Download Pintu App

Rumors of Interest Rate Cut by the FED: How Will It Impact the Crypto Market?

Jakarta, Pintu News – Ahead of the Federal Open Market Committee (FOMC) meeting on December 9-10, global financial markets are in suspense. Speculation regarding an interest rate cut by the Federal Reserve has triggered significant changes in market expectations. Recent weak labor data has increased the chances for a rate cut, which could have a major impact on markets, including crypto markets.

Market Dynamics Ahead of FED Decision

The market has shown a strong response to signals from Federal Reserve officials indicating a possible interest rate cut. FED Governor, Christopher Waller, stated on November 24 that there are no signs of economic recovery, which added to speculation about a rate cut.

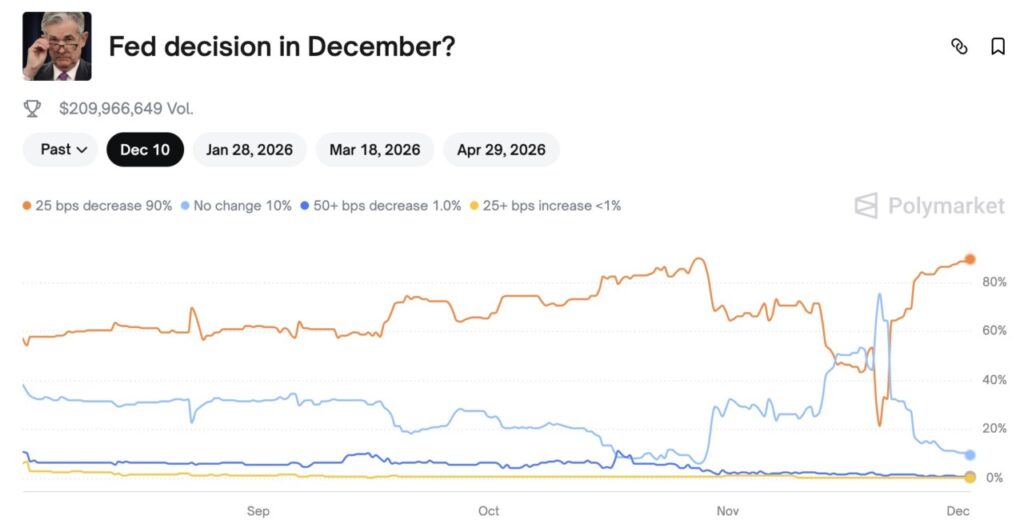

Prices on Polymarket, a market betting platform, jumped from 65 cents to 84 cents in a day, indicating high expectations of a 25 basis point rate cut. Pending economic data also played a significant role in changing the market outlook.

September’s jobs report showed the addition of only 119,000 jobs, with the unemployment rate rising to 4.4% and revisions to previous months’ data showing a decline. This condition, referred to as “stagnation velocity,” suggests a slowdown in the labor market without a complete collapse, prompting more discussion about the need for monetary policy intervention.

Also read: MicroStrategy Considers Selling Bitcoin, What’s the Reason?

The Impact of Interest Rate Decision on Bitcoin and Crypto Market

Bitcoin (BTC), which has dipped below its 10-month moving average (10MMA) for the first time in 46 months, is facing a critical period. The upcoming FOMC decision could trigger a major change or prolong the price stagnation. If the FED decides not to cut interest rates, Bitcoin may be stuck in the $60,000 to $80,000 price range until the end of the year.

However, if the FED does cut interest rates, this could be a catalyst for Bitcoin price gains. Stablecoin reserves on exchanges have reached record highs, suggesting that liquidity is ready to support a major rally. Every major Bitcoin rally in 2025 started after a similar accumulation period, showing the importance of liquidity in determining price movements.

Read also: Peter Schiff Calls Bitcoin a Fake Asset, Gold and Silver Surge?

Market Reaction and Anticipation

The overall financial market, including the stock and bond markets, also showed a significant change in expectations. Comments from FED officials such as Mary Daly and John Williams, who suggested that interest rates should not remain high for longer than necessary, have reinforced the view that a rate cut is possible. This shows flexibility in the FED’s monetary policy, which is important for stabilizing the economy.

In addition, political voices such as that of President Trump are calling for bigger rate cuts, although the FED usually does not respond directly to political pressure. However, this adds to the complex dynamics in the FED’s decision-making. With all the data and guidance from the FED, the market will continue to monitor closely to catch any signals or changes in policy.

Conclusion

With the upcoming FOMC meeting, all eyes are on the FED’s interest rate decision. This decision will not only affect global financial markets but also have long-term implications on macroeconomics and crypto markets. Investors and analysts alike are waiting with bated breath, knowing that the impact will be far-reaching.

FAQ

What is the Federal Open Market Committee (FOMC)?

The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve System responsible for monetary policy, including the setting of interest rates.

Why is labor data important for the FED rate decision?

Labor data provides insight into economic conditions. If the data shows a slowdown, the FED may cut interest rates to stimulate growth.

How will the FED rate cut affect Bitcoin price?

Interest rate cuts tend to lower the value of the US dollar, which could make assets like Bitcoin more attractive as a hedge against inflation, potentially increasing its price.

What impact will the rate cut have on the stock and bond markets?

Interest rate cuts are usually positive for the stock market as lower borrowing costs can increase spending and investment. For the bond market, it could lower bond yields.

How do stablecoin reserves on exchanges affect the price of Bitcoin?

High stablecoin reserves on exchanges indicate ready liquidity, which can support large purchases of Bitcoin, potentially fueling price increases.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Fed Meeting in December: Crypto Market Braces for Interest Rate Cut Decision. Accessed on December 2, 2025

- Featured Image: VOI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.