid-session weakness to a session high of $2.26.

- The technical structure shows three consecutive higher lows around $2.15, confirming the absorption of selling pressure.

- Trading volume surged 81% above average (117.7 million tokens vs. 65 million on average).

- The current price pattern forms an ascending broadening wedge, a technical formation that generally indicates a potential continuation of the uptrend.

If XRP is able to hold above $2.15 (or ideally $2.20), then the medium-term target is around $2.35 to $2.60.

Also Read: True XRP Holders Keep Calm Amid Weak Markets, Here’s the Outlook for December 2025!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

1. What is the main cause of XRP’s recent price spike?

The launch of XRP ETFs (XRPZ and GXRP) that attracted $164 million in institutional funds, as well as technical confirmation that shows a V-shaped recovery.

2. What is the “ascending broadening wedge” pattern?

A technical chart pattern showing upward price widening with the potential for uptrend continuation if the support level is maintained.

3. What are the key levels that XRP should maintain?

- Key support: $2.15 and $2.00

- Next resistance: $2.25-$2.35 and potentially $2.60

4. Can the price go down again?

If the price drops below $2.20, XRP risks retesting the $2.15 or even $2.00 support. However, as long as the price holds above the support line, the uptrend is still valid.

5. What does the ETF mean for the XRP price in the long run?

ETFs expand access for institutional investors and give XRP new legitimacy as an investment asset, potentially strengthening demand and long-term price stability.

Reference

- CoinDesk. XRP Prints V-Shaped Recovery as ETF Catalysts Align With Technicals. Accessed on November 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.